401(K) BLUNDERS TO AVOID

By MacKenzy Pierre

The estimated reading time for this post is 294 seconds

401(k) blunders to avoid to ensure a comfortable retirement. With the disappearance of defined-benefit pensions in the workforce, employers switched another obligation to workers. That obligation is not something that they can take lightly because their lifestyle in retirement depends solely on how serious they take it. Employees need to know how to manage their 401(K) efficiently and effectively.

The Old Days: Defined-benefit Pensions

Reagan and Thatcher’s years brought with them the deregulation of everything and assault on labor unions. Ronald Reagan was the president of the United States from 1980 to 1988, and Margaret Thatcher was the prime minister of the United Kingdom around that same period.

Corporations stopped investing in their communities, seeing their employees as capital, and filing full tax returns and paying taxes to their local government. They convinced themselves that their responsibility is solely to maximize shareholder values.

Defined-benefit pensions were one of the first employee benefits that employers replaced with defined-contribution plans. The latter is cost-saving for the employers and makes every single employee Chief Investment Officer of their retirement accounts.

Pension Plans

The majority of big employers used to provide pensions to their employees. Employers such as Sears Roebuck, General Electric (GE), and AT&T used to contribute to the plan, and employees would receive a monthly installment when they retired for the rest of their life. Corporations were responsible for the asset allocations, assumed the investment risks, and guaranteed a return.

A small percentage of Fortune 500 companies are still offering defined-benefit pensions. However, the overwhelming majority of employers now provide defined-contribution plans, including 401(k) and 403(b), to their employees. Those plans are cost-savings for the companies, and they switch the responsibility from the employer to the employee.

Defined-contribution Plans

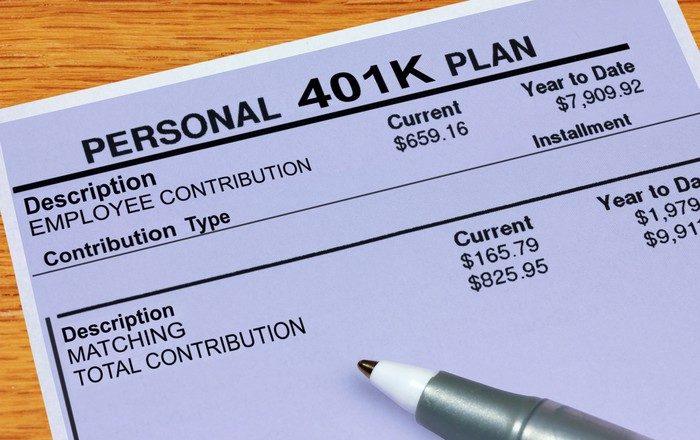

In 1978 congress passed, and President Jimmy Carter signed the Revenue Act, which created 401(k) and allowed employees a tax-free way to defer compensation. Employees are no longer guaranteed a flat amount for life after retirement.

Employees have their accounts. The employer may or may not have a matching principle, which the employer can contribute to that account as well. However, unlike the defined-benefit pension, the employer’s contribution is not mandatory. The 401(k)-employer match can come and go.

Employees have now assumed the investment risks and are responsible for the asset allocations of their retirement account. They often make serious blunders while managing their 401(k) and other qualified and non-qualified retirement accounts. Here are the four 401(k) blunders to avoid:

Not Participate in the Plan

Defined-contribution plans are the most popular employer-sponsored retirement plans in the United States, but more than a third of corporate employees don’t even join their plans according to Fidelity.

Most companies follow the matching principle, which means the employer contributes a certain amount or percentage to every dollar that the employee defers to the plan. When eligible employees don’t participate in their employer’s defined-contribution plan, they are technically leaving free money on the table.

According to Glassdoor, Google offers a 401(k) plan that matches 50 percent of the employee contribution, up to $8,250, meaning that Google will give you $4,125 ($8,250×0.50) in free money if you contribute the maximum amount.

Google’s employee who chooses not to participate in the plan would leave $4,125 free money on the table. You need to figure out the maximum amount your employer is willing to match and contribute that amount to your 401(K) or your current profit-sharing plan.

Do Not Diversify

With just three investment options, 401(k) administrators comply with ERISA. The Employee Retirement Income Security Act of 1974 (ERISA) sets minimum standards for most voluntarily established retirement and health plans in private industry.

According to Fidelity, one-quarter of all plan participants have their entire account in a single investment option. Diversification is the cardinal rule of investment. If you want a decent return and reduce investment-specific risk, you have to invest your retirement funds in more than one investment vehicle.

Hold too many of Your Employer’s Stocks

Too many employees hold too many of their employer’s stock. Enron’s employees who invested most of their retirement funds in Enron’s stock lost everything when the company collapsed and filed for bankruptcy.

Even if you are bullish on your company and love what you do, the cardinal rule is still applied. You should never put all your eggs in one basket. Diversification protects you against idiosyncratic risk; you should always diversify.

Cash Out after Leaving the Job

401(K) is your account, which you can take with you if you end up leaving your job for whatever reason. Too many people cashed out their 401(k) after they left their job. Defined-contribution plans let you contribute pretax income to the plan.

When you cash out the plan before you turn 59 ½, you have to pay regular income tax and a 10% penalty. So, if you are in the 25% tax bracket, you have to pay a 35 percent tax on the amount being withdrawn from the profit-sharing plan.

If you have $50,000 in your 401(k) plan and decide to cash it out early, you will pay $17,500 ($50,000×0.35) in taxes and penalties. You have 60 days to rollover your employer-sponsored retirement plans without paying any taxes, penalties, or both.

Don’t Repay 401(k) Loan

If you need cash and don’t want to cash out your 401(k) due to taxes and penalty, you can reach out to your 401(k) administrator or HR Department and get a loan. You are borrowing from yourself. The loan charges interest around 8%, and you have five years to pay it back.

Many borrowers failed to pay back the 401(K) loan within five years. The loan becomes a withdraw, and you have to pay income tax and penalty on the outstanding amount.

Sometimes, you can withdraw from your defined-contribution plan (s) without income tax and a penalty for a down payment on a home. Check with your 401(k) administrator or HR Department before making the withdrawal.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...