NO, TESLA IS NOT WORTH MORE THAN TOYOTA, VOLKSWAGEN, HYUNDAI, GM, AND FORD PUT TOGETHER

By MacKenzy Pierre

The estimated reading time for this post is 390 seconds

Tesla, the American electric vehicle and clean energy company, market capitalization hit $500 billion this week. Market capitalization or market cap is the market value of a publicly-traded company’s outstanding shares.

On February 19, 2020, Tesla completed a public offering of its common stock and issued a total of 15.2 million shares; on August 10, 2020, it declared a five-for-one split, and on September 1, 2020, it raised $5 billion by selling additional 11,141,562 shares of common stock.

The above financial and accounting transactions created a lot of additional outstanding shares. Also, it shows that Tesla is far from being able to finance its growth through its operations.

The new market cap makes Tesla more valuable than Ford, Hyundai, General Motors (GM), Toyota, and Volkswagen combined.

Omitting irrational exuberance, Tesla should not even be more valuable than Toyota, which Lexus luxury vehicle division is marketed in more than 70 countries and territories worldwide. As of this writing, Toyota’s market capitalization is around $186 billion.

The common rebuttals that I often get from Tesla’s fanatics are it is the leader in the alternative fuel vehicle market and the self-driving technology and other vehicle applications and software platforms. They mean that Tesla is a technology company like Google and Microsoft.

Jim Cramer, the animated host of the American finance television program Mad Money, said that ” Tesla’s not really a car company, it’s a tech company one wheels. That’s what keeps confusing people.”

Daimler AG and Volkswagen AG have been pioneered intuitive mobility technology for years, but investors have never mistaken the parent companies of Mercedes-Benz and Lamborghini for technology firms.

I remember that it was not too long ago that people like Jim Cramer were telling their viewers that WeWork was a technology company, not just another commercial real estate firm. We all know how that situation ended.

Before digging into the fundamental analysis for all the six companies ( Tesla, Ford, Hyundai, General Motors (GM), Toyota, and Volkswagen), I want to remind you of the additional brands that legacy automakers such as Toyota and Volkswagen have in their portfolios.

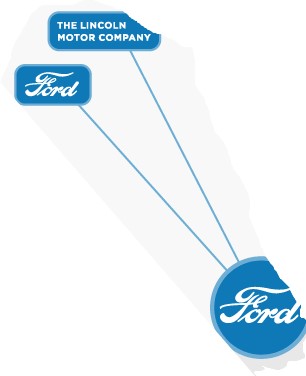

Ford Brands

The Ford Motor Company controls the Ford and Lincoln brands. In 2019, the company sold 5.4 million vehicles. According to cardsanddrive.com, its Ford F-Series was the best-selling vehicle in the united state of America in 2019, with 896,526 vehicles sold.

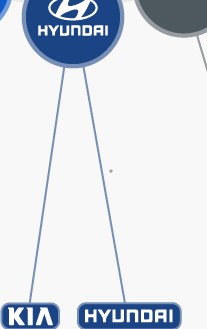

Hyundai Brands

The Hyundai Motor Company or Hyundai Motors control both Hyundai and Kia brands. The South Korean multinational automotive manufacturer sold 688,771 vehicles in the U.S., with nearly 4.6 million cars sold globally.

According to cardsanddrive.com, Hyundai Elantra was one of the best selling cars in America in 2019.

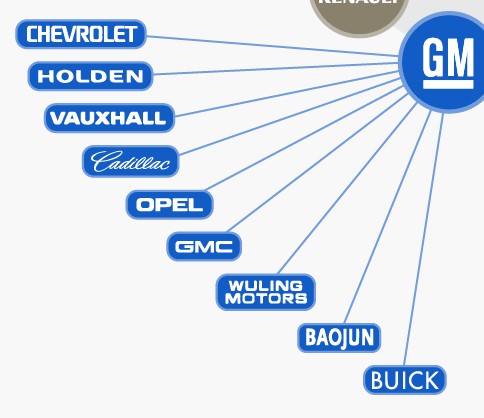

General Motors Brands

According to carsandrives.com, GM will soon have 12 electric vehicles, including Hummer EV, Chevy Bolt, and Cadillac LYRIQ.

In 2019, GM sold nearly 2.9 million vehicles in the United States, with about 7.7million vehicles sold globally.

Chevrolet Silverado, Chevrolet Equinox, GMC Sierra were amongst the best selling cars in the united states in 2019.

Toyota Brands

Toyota Motor Corporation is the world’s largest automaker by volume. Lexus and Scion are its two wholly-owned brands, but it owns controlling and minority stakes in truck and bus manufacturers Hino and Daihatsu and Subaru, respectively.

In 2019, Toyota Motor Corporation sold nearly 9 million vehicles globally. Toyota Highlander, Toyota Tacoma, Toyota Corolla, Toyota Camry, Toyota RAV4 were amongst the top-selling cars in America.

Subaru Forester and Subaru Outback were also amongst the top-selling cars in America. Toyota Motor Corporation owns a minority stake in Subaru’s parent company.

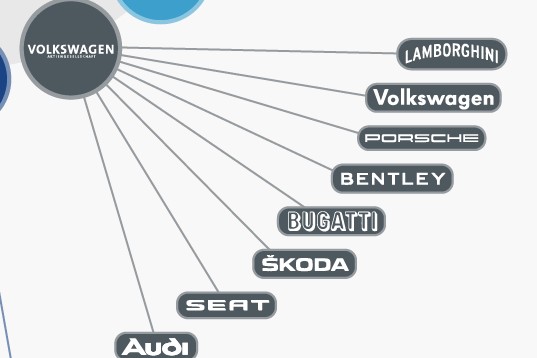

Volkswagen Brands

Lamborghini, Bentley, and Bugatti are amongst Volkswagen AG’s twelve brands with an individual identity and common goal.

The German multinational automotive manufacturing sold nearly 6.3 million vehicles globally in 2019.

Volkswagen AG does not have any vehicles listed on the carsanddrives.com 25 best-selling cars, trucks, and SUVs of 2019. However, Lamborghini, Bentley, and Bugatti, Audi are loved brands in America.

Tesla Brands

In 2019, Tesla sold 367,500 cars. Toyota Camry, Toyota RAV4, and Ford F-Series sold 336,978, 448,071, and 896,526 units sold.

However, the Tesla Model 3 was the world’s most popular plug-in electric vehicle with worldwide unit sales of more than 300,000 in 2019

Tesla Fundamental Analysis

On Oct. 21, Tesla reported third-quarter results net income of $331 million on revenue of $8.77 billion.

The company’s adjusted earnings of $0.76 per share, above estimates of $0.56.

Tesla sees third-quarter revenue of $8.77 billion vs. consensus for $8.36 billion.

The company reported deliveries of 139,300 vehicles for the third-quarter ending September 30, 2020

Operating expenses increased by 33%; its income from operations was $809 million.

This year, Tesla has a couple of profitable quarters. However, it remains to be seen whether or not the company can grow global product sales, install and service vehicle charging networks, and continue to remove vehicle delivery bottlenecks for consumers are yet to be seen.

Most importantly, all the aforementioned established automotive manufacturers’ Capital expenditures (CapEx) are allocating towards their alternative fuel vehicle divisions, with Volvo promised to have all-electric vehicles by 2030.

Ford Fundamental Analysis

On Oct. 28, Ford Motor Company reported third-quarter results net income of $2.4 billion on revenue of $38 billion.

The company’s adjusted earnings of $0.65 per share, well above estimates of $0.19.

Ford sees third-quarter revenue of $38 billion vs. consensus for $37 billion.

The company sold 551 796 vehicles for the third-quarter ending September 30, 2020

Ford Motor Company’s Ford F-Series was the best-selling vehicle in the united state of America in 2019, with 896,526 vehicles sold. The 117-year old company has executed and delivered stronger than expected financial results during the 3rd quarter.

Hyundai Fundamental Analysis

On Oct. 26, Hyundai Motor Company reported third-quarter results loss of $97.72 million on revenue of $24.4 billion below analyst expectations.

The company sold 173,028 vehicles in the United States for the third-quarter ending September 30, 2020. They sold 997,842 vehicles worldwide in the July-September period.

Hyundai Motor Company would have had a $1.6 billion net income if it were not because of its engines’ ongoing issues. During the third quarter, the company spent nearly $5 billion to address the quality problem with the engines.

GM Fundamental Analysis

On Nov. 5, General Motors Company reported third-quarter results net income of $4.05 billion on revenue of $35.48 billion. The net income increased by a whopping 74% in the July-September period.

The company’s adjusted earnings of $2.83 per share, above estimates of $1.38.

GM had third-quarter revenue of $35.48 billion vs. consensus for $35.51 billion.

The company sold 665,192 vehicles for the third-quarter ending September 30, 2020

Unlike Tesla, which depends on outside funds to fund its ambitious growth. The largest US automaker generated $9.1 billion in cash flow from its auto operations during the third quarter. At the end of the third quarter, GM had $30.2 billion in cash.

Toyota Fundamental Analysis

On May 12, the Japanese giant automotive reported its financial results for the fiscal year ended March 31, 2020. Toyota reported third-quarter results with a net income of $17.27 billion on revenue of $274.6 billion.

The company sold 8,958,423vehicles for the fiscal year ended March 31, 2020

Toyota Motor Corporation Global Presence

During the fiscal year ended March 31, 2020, Toyota Motor Corporation sold 2,239,549 in Japan, 2,713,165 in North America, 1,028,537 in Europe, 1,604,870 in Asia, 1,372,302 in South America, Africa, and the Middle East.

Volkswagen Fundamental Analysis

On Oct. 29, Tesla reported third-quarter results net income of $3.2 billion on revenue of $66.9 billion.

The company sold 2.6 million vehicles for the third-quarter ending September 30, 2020

The German auto giant seems like it put the CO2 emission scandal behind as it returned to profitability in the midst of a pandemic.

Conclusion

Tesla is not worth more than the Ford Motor Company, Hyundai Motors, General Motors Company, Toyota Motor Company, and Volkswagen AG combined.

At the end of the third quarter, GM had $30.2 billion in cash. Toyota reported a net income of $17.27 billion for that same quarter, and they sold nearly 2.8 million vehicles in Nort America alone.

A valid argument can be made that Tesla is more valuable than Ford because of its excess debt and rigid bureaucracy or Hyundai Motors with its continuous operational deficiency.

However, that argument starts losing weight when factoring well-established and profitable giants such as Toyota Motor Company or Volkswagen AG.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years of economic growth and increased financial services accessibility, millions of Americans continue to operate...

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about everyone with a calculator and an opinion. And yet, too many people still get...

1 Comment

Leave Comment

Cancel reply

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

Gig Economy

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2%...

Pingback: 2021 IPO DRAFT CLASS: Ranking the Top 10 Prospects - FMC