Biggest Financial Crimes: Countrywide Financial Corporation The opacity of the financial industry and complex business operations allow certain groups of organizations, financial and non-financial institutions, and...

First and foremost, moving to a new state or city is a big decision, and buying a property can be a thrilling experience, but it can...

Buying a home for the first time might be difficult, especially right now with the median U.S. home price above $400,000. Understandably, you’d be concerned about...

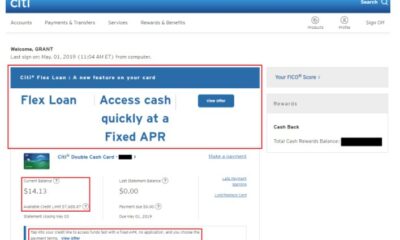

As American household debt rises, credit card fixed-interest loans are becoming a significant percentage. Credit card companies are letting their cardmembers convert part or all of...

Financial literacy and education are more critical now than ever. Every day, American consumers have to navigate complex financial consumer markets. However, too few of them...

In America, there is a massive knowledge gap America when it comes to personal finance. This article will explore the current state of financial education in...

Everyday credit cards provide cardholders with price protection, cashback rewards, rental car insurance, and more excellent rewards. However, not all credit cards are great financial...

Biggest Financial Crimes: Tyco International When people dwell on the enormous scope of finance, crime certainly does pay. In fact, over the years, various individuals and...

American credit cardholders carry, on average, about $6,000 in credit balances, but 40% of them don’t know the interest rate that they are paying on such...

American homeowners have $9.4 trillion in tappable home equity. The average wealthy American homeowner can take $178,000 out of their home to start their business, build...