- Too many low- and moderate-income individuals don’t have bank accounts.

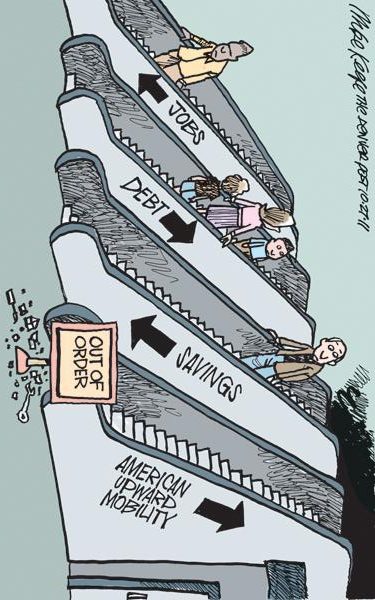

- The scarcity of blue-collar jobs impedes the low- and moderate-income individuals to move up to the middle class.

- Lousy credit scores make most of the financial transactions the low- and moderate-income individuals partake in more expensive. Everything from car insurance to cell phone service to a down payment on utility service cost them more.

- Low- and moderate-income individuals spend an average of 50 percent of their disposable income on housing.

1. Financial Exclusions

Too many low- and moderate-income individuals don’t have bank accounts. They use expensive options like payday loans, check cashers, and prepaid cards; those alternatives are often sleazy, predatory, and downright abusive.

2. Globalization and Automation

When Thomas Friedman’s The World Is Flat, a New York Times bestseller, published in 2005, we became somewhat conscious of the interconnectedness of the world. The internet, technologies, and automation flattened the earth. Automation reduced the need for additional workers, a connected world facilitated outsourcing, and the internet has allowed mega-companies to spring up with fewer employees. The scarcity of blue-collar jobs impedes the low- and moderate-income individuals to move up to the middle class

3. Wage Stagnation

The hourly inflation-adjusted wages received by American workers have not risen since the 1970s, but housing, education, and healthcare have increased many folds.

4. Bad Credit

Lousy credit scores make most of the financial transactions the low- and moderate-income individuals partake in more expensive. They pay more on everything from car insurance to cell phone service to a down payment on utility service. Low-income individuals spend more on most everything; they are either in the red at the end of the month or have nothing to save or both. Investment and reinvestment in oneself are one of the surest ways to move up to the next socioeconomic rung. Low- income individuals cannot invest or reinvest in themselves if they are in the red every month.

5. Housing

According to Smart Assets, you need to earn $187,800 per year to comfortably afford a 2-bedroom apartment in San Francisco, California, $45,343 in Jacksonville, Florida, and $33,129 in El Paso, Texas. Housing has been a tremendous burden to majority Americans, especially to the low- and moderate-income individuals. They spend an average of 50 percent of their disposable income on housing.

Real estate has been the best way for Americans to build wealth. Tight lending standards and inflated housing prices make buying a home out-of-reach for the majority of low- and moderate-income individuals.

Image Source: https://www.denverpost.com/2011/10/26/upward-mobility/

Pingback: Work Is Now a Less Priority to - American Middle Class