Non-Fungible Token (NFT):EXPLAINED

By MacKenzy Pierre

The estimated reading time for this post is 168 seconds

Portland, Oregon, Moda Center, the first round of the 2019 NBA Playoffs, Game 7- score-115-115. With about 10 seconds left on the clock, Dame Dollar, aka Damian Lillard, Portland Trailblazer’s point guard, pulled up to shoot, 37 feet from the basket, and sunk a 3-point shot as the clock expired.

The Portland Trailblazer won the game 118-115 to advance to the second round of the NBA playoffs. Lillard finished up the game with 50 points, including 10 three-pointers.

That’s the shot or a moment in basketball history that I would love to own. If my pockets were deep enough, I could own that shot or that scary Lebron James’ Game 6 look in the 2012 NBA Playoffs against my beloved Boston Celtics thanks to non-fungible tokens (NTFs).

What Is a Non-fungible Token?

Using the blockchain, an open ledger system that allows every transaction to be recorded for all to see, content creators can tokenize all aspects of their work, including NBA clips, images, videos, songs, and more. The unique identification code validates their authenticity; in essence, it creates a non-fungible token or NFT. The value of NTF derives from its scarcity and authenticity.

For example, the NBA can attach an NFT to Damian Lillard’s shot and sell it as an authentic digital asset. The NBA launched NBA Top Shot, which facilitates the buying and selling of NBA highlights’ digital collectibles. Every transaction for every token is recorded for all to see. NFT owners don’t get any royalties, but their ownership is indisputable.

What Do Non-Fungible Tokens Mean for Content Creators

NTFs provide content creators another way to monetize their work. A Youtuber, Tik Toker, digital artist, or radio show personality can assign unique identification codes to their video clips or digital arts and auction them. The tokenized works also give their staunch fans a way to show their support. Content creators can use this step-by-step guide to create their own non-fungible tokens.

Should You Invest in NTFs?

A non-fungible token is a highly speculative asset class. Investors need to do their due diligence before putting their money in NFTs. Sport NFTs are like the digital version of sports cards. There are countless shoeboxes of sports cards in attics and basements across the country that are worth nothing.

Unlike precious and industrial metals, NFTs have no storage fees due to their digital nature.

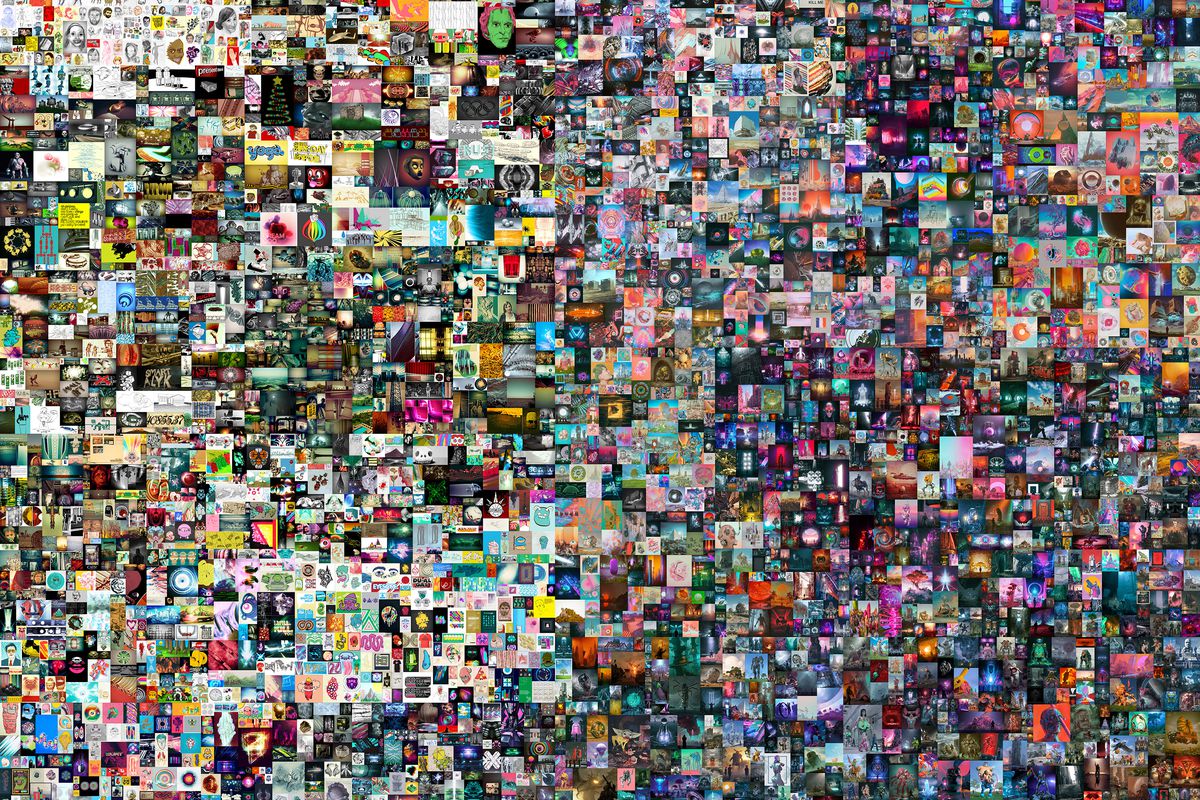

This year alone, digital art by Steve Aoki, Twitter CEO Jack Dorsey’s first tweet, and a Lebron James highlight was sold for $69 million, $2.9 million, and $200,000, respectively. Steve Aoki crypto art title Beeple sold at Christie’s Auction house last month. NFT is a new asset class, but it already has bubble-like characteristics.

Cheap money and yield-seeking investors are propping up new and old asset classes, including special purpose acquisition companies (SPACs), digital currencies (Bitcoin), and non-fungible tokens.

Investors can explore NBA Top Shots for all NBA highlight NFTs and Niftygateway for others.

The Bottom line

A non-fungible token or NFT is a highly speculative asset class. Some might argue that it’s more of a collectible item than an asset class. Any reasonable collector knows that many collectibles don’t age well–Beanie Babies.

If I could afford the Dame Dollard’s shot, I would buy it just so that I could brag to my friends that I own it. Asset appreciation would be icy on the cake.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars...

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years of economic growth and increased financial services accessibility, millions of Americans continue to operate...

1 Comment

Leave Comment

Cancel reply

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

Gig Economy

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2%...

Pingback: Build Wealth with Boring Investments - Stock News