Be a Better Investor: Risk-Return Tradeoff

By Article Posted by Staff Contributor

The estimated reading time for this post is 291 seconds

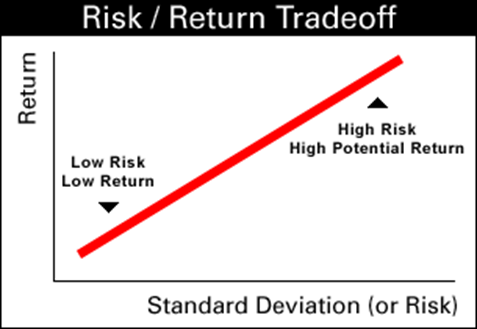

Risk-return tradeoff is the type of investment principle that all investors must understand. Individuals often invest their money in various assets such as stocks, bonds, real estate, or commodities, whether for retirement or building wealth. While making investments, investors often weigh the risks and returns of different investment options before making a decision. This is where the risk-return tradeoff comes into play.

The risk-return tradeoff is a fundamental investment principle that helps investors understand the relationship between risk and return.

The concept states that the potential return an investor expects to earn from an investment should increase as the level of risk increases. In this article, we will explore the concept of risk-return tradeoff, what it tells investors, its meaning, importance, and calculation.

Definition:

The risk-return tradeoff is the principle that investors must be compensated for taking additional risks. The concept states that the higher the risk associated with an investment, the higher the potential return an investor can earn.

The risk-return tradeoff principle assumes that investors are rational and will only take on additional risk if they expect to earn higher returns.

What Risk-Return Tradeoff Tells Investors:

The risk-return tradeoff tells investors they cannot expect to earn high returns without taking on some level of risk. If investors want to earn higher returns, they must be willing to accept a higher level of risk. On the other hand, if investors want to reduce their risk, they must accept lower potential returns.

The principle of risk-return tradeoff also tells investors that there is no such thing as a risk-free investment. Even the safest investments, such as government bonds, carry some level of risk.

While the risk associated with government bonds may be relatively low, the potential return is also low. On the other hand, investments in stocks, which are generally riskier, offer the potential for higher returns.

Meaning:

The risk-return tradeoff means that investors must balance their desire for higher returns with their tolerance for risk. Different investors have different risk tolerances, which affect their investment decisions.

Some investors may be willing to take on more risk to earn higher returns, while others may be more conservative and prefer lower-risk investments with lower potential returns.

The principle of risk-return tradeoff also means that investors must consider the risks associated with different investment options before making a decision.

The risks associated with an investment can include market risk, credit risk, liquidity risk, inflation risk, and interest rate risk. Investors must assess the likelihood and potential impact of each of these risks before making an investment decision.

Importance:

The risk-return tradeoff is important because it helps investors make informed investment decisions. Understanding the relationship between risk and return allows investors to evaluate the potential risks and rewards of different investment options.

This knowledge can help investors make decisions that align with their investment goals and risk tolerance.

The principle of risk-return tradeoff is also important because it helps investors diversify their portfolios. Diversification is spreading investments across multiple asset classes, industries, and geographies to reduce overall risk.

By diversifying their portfolios, investors can earn higher returns while reducing risk exposure.

Calculation:

The calculation of the risk-return tradeoff is relatively simple. It involves comparing an investment’s potential return to the risk associated with that investment.

The potential return of an investment can be estimated based on historical performance, future earnings projections, or other factors. The level of risk associated with an investment can be estimated based on the probability of loss or the volatility of the investment’s returns.

One way to calculate the risk-return tradeoff is to use the Sharpe ratio. The Sharpe ratio is a measure of risk-adjusted return that compares the potential return of an investment to the level of risk associated with that investment.

The Sharpe ratio is calculated by subtracting the risk-free rate of return from the expected return of the investment and dividing the result by the standard deviation of the investment’s returns.

The risk-free rate is typically the rate of return on a government bond or other investment considered low risk.

For example, suppose an investor is considering two investments, Investment A and Investment B. Investment A has an expected return of 10% and a standard deviation of 15%. Investment B has an expected return of 12% and a standard deviation of 20%. The risk-free rate of return is 2%. Using the Sharpe ratio, we can calculate the risk-return tradeoff for each investment as follows:

Sharpe ratio for Investment A = (10% – 2%) / 15% = 0.53

Sharpe ratio for Investment B = (12% – 2%) / 20% = 0.50

Based on the Sharpe ratio, Investment A has a slightly better risk-return tradeoff than Investment B. This means that, on a risk-adjusted basis, Investment A is a better investment option.

Alternative Solutions or Perspectives:

While the risk-return tradeoff is a fundamental investment principle, it is not the only perspective on investing. Some investors may focus more on minimizing risk than maximizing returns, while others may be willing to take on significant risk to earn higher returns potentially.

In addition, some investment strategies may focus on different factors, such as value, momentum, or size. These strategies may have different risk-return profiles than a traditional portfolio that is diversified across asset classes.

Conclusion:

The risk-return tradeoff is a fundamental investment principle that helps investors understand the relationship between risk and return.

It is a concept that states that investors must be compensated for taking on additional risk, and the potential return an investor expects to earn from an investment should increase as the level of risk increases.

The principle of risk-return tradeoff is important because it helps investors make informed investment decisions and diversify their portfolios.

While the Sharpe ratio is a useful tool for calculating the risk-return tradeoff, it is not the only perspective on investing, and investors should consider their individual risk tolerance and investment goals when making investment decisions.

RELATED ARTICLES

Auto Loan Calculator

The estimated reading time for this post is 558 seconds Home › Tools & Calculators › Auto Loan Calculator FMC Financial Middle Class Auto Loan Calculator for Real Middle-Class Budgets Estimate your monthly payment, see how much interest the bank...

How Much Do the Holidays Cost Middle-Class Americans?

The estimated reading time for this post is 274 seconds You already know the punchline: they cost more than we planned—financially and emotionally. Between Halloween, Thanksgiving, Christmas, and everything in between, too many middle-class families overspend, carry a balance, and...

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Dec 13, 2025

The Negative Equity Trap

Negative equity keeps drivers rolling debt into “upgrades.” Learn how to break the loop, lower your payoff, and regain control—read now.

By Article Posted by Staff Contributor

American Middle Class / Dec 13, 2025

Luxury Cars Punish Impatience More Than Bad Credit

The estimated reading time for this post is 416 seconds Why waiting a week can save you more than raising your credit score On a Saturday...

By Article Posted by Staff Contributor

American Middle Class / Dec 13, 2025

Emergency Cash Without New Debt: A Middle-Class Playbook for Finding $500–$2,000 Fast

Need $500–$2,000 fast? Use this no-debt playbook to buy time, cut bills, and find cash—without payday loans. Start now.

By Article Posted by Staff Contributor

American Middle Class / Dec 13, 2025

Credit Card Grace Periods Explained: How to Borrow for Free (and the Mistakes That Cancel It)

Credit card grace periods can mean $0 interest. Learn how they work, what cancels them, and how to get them back. Read now.

By Article Posted by Staff Contributor

American Middle Class / Dec 13, 2025

Cash Advance vs Personal Loan vs Payday Loan: The Real Cost of “Quick Cash”

Cash advance vs personal loan vs payday loan—compare real costs, fees, and traps. Pick the least-bad option with our checklist.

By Article Posted by Staff Contributor

American Middle Class / Dec 12, 2025

Cheapest Ways to Access Credit Card Funds (Avoid Fees)

Need cash fast? Learn the cheapest ways to use credit card funds—without cash-advance fees. Use the cost ladder & choose your lane.

By Article Posted by Staff Contributor

American Middle Class / Dec 12, 2025

Perceptions of the “Trump Economy”: Data, Sentiment, and the Debate Over Prosperity

Explore why data and voters disagree on the Trump economy in this neutral, fact-driven analysis. Learn the key numbers and arguments.

By FMC Editorial Team

American Middle Class / Dec 12, 2025

2026 Tax Season: Will It Really Deliver the Biggest Refunds in U.S. History?

Will 2026 deliver the biggest tax refunds ever? See who wins, who doesn’t, and how to use this refund wave to strengthen your finances.

By Article Posted by Staff Contributor

American Middle Class / Dec 11, 2025

Are You Actually Ready to Retire? A Realistic Sanity Check for Savings, Home Equity, and Your Next Moves

Compare your savings, home equity and Social Security to real-world benchmarks and learn practical moves to strengthen your retirement plan today.

By FMC Editorial Team

American Middle Class / Dec 11, 2025

10 Signs You’re Doing Better Financially Than the Average American (Even If It Doesn’t Feel Like It)

Feeling behind? These 10 signs reveal you’re doing better financially than the average American. See where you stand and what to improve next.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Dec 13, 2025

The Negative Equity Trap

Negative equity keeps drivers rolling debt into “upgrades.” Learn how to break the loop, lower...

American Middle Class / Dec 13, 2025

Luxury Cars Punish Impatience More Than Bad Credit

The estimated reading time for this post is 416 seconds Why waiting a week can...

American Middle Class / Dec 13, 2025

Emergency Cash Without New Debt: A Middle-Class Playbook for Finding $500–$2,000 Fast

Need $500–$2,000 fast? Use this no-debt playbook to buy time, cut bills, and find cash—without...