Are Big Market Cap Companies Too Big to Fail

By MacKenzy Pierre

The estimated reading time for this post is 179 seconds

Too big to fail banks and nonbank financial companies are still a problem. Moreover, many companies across new sectors and industries have become part and parcel of the U.S. economy. They have significant systematic risk, and their failure will be disastrous to the domestic and global economies.

Banks and non-bank financial companies such as American International Group (AIG) and the Federal National Mortgage Association (Fannie Mae) ushered in the worst economic downturn since the Great Depression.

Thirteen years after the 2008 financial crisis, big market cap organizations, mainly those with a $ trillion or more, can also be considered too big to fail.

Market capitalization, aka market cap, is the total dollar market of a company’s outstanding shares of stock.

Are Big Market Cap Companies Too Big to Fail?

After the 2008-09 financial crisis, Congress passed, and President Obama signed the Dodd-Frank to prevent private companies from becoming too big to fail by expanding regulatory oversight to nonbank systematically-important companies.

The expanded oversight did not address multinational corporations that are not part of the financial sector but are interconnected to the whole economy and have millions of shareholders and stakeholders.

When the Dodd-Frank passed in 2010, no U.S.-based companies had a market capitalization of a$1 trillion. Now, four firms meet that criterion, including Amazon.

The Seattle-based company is not a bank nor a nonbank financial firm, but it is an integral part of the American consumers and deeply ingrained in the global economy.

Do taxpayers have to bail out Amazon to prevent the U.S. economy from collapsing if the giant e-retailer finds itself in Tyco International-like accounting scandal?

Let’s review those four companies’ supply-chains and stakeholders to assess their systematic risk and threats to the U.S. economy.

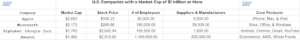

U.S. Companies with a Market Cap of $1 trillion or More

Too big to fail

On August 2, 2018, Apple because the first U.S. company to hit $1 trillion in value. Since then, a few companies have reached those milestones. However, as of this writing, only the four companies below have a market cap of $1 trillion or more:

Apple

Apple has a market cap of $2.663 trillion with 80 000 employees, 450,000 jobs through its U.S.-based suppliers, and more than 9,000 U.S. suppliers and manufacturers.

The Cupertino-based technology company claims an additional 1,530,000 U.S. jobs attributable to its App Store ecosystem.

Microsoft

Microsoft Corporation has a market cap of $2.173 trillion with more than 180 000 employees and more than 58,000 suppliers.

More than 1 billion people worldwide use the Washington-based firm’s office product or service.

Alphabet

Alphabet has a market cap of $1.745 trillion with more than 156,500 and 1,000 suppliers in 70 countries.

Billions of people use the Mountain View-based conglomerate’s core products, including Android, Chrome, Gmail, YouTube, Google Pixel, and more.

Amazon

Amazon has a market cap of $1.482 trillion with more than 1.1 million employees and 200,000 U.S. suppliers. 1 out of every 153 American workers is an amazon employee.

In 2021, the Seattle-based retail giant said it planned to buy more than $120 billion worth of supplies, services, and equipment from American suppliers.

Conclusion

All four companies with a market cap of $1 trillion or more are deeply ingrained in the U.S. economy. They have more than 1.6 million employees and 270,000 U.S. suppliers and manufacturers. Moreover, billions of American consumers use their core products daily.

Big multinational conglomerate companies, just like the banks and nonbank financial companies, are too big to fail.

The failure of any of those four companies can unravel the entire economy. American taxpayers need to get ready to bail them out if they experience any distress.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...