Be a Better Investor: Tax-Advantaged Accounts

By Article Posted by Staff Contributor

The estimated reading time for this post is 284 seconds

Tax-advantaged accounts allow individuals to save money while enjoying additional tax benefits. These accounts, including retirement, education, and health plans, can significantly impact an individual’s financial future.

By understanding these accounts’ key features and benefits, individuals can make informed decisions to optimize their tax savings and achieve their financial goals.

Retirement Plans

Retirement plans are one of the most well-known types of tax-advantaged accounts. They provide individuals with various options to save for their golden years while enjoying tax benefits.

Employer-sponsored 401(k) plans are a popular choice, as they often come with employer contributions and the ability to defer taxes on the contributed amount and any investment gains until withdrawal.

Individuals who are self-employed or have maximized their contributions to employer-sponsored plans can turn to Individual Retirement Accounts (IRAs).

IRAs allow for tax-deferred growth, with traditional IRAs offering tax-deductible contributions and Roth IRAs providing tax-free withdrawals in retirement.

Education Plans

Education plans, such as 529 Plans and Coverdell Education Savings Accounts, are designed to help individuals save for educational expenses while enjoying tax advantages.

529 Plans are state-sponsored investment accounts that allow tax-free growth and withdrawals when funds are used for qualified education expenses, including tuition, books, and room and board. They offer flexibility in terms of beneficiary and state residency requirements.

Coverdell Education Savings Accounts are another option for educational savings.

They offer tax-free growth and withdrawals for qualified educational expenses, including primary, secondary, and higher education costs. However, contributions to Coverdell ESAs are limited to $2,000 per year per beneficiary.

Health Plans

Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals save for medical expenses while reducing their tax burden.

To be eligible for an HSA, individuals must be covered by a high-deductible health plan (HDHP). Contributions to an HSA are tax-deductible, and the funds can be invested and grown tax-free. Withdrawals used for qualified medical expenses are also tax-free.

Benefits of Tax-Advantaged Accounts

Reduced Current Tax Burdens: Tax-advantaged accounts allow individuals to lower their current tax liabilities. Contributions to these accounts are often tax-deductible or made with pre-tax dollars, reducing taxable income.

Predictability in Tax Payments: With tax-deferred accounts, such as traditional 401(k)s and traditional IRAs, individuals can postpone paying taxes until retirement when they may be in a lower tax bracket. This provides predictability in tax payments and allows for greater savings growth.

Financial Incentives for Savings: Tax-advantaged accounts provide individuals with financial incentives to save for specific purposes. These accounts are structured to encourage long-term savings by offering tax benefits that can amplify growth over time.

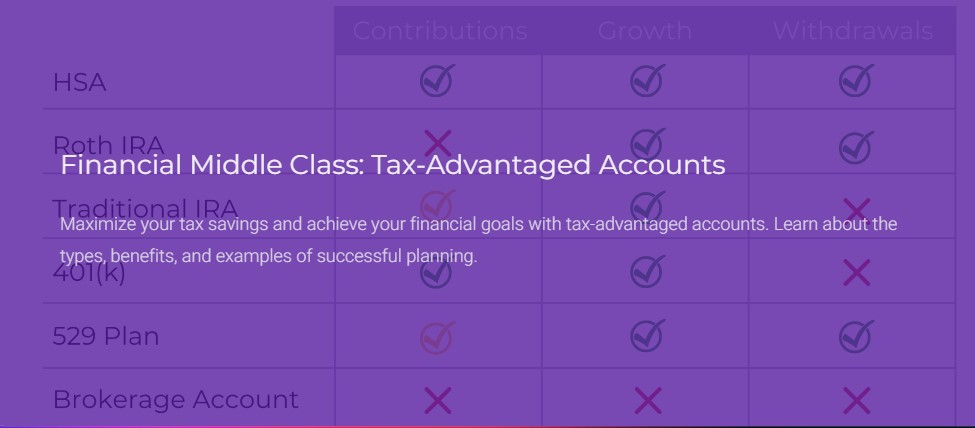

Types of Tax-Advantaged Accounts

Health Savings Accounts (HSAs): Ideal for saving for medical expenses, HSAs offer tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Flexible Spending Accounts (FSAs): FSAs are typically employer-sponsored accounts that allow employees to set aside pre-tax dollars to cover eligible medical, dental, and vision expenses. However, FSAs have a “use it or lose it” provision, meaning unused funds are forfeited at the end of the year.

529 Plans: These state-sponsored plans allow tax-free growth and tax-free withdrawals when funds are used for qualified educational expenses, making them an attractive option for saving for college or other educational costs.

Coverdell Education Savings Accounts: Coverdell ESAs provide tax-free growth and withdrawals for qualified educational expenses. However, contributions are limited to $2,000 per year per beneficiary.

Traditional and Roth 401(k)s Employer-sponsored retirement plans that offer tax advantages. Traditional 401(k)s allow tax-deferred contributions, while Roth 401(k)s offer tax-free withdrawals in retirement.

Traditional and Roth IRAs: Individual retirement arrangements with distinct tax advantages. Traditional IRAs allow for tax-deductible contributions, while Roth IRAs provide tax-free withdrawals in retirement.

Simplified Employee Pension IRAs (SEP-IRAs): Designed for self-employed individuals and small business owners, SEP-IRAs allow tax-deductible contributions and tax-deferred growth.

Considering Other Options

While tax-advantaged accounts provide significant benefits, individuals should also consider their financial goals and need for flexibility.

If accessibility and easy withdrawal options are essential, exploring high-yield savings accounts or certificates of deposit (CDs) with favorable interest rates may be worthwhile.

These options can complement tax-advantaged accounts and provide additional financial stability.

Successful Tax Planning with Tax-Advantaged Accounts

Strategies for Retirement Planning:

- Start early to maximize compound growth

- Contribute regularly: Consistent contributions maximize the benefits of tax-deferred growth and potential employer matching.

- Consider a Roth IRA: While contributions to a Roth IRA are not tax-deductible, qualified withdrawals during retirement are tax-free. Roth IRAs can be an excellent option if you anticipate being in a higher tax bracket in retirement.

- Choose low-cost index funds to minimize fees

Strategies for Healthcare Planning:

- Contribute the maximum allowed: Take full advantage of the contribution limits for HSAs and FSAs to maximize tax savings.

- Plan for future medical expenses: Utilize HSAs as a long-term investment vehicle, allowing funds to grow to cover future healthcare costs in retirement.

- Save your receipts for qualified medical expenses to withdraw tax-free in the future.

Strategies for Education Planning:

- Start early and save regularly: Compounding can significantly impact education savings, so it’s essential to begin saving early and contribute regularly.

- Explore state benefits: Research the available state tax benefits for 529 plans, as some states provide additional incentives for residents.

Conclusion

Tax planning with tax-advantaged accounts is a smart and efficient way to optimize your financial strategy while minimizing tax liabilities.

By utilizing retirement, healthcare, and education accounts, you can save for the future, manage medical expenses, and fund educational aspirations effectively.

Remember to consult with a financial advisor or tax professional to understand the specific rules and regulations governing each account and to tailor your tax planning strategy to your unique circumstances.

Carefully planning and using tax-advantaged accounts can enhance your financial well-being and achieve your long-term goals.

RELATED ARTICLES

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

1 Comment

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist....

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and...

Pingback: Traditional 401(k) vs. Roth 401(k): Which Is Better for You? - FMC