Fixed-Income Boom

By MacKenzy Pierre

The estimated reading time for this post is 280 seconds

In the midst of a Fixed-Income Boom, Do Active Wealth Managers Still Hold Sway?

In this current fixed-income market where the annual percentage yield (APY) on high-yield savings accounts touches 4.25%, the U.S. 10-year Treasury Note stands equal to 4.2%. The average 5-year Certificate of Deposit (CD) hovers over a striking 5.50% – the question looms large: Is there a genuine need for active wealth managers today?

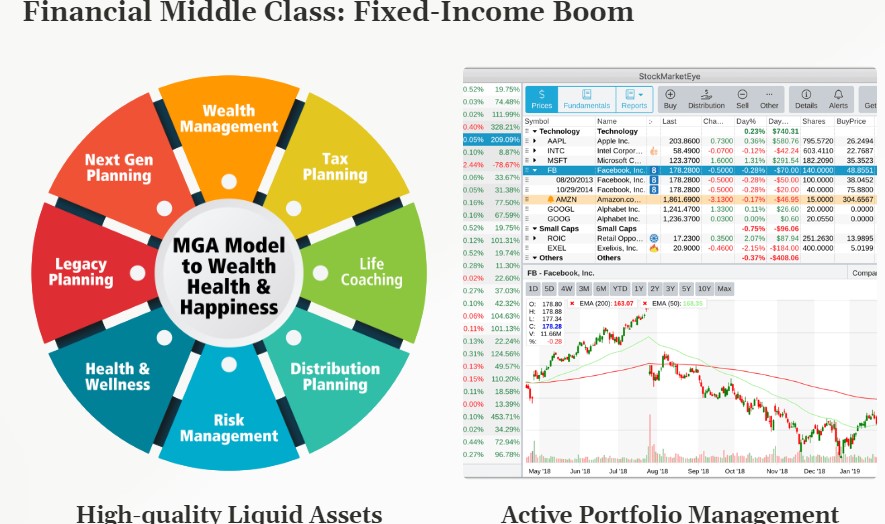

Investors can put their money in high-quality liquid assets and other higher-yielding investment products without the help of an investment professional and gain a satisfactory real rate of return even in this inflationary environment. Moreover, they do not need much education to implement this low-risk investing strategy.

The sight of a 5-year Certificate of Deposit (CD) boasting a substantial 5.50% further fuels the investor’s imagination. Yet, amidst these promising numbers, the pivotal role of active wealth managers in an individual’s financial odyssey stands under scrutiny.

Savers Had Had Rough Patch

For savers who have navigated a barren financial landscape for years, the current marketplace seems to unfurl a lush, verdant oasis where the prospect of favorable returns is not just a mirage but a tangible reality.

The Federal Reserve has raised rates 11 times in 2022 and 2023, but before that, it went nearly 16 years without raising them.

In the wake of a period where traditional financial instruments offered nothing more than a trickle of returns, the emergence of such fertile grounds for investment presents a refreshing change.

For the lay investor, these instruments embody simplicity and convenience, promising a hassle-free journey to accumulating wealth, devoid of the turbulent waves often witnessed in the stock market.

The Simplicity and Convenience of Passive Investments

The modern investor, weary from a history marked by stagnant or negligible returns, now finds themselves captivated by the straightforward allure that higher-yielding investment products provide.

These vehicles seem to have distilled the essence of investment to its purest form: park your savings and watch the interest accrue, almost in a magical symphony of growing wealth, without the turbulence traditionally associated with stock market ventures.

The simplicity extends further to the convenience it offers. Investors are now able to detach themselves from the relentless frenzy of the stock market, freeing themselves from the need to incessantly monitor the health and fluctuations of their portfolio.

In this new paradigm, the funds are placed in interest-bearing avenues, where they steadily mature, offering the sweet fruits of compounded interest without the customary stress and strain.

This shift towards passive investment vehicles also introduces investors to a tranquil state of mind. A portion of one’s savings can be allocated to these instruments, allowing for a ‘set and forget’ approach.

This strategy eliminates the need for the frequent portfolio rebalancing that was once the norm, freeing up valuable time and mental space, and thus facilitating a lifestyle where one can enjoy the fruits of their investments without the accompanying anxiety. Yet, one cannot ignore the continued relevance and expertise brought to the table by active wealth managers.

Active Wealth Management for Alpha

As of this writing, the U.S. inflation rate stands at 3.18%, which means the real rate of return on high-yield savings accounts with an annual percentage yield (APY) of 4.25% at a tangible 1.07%.

It is worth noting that the majority of proficient active managers can outperform portfolios centered around cash or cash-equivalent investments.

The expertise of active wealth managers merely based on the rising allure of passive investments would be an oversight.

- Portfolio Diversification

The landscape of investment is vast and varied. Active managers have the prowess to weave a diversified portfolio, encompassing equities, alternative investments, and global opportunities, thereby laying the groundwork for a well-rounded growth strategy that transcends mere interest accumulation.

- Tailored Strategies

Recognizing the uniqueness of each investor’s financial blueprint, active managers sculpt strategies that resonate with an individual’s financial aspirations, risk tolerance, and investment horizon, offering a bespoke approach in contrast to the generic solutions presented by passive investments.

- Mitigating Market Volatility

The investment arena is not devoid of fluctuations and downturns. In times of market volatility, the acumen of an active manager can serve as a beacon, helping to hedge against potential losses and capitalize on market inefficiencies.

- Tax Efficiency

Beyond mere capital gains, active managers craft strategies to diminish tax liabilities, thereby ensuring that investors retain a substantial portion of their gains.

- Holistic Financial Planning

Active wealth management transcends mere investment selections, encompassing a broader spectrum that includes comprehensive financial planning, estate planning, and strategizing for a comfortable retirement.

A Paradigm Shift in Wealth Accumulation

The enticing blend of impressive returns, unmatched convenience, and mental peace makes these passive instruments a powerhouse in the current financial landscape.

As individuals find themselves increasingly drawn to these avenues, it signals a significant shift in wealth accumulation strategies.

For the contemporary investor, this scenario unfolds a panorama where the lure of passive investments seems to eclipse the erstwhile perceived necessity of active wealth managers.

In this evolving narrative, the fixed-income market emerges as a dominant player, promising stability and growth with a simplicity that is both refreshing and lucrative. Yet, adopting a strategy that places all financial resources in this basket might not bear fruit in the long run.

Active wealth managers continue to hold their ground, offering an unparalleled blend of expertise, personalization, and a holistic approach to wealth management.

As the financial canvas continues to morph, its role in steering investors through its intricate maze remains indispensable. For the discerning investor, the choice morphs into a balanced approach, one that seamlessly integrates both passive and active strategies to sculpt a robust and resilient financial portfolio.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars...

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years of economic growth and increased financial services accessibility, millions of Americans continue to operate...

Leave Comment

Cancel reply

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

Gig Economy

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2%...