Corporate Credit Cards vs. Small Business Credit Cards

By Article Posted by Staff Contributor

The estimated reading time for this post is 466 seconds

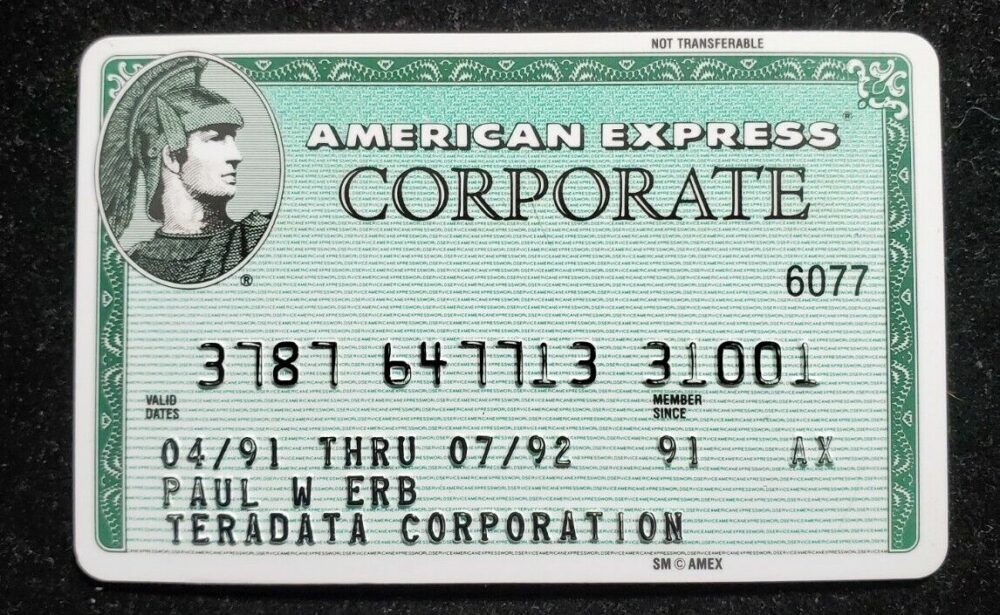

Corporate credit cards dont require business owners to assume liability for the debt, but they are often available to established corporations with multi-million dollar annual revenue.

For established businesses, having access to credit cards tailored to their specific needs is essential. However, “corporate credit card” and “small business credit card” are often used interchangeably, leading to confusion.

This article will delve into the disparities between corporate and small business credit cards, weighing their pros and cons to help entrepreneurs make informed decisions.

We will also explore the transition from a small business credit card to a corporate credit card, considering alternative perspectives and solutions.

Corporate Credit Cards:

Corporate credit cards are designed for larger organizations with high revenues and established business credit. These cards require the company to apply using an Employer Identification Number (EIN) instead of a Social Security Number (SSN).

- Higher credit limits: Corporate credit cards often offer higher credit limits compared to small business credit cards. This enables corporations to manage more considerable expenses associated with their operations, such as travel, procurement, and vendor payments. Here are some key characteristics of corporate credit cards:

- Robust expense management tools: Corporate credit cards provide advanced solutions, including detailed reporting and integration with accounting software. These features streamline the reconciliation process, help businesses monitor spending patterns, and identify cost-saving opportunities.

- Customizable controls and spending limits: Corporate credit cards offer enhanced control features, allowing businesses to set spending limits for individual employees or departments. This level of granularity helps enforce expense policies, prevent overspending, and mitigate fraud risks.

- Dedicated customer support: Larger corporations often receive personalized customer support for their corporate credit card accounts. This includes specialized assistance in managing account-related queries, resolving disputes, and addressing any issues that may arise.

Pros of Corporate Credit Cards

Enhanced spending power: Corporate credit cards provide businesses the financial flexibility to cover substantial expenses, making them ideal for larger organizations with high operational costs.

Streamlined expense management: Corporate credit cards’ advanced reporting and integration capabilities simplify the tracking and reconciliation of expenses, saving time and effort for accounting teams.

Tailored controls: The ability to customize spending limits and implement strict policies helps businesses enforce responsible spending behavior and reduce the risk of misuse.

Cons of Corporate Credit Cards:

Stringent eligibility requirements: Corporate credit cards often require high revenue levels and strong business credit history, making them less accessible for small and growing businesses.

Potential for misuse and abuse: With higher spending limits and less oversight, corporate credit cards may be susceptible to unauthorized or fraudulent transactions, necessitating strict internal controls and monitoring systems.

Complex expense reporting: The extensive data generated by corporate credit cards can be overwhelming to manage, requiring dedicated resources for proper analysis and reporting.

Small Business Credit Cards

Small business credit cards cater to the needs of smaller enterprises and entrepreneurs. These cards are typically easier to obtain, with more flexible eligibility requirements and application processes.

- Lower credit limits: Small business credit cards generally offer lower credit limits than their corporate counterparts. While this may limit the scope of more considerable business expenses, it can help maintain financial discipline and control.

- Let’s explore the key characteristics of small business credit cards: Simplified application process: Small business credit cards often require less extensive documentation and may allow business owners to apply using their Social Security Number (SSN) instead of an Employer Identification Number (EIN).

- Rewards and perks: Small business credit cards frequently offer rewards programs tailored to business expenses, such as cashback on office supplies, travel rewards, or discounts on advertising spend. These perks can provide tangible benefits to smaller businesses.

- Build credit history: Using a small business credit card

- Build credit history: Using a small business credit card responsibly can help establish and build a separate credit history for the business. This can be beneficial in the long run when seeking more extensive lines of credit or loans for expansion or investment purposes.

- Expense tracking and categorization: Similar to corporate credit cards, small business credit cards offer online tools and apps that assist in tracking and categorizing business expenses. This simplifies financial record-keeping, making monitoring cash flow and preparing accurate financial statements easier.

- Accessible to startups and smaller businesses: Small business credit cards are more accessible to startups and smaller companies that may not meet corporate credit card revenue or credit requirements. This allows them to access credit for operational needs and manage expenses effectively.

Pros of Small Business Credit Cards

Ease of obtaining credit: Small business credit cards offer a relatively straightforward application process, making it easier for entrepreneurs and startups to access credit without the stringent requirements of corporate credit cards.

Rewards and perks: Many small business credit cards provide rewards and perks tailored to business spendings, such as cashback on office supplies, travel rewards, or discounts on advertising expenses. These benefits can help businesses save money or earn valuable incentives.

Building credit history: Using a small business credit card responsibly can contribute to building a positive credit history for the business, improving its creditworthiness and future borrowing prospects.

Cons of Small Business Credit Cards

Lower credit limits: Small business credit cards often come with lower credit limits, which may restrict the ability to cover substantial expenses or manage larger-scale operations effectively.

Limited control features: Small business credit cards may not offer the same level of customizable controls as corporate credit cards. This can make it challenging to enforce spending policies or set individual spending limits for employees.

Potentially higher interest rates: Small business credit cards may have higher rates than corporate credit cards. This can be a significant concern if the business is balanced, potentially leading to higher interest costs and financial strain.

Moving from a Small Business Card to a Corporate Card

As a small business grows, its financial needs and capabilities evolve.

Transitioning from a small business credit card to a corporate credit card can be a strategic move.

Here are some considerations and alternative solutions to guide this transition:

- Assess financial growth and needs: Evaluate the current and projected revenue levels and the scale of expenses. A corporate credit card may be more suitable if the business has expanded significantly, with higher revenue and a need for more significant credit limits.

- Improve business credit history: To qualify for a corporate credit card, businesses need a strong credit history. Timely payments, responsible credit utilization, and maintaining a favorable credit profile are crucial. Ensure that the business credit score is well-established and meets the requirements of corporate card issuers.

- Explore business banking relationships: Building a solid relationship with a business bank can provide access to financial services tailored to larger organizations. Discuss options for corporate credit cards and additional banking products with the bank’s representative.

- Consider alternative financing options: If the business does not meet the criteria for a corporate credit card, explore alternative financing options such as business lines of credit, loans, or vendor credit arrangements. These can help bridge the gap between small business and corporate credit needs.

- Consult with financial advisors: Seek guidance from financial advisors or credit professionals specializing in corporate credit. They can provide valuable insights, review financial goals, and recommend appropriate strategies for transitioning to a corporate credit card.

Conclusion:

Choosing between a corporate credit card and a small business credit card depends on the specific needs and stage of the business.

Corporate credit cards are tailored for larger organizations with high revenue and established business credit, offering higher credit limits and advanced expense management tools.

On the other hand, small business credit cards cater to smaller enterprises, providing easier access to credit, rewards programs, and the opportunity to build a separate credit history for the business.

When deciding between a corporate credit card and a small business credit card, it is crucial to consider the pros and cons of each option.

Corporate credit cards offer enhanced spending power, robust expense management tools, and customizable controls, but they come with stringent eligibility requirements and potential complexities in expense reporting.

Small business credit cards provide ease of obtaining credit, rewards, and perks, and the opportunity to build a credit history. Still, they often have lower credit limits and limited control features.

Several factors must be considered to transition from a small business credit card to a corporate credit card. Assessing the financial growth and needs of the business is crucial, along with improving the business credit history to meet the requirements of corporate card issuers.

Building strong relationships with business banks and exploring alternative financing options can also help bridge the gap between small businesses and corporate credit needs.

Consulting with financial advisors specializing in corporate credit can provide valuable guidance in the transition.

The decision between a corporate credit card and a small business credit card depends on the size, revenue, and specific business needs.

Corporate credit cards offer greater spending power and advanced expense management tools. In contrast, small business credit cards provide easier access to credit, rewards programs, and the opportunity to build a credit history.

Careful consideration of the pros and cons and alternative financing options can guide businesses in making informed decisions and transitioning from small business cards to corporate cards when appropriate.

Ultimately, businesses should evaluate their unique circumstances and goals to select the credit card option that best aligns with their needs and supports their financial growth.

RELATED ARTICLES

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years of economic growth and increased financial services accessibility, millions of Americans continue to operate...

Leave Comment

Cancel reply

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Gig Economy

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...