Rent Burden: 11 Cities Where a Six-Figure Salary is a Must for Affordable Housing

By Article Posted by Staff Contributor

The estimated reading time for this post is 252 seconds

The rental market in the United States has experienced unprecedented highs in the aftermath of the Covid-19 pandemic. With rental rates soaring nationwide, many individuals and families need help to secure affordable housing.

This article will explore the challenges renters face in various cities and the reasons behind the rising rent burden. We will focus on the Waller, Weeks, and Johnson Rental Index, which ranks the most overvalued rental markets in the country based on past leasing data.

This index estimates that the average U.S. rent should be around $1,915, but the current reality sees it at a staggering $2,018. Furthermore, we will analyze the financial implications of the rent burden and highlight 11 cities where a six-figure salary is necessary for comfortable and affordable housing.

The Rent Burden Dilemma

Financial experts often recommend that individuals spend no more than 30% of their gross income on rent to avoid being rent-burdened.

Unfortunately, many United States renters exceed this threshold due to exorbitant rental costs. According to the Waller, Weeks, and Johnson Rental Index, renters in the top six cities spend over 50% of their household income on rent, categorizing them as severely rent-burdened.

On average, a U.S. renter must earn almost $81,000 yearly to avoid being considered rent-burdened. However, in 11 cities, residents must earn over $100,000 a year to comfortably afford their rent. It is important to note that these estimates provided by the index are conservative and do not account for utilities, increasing the actual income required to sustain a reasonable standard of living.

California’s Dominance in the Rent Burden Crisis

The list of cities where a six-figure salary is necessary for affordable housing is dominated by California, with six out of the 11 cities located in the state.

California’s high cost of living and limited housing supply contributes significantly to the rental affordability crisis. Cities such as San Francisco, Los Angeles, and San Diego consistently rank among the most expensive rental markets in the country.

A booming technology industry, an attractive climate, and limited housing availability have created a perfect storm, resulting in astronomical rental prices.

Beyond California: Other Cities Struggling with Rent Burden

While California leads the rent burden crisis, other cities across the United States also grapple with similar challenges. New York City, with its vibrant culture and job opportunities, is notorious for its sky-high rents.

The competitive rental market and a lack of affordable housing options have made it incredibly difficult for New Yorkers to secure affordable accommodations.

Seattle, Washington, is another city where the rent burden is a pressing issue. The rapid growth of tech giants such as Amazon has led to an influx of highly paid employees, driving up the demand for housing and subsequently escalating rental costs.

This surge in rental prices has made it increasingly challenging for lower-income individuals and families to find affordable housing options.

The Impact of the Pandemic and Stagnant Wages

The housing market in the United States has been significantly influenced by the Covid-19 pandemic and stagnant wages, further exacerbating the issue of affordability.

While some areas have experienced a cooling of housing costs, high mortgage rates have made homeownership less attainable for many individuals. This, in turn, has increased the demand for rental properties, driving up rents in many cities nationwide.

Additionally, stagnant wages have failed to keep up with the rising cost of living, particularly in cities with booming industries and high demand for skilled workers.

This disconnect between wage growth and housing costs has created a situation where even those with well-paying jobs find it challenging to afford suitable rental accommodations.

The Ongoing Housing Affordability Crisis

The rent burden faced by many Americans highlights an ongoing housing affordability crisis. The lack of affordable housing options and skyrocketing rental prices disproportionately affect low-income individuals and families, pushing them into precarious financial situations.

The Economist, renowned for its analysis of global economic trends, recently addressed the severity of the housing affordability crisis in the United States. The article emphasizes the need for increased incomes to address this pressing problem, as high rents continue to burden individuals and households across the country.

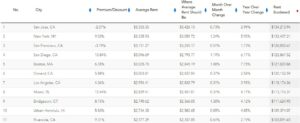

11 Cities Where a Six-Figure Salary is a Must for Affordable Housing

Rent Burden

Conclusion

The rental market in the United States has reached record highs, with rental rates surpassing the 30% threshold for the average American.

The Waller, Weeks and Johnson Index sheds light on the severity of the rent burden crisis, estimating that renters in 11 cities must earn over $100,000 a year to afford rent comfortably.

While California dominates the list, other cities, such as New York City and Seattle, face significant challenges regarding affordable housing.

The pandemic and stagnant wages have further complicated the issue, making it increasingly difficult for individuals to secure suitable rental accommodations.

Addressing the housing affordability crisis requires a multi-faceted approach that includes increasing the availability of affordable housing, implementing rent control measures, and addressing income disparities.

Without concerted efforts from policymakers, the rent burden crisis will persist, leaving millions of Americans struggling to secure safe and affordable housing.

RELATED ARTICLES

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars...

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference, and how do you decide which one’s right for you? Understanding these concepts can...

Leave Comment

Cancel reply

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

Gig Economy

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2%...