How Entrepreneurs Can successfully Bootstrap Their Startups

By MacKenzy Pierre

The estimated reading time for this post is 264 seconds

Starting a business is an exciting and challenging endeavor. One of the most significant hurdles entrepreneurs face is securing funding to get their businesses off the ground. However, there is an alternative to seeking external financing: bootstrapping.

Bootstrapping refers to starting a business with little to no outside funding. This approach requires creativity, resourcefulness, and hard work but can lead to greater control and independence.

The Clorox Company, Hewlett- Packard (HP Inc), and Spanx are amongst the successfully bootstrapped companies. Less than 1% of startups get investment capital.

This article will discuss bootstrapping, why it is a viable option for startups, and how to do it successfully.

What is bootstrapping?

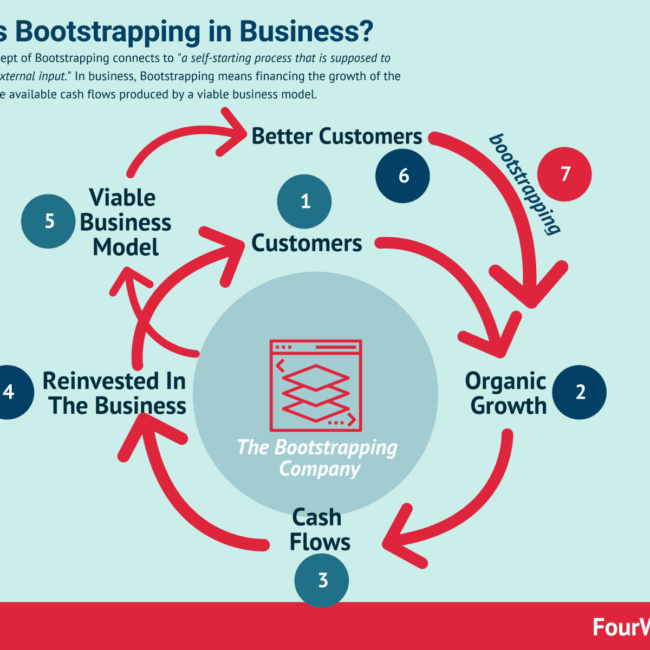

Bootstrapping is a method of starting a business with minimal financial resources. The term “bootstrapping” comes from “pulling yourself up by your bootstraps,” meaning to succeed through one’s own efforts.

In the context of starting a business, bootstrapping means using personal savings, revenue generated by the company, and other creative methods to fund the startup.

Why bootstrap?

Bootstrapping can be a viable option for startups for several reasons. First, it allows the entrepreneur to maintain control of the business.

When external funding is involved, the investor often wants a say in how the business is run, which can lead to conflicts of interest.

Bootstrapping eliminates this issue, allowing entrepreneurs to decide based on their vision and values.

Second, bootstrapping forces the entrepreneur to be resourceful and creative. With limited funding, entrepreneurs must find ways to get the most out of what they have. This can lead to innovative solutions and a leaner, more efficient business model.

Finally, bootstrapping can be a more sustainable way to start a business. There is often pressure to grow quickly and generate a high return on investment when external funding is involved.

This can lead to unsustainable growth, which can ultimately lead to failure. Bootstrapping allows the entrepreneur to grow at a sustainable and manageable pace.

How to bootstrap a startup

Bootstrapping a startup requires a different approach than seeking external funding. Here are some critical steps to successfully bootstrap a startup:

-

Start small and Develop a Minimum Viable Product (MVP).

When bootstrapping a startup, it is vital to start small. Focus on developing a minimum viable product (MVP) that can be tested with a small group of customers. This allows the entrepreneur to validate their idea without investing too much time or money.

More importantly, early adopters can provide feedback that entrepreneurs can leverage to improve their products or service or develop better ones.

-

Be frugal.

When bootstrapping a startup, every dollar counts. Entrepreneurs should be frugal and look for ways to save money wherever possible.

This could mean working from home instead of renting office space, using open-source software instead of paid software, or bartering services with other businesses.

-

Leverage personal savings

Personal savings can be a valuable resource when starting a business with little to no external funding.

Entrepreneurs should consider using their own savings or holding on to a part-time job to fund the business. This can help avoid taking on debt or giving up equity in the company.

-

Conduct Market Research

A thorough market research is critical for entrepreneurs who are bootstrapping their startups. They can immediately see if there’s a demand for their product or service. This can involve researching competitors, conducting surveys, and analyzing industry trends.

They should also identify their target audience and understand their needs and preferences and which marketing channels to use to reach the said target audience.

-

Generate revenue early

Generating revenue early is critical when bootstrapping a startup. The entrepreneur should focus on developing a product or service to generate revenue immediately. This can help fund the business and provide validation for the idea.

-

Build a network.

Building a network of supporters and advisors can be invaluable when bootstrapping a startup. Entrepreneurs should look for mentors, advisors, and other entrepreneurs with industry experience. These individuals can provide guidance, support, and feedback.

-

Be flexible

Entrepreneurs who are bootstrapping their businesses cannot afford to be attached to their business idea or business model.

Bootstrapping a startup requires flexibility and adaptability.

The entrepreneur should be willing to pivot if the initial idea is not working.

They should be open to feedback from customers and other stakeholders and be ready to make changes as needed.

-

Leverage technology

Technology can be a powerful tool entrepreneurs can use to bootstrap their startups. They can use software and apps to automate processes, streamline operations, and reduce costs.

Many free and low-cost online tools can help them manage their business, including accounting software, project management tools, and email marketing platforms.

The rapid advancement of artificial intelligence (AI) and the broad availability of open-source software will give entrepreneurs more affordable software and tools to bootstrap their startups more effectively and efficiently.

In conclusion, bootstrapping a new business requires hard work, dedication, and creativity. However, it’s an excellent way for entrepreneurs to finish their businesses without incurring much debt.

Entrepreneurs can successfully bootstrap their new business by identifying their business idea, creating a business plan, leveraging their network, focusing on cash flow, being creative, and using technology.

Business owners must remember that success doesn’t happen overnight and must be patient and persistent as they work to grow their businesses.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars...

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference, and how do you decide which one’s right for you? Understanding these concepts can...

1 Comment

Leave Comment

Cancel reply

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

Gig Economy

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2%...

Pingback: 10 Ways Black Entrepreneurs Can Access Capital - FMC