The Middle-Class Needs to Support Elizabeth Warren’s Bankruptcy Plan

By Article Posted by Staff Contributor

The estimated reading time for this post is 174 seconds

-

The middle class needs to support Elizabeth Warren’s bankruptcy plan because they can benefit significantly from it. The proposed new bankruptcy laws will revert the corporate-friendly bankruptcy provision that the House passed, and President George W Bush signed in 2005.

-

The 2005 Bankruptcy law made it harder for consumers to file chapter 7 or liquidation bankruptcy and required a higher percentage of disposable income to be allocated toward chapter 13 bankruptcy three-to-five-year repayment plan to repay all or part of the debt.

-

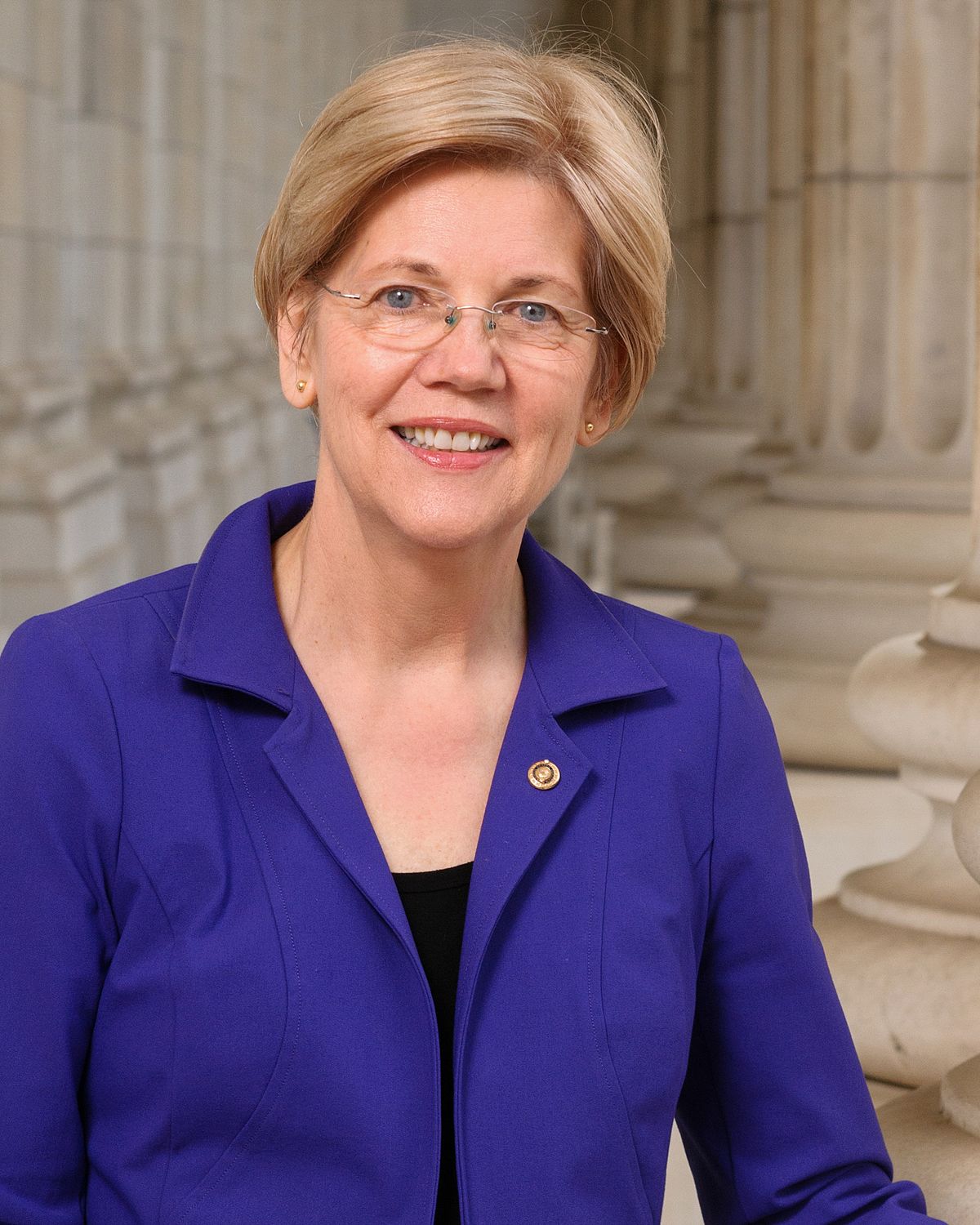

Senator Elizabeth Warren wants to make the bankruptcy process cheaper and less painful for most Americans. Her plan will let people protect their homes and cars and discharge student loan debt in bankruptcy.

-

Visit the Financial Middle-Class homepage for more stories

The middle class needs to support Elizabeth Warren’s bankruptcy plan because they can benefit significantly from it. The proposed new bankruptcy laws will revert the corporate-friendly bankruptcy provision that the House passed, and President George W Bush signed in 2005.

The 2005 Bankruptcy law made it harder for consumers to file chapter 7 or liquidation bankruptcy and required a higher percentage of disposable income to be allocated toward chapter 13 bankruptcy three-to-five-year repayment plan to repay all or part of the debt.

Predatory lenders use the protection of the U.S. bankruptcy courts to exploit vulnerable Americans. They felonious tactics to promote toxic financial products to consumers at tremendously high-interest rates. Companies are willing to abandon their risk management because they know consumers, specifically middle-class consumers, would have a hard time to discharge their debts.

Senator Elizabeth Bankruptcy Plan

Senator Elizabeth Warren wants to make the bankruptcy process cheaper and less painful for most Americans. Her plan will let people protect their homes and cars and discharge student loan debt in bankruptcy.

During the debate to revamp bankruptcy laws in 2005, lobbyists claimed that most families who filed for bankruptcy were reckless or irresponsible or both. We know that’s not the case

Anemic wage growth, high rents, student loan debt, and medical bills have been squeezing the middle class. Payday lenders and subprime credit cards issuers and auto lenders draw new business strategies to exploit middle-class financial despairs.

Based on St. Louis Fed’s calculation, payday lenders charge their customers annual percentage rate (APR) as high as 400%. The Wall Street Journal reported a few weeks ago that subprime auto lenders are pressuring and falsifying their customer loan applications to get them approved. Those criminal loan terms and toxic financial products put and keep the middle class into a vicious economic cycle.

If private companies such as credit card issuers, payday loan companies, and subprime auto lenders want to take an unlimited risk and exploit the middle class in the process, the federal government should not protect them when their consumers get into major financial crises and want a fresh-tart.

What Happened to Creative Destruction

Companies should not be able to advocate for the deregulation of capital markets and the reduction of state influence in the economy while demanding protections in the U.S bankruptcy courts. The preceding sentence is the definition of crony capitalism.

Subprime auto lenders are falsified borrowers’ applications to get them approved for loans and extended loans terms to as long as 96 months to give them the illusion of affordability. When those borrowers lost their job or had other financial emergencies, Mrs. Warren’s plan would facilitate the process of starting over.

Her proposed bankruptcy plan will stop incentivizing non-reputable companies that promote toxic financial products to the middle-class.

RELATED ARTICLES

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars...

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years of economic growth and increased financial services accessibility, millions of Americans continue to operate...

Leave Comment

Cancel reply

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

Gig Economy

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2%...