-

The middle class needs to support Elizabeth Warren’s bankruptcy plan because they can benefit significantly from it. The proposed new bankruptcy laws will revert the corporate-friendly bankruptcy provision that the House passed, and President George W Bush signed in 2005.

-

The 2005 Bankruptcy law made it harder for consumers to file chapter 7 or liquidation bankruptcy and required a higher percentage of disposable income to be allocated toward chapter 13 bankruptcy three-to-five-year repayment plan to repay all or part of the debt.

-

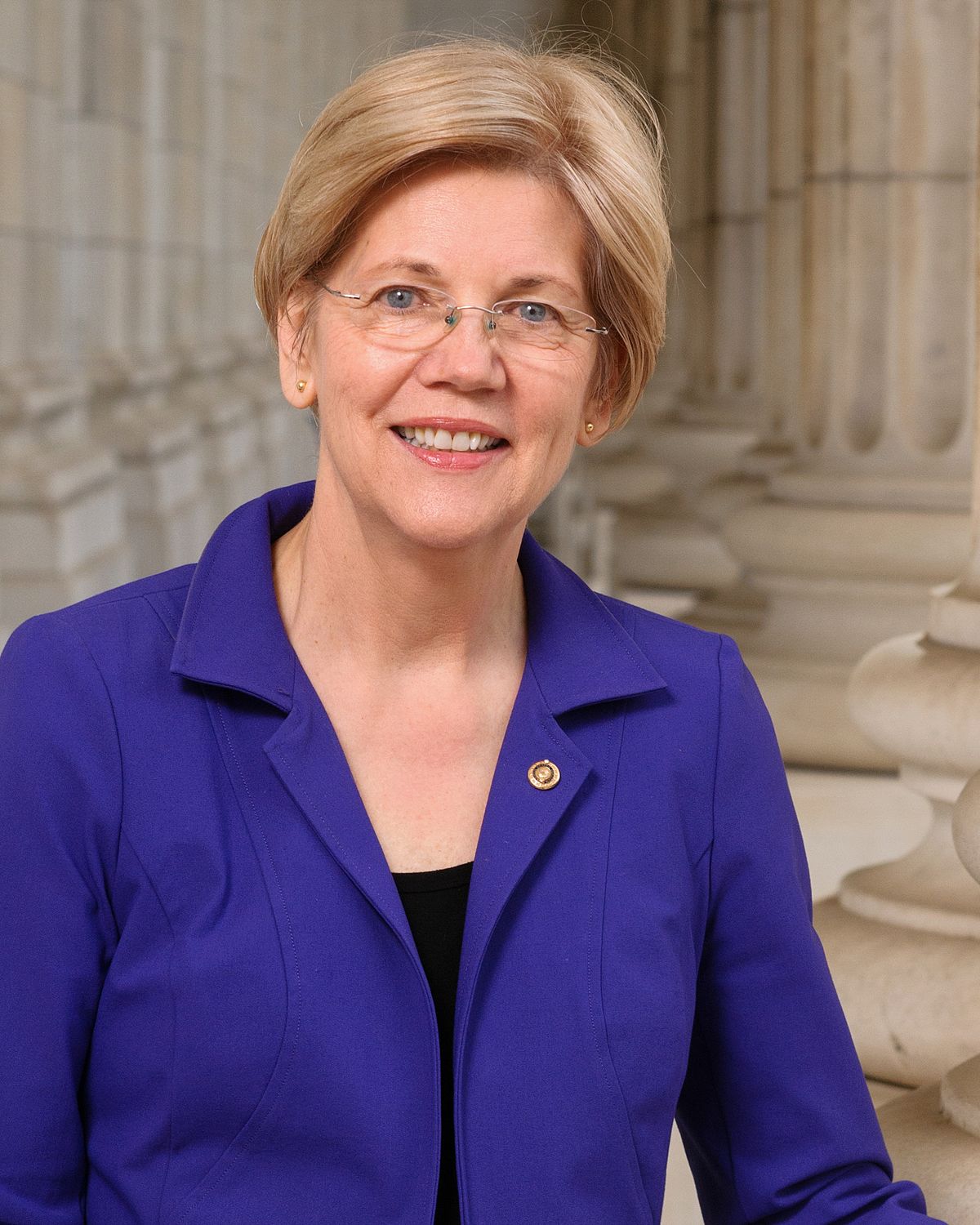

Senator Elizabeth Warren wants to make the bankruptcy process cheaper and less painful for most Americans. Her plan will let people protect their homes and cars and discharge student loan debt in bankruptcy.

-

The middle class needs to support Elizabeth Warren’s bankruptcy plan because they can benefit significantly from it. The proposed new bankruptcy laws will revert the corporate-friendly bankruptcy provision that the House passed, and President George W Bush signed in 2005.

The 2005 Bankruptcy law made it harder for consumers to file chapter 7 or liquidation bankruptcy and required a higher percentage of disposable income to be allocated toward chapter 13 bankruptcy three-to-five-year repayment plan to repay all or part of the debt.

Predatory lenders use the protection of the U.S. bankruptcy courts to exploit vulnerable Americans. They felonious tactics to promote toxic financial products to consumers at tremendously high-interest rates. Companies are willing to abandon their risk management because they know consumers, specifically middle-class consumers, would have a hard time to discharge their debts.

Senator Elizabeth Bankruptcy Plan

Senator Elizabeth Warren wants to make the bankruptcy process cheaper and less painful for most Americans. Her plan will let people protect their homes and cars and discharge student loan debt in bankruptcy.

During the debate to revamp bankruptcy laws in 2005, lobbyists claimed that most families who filed for bankruptcy were reckless or irresponsible or both. We know that’s not the case

Anemic wage growth, high rents, student loan debt, and medical bills have been squeezing the middle class. Payday lenders and subprime credit cards issuers and auto lenders draw new business strategies to exploit middle-class financial despairs.

Based on St. Louis Fed’s calculation, payday lenders charge their customers annual percentage rate (APR) as high as 400%. The Wall Street Journal reported a few weeks ago that subprime auto lenders are pressuring and falsifying their customer loan applications to get them approved. Those criminal loan terms and toxic financial products put and keep the middle class into a vicious economic cycle.

If private companies such as credit card issuers, payday loan companies, and subprime auto lenders want to take an unlimited risk and exploit the middle class in the process, the federal government should not protect them when their consumers get into major financial crises and want a fresh-tart.

What Happened to Creative Destruction

Companies should not be able to advocate for the deregulation of capital markets and the reduction of state influence in the economy while demanding protections in the U.S bankruptcy courts. The preceding sentence is the definition of crony capitalism.

Subprime auto lenders are falsified borrowers’ applications to get them approved for loans and extended loans terms to as long as 96 months to give them the illusion of affordability. When those borrowers lost their job or had other financial emergencies, Mrs. Warren’s plan would facilitate the process of starting over.

Her proposed bankruptcy plan will stop incentivizing non-reputable companies that promote toxic financial products to the middle-class.