Build your credit for free with Experian Go™, which is a free, first-of-its-kind program to help the 28 million or so Americans who don’t have credit reports, therefore, are credit Invisibles.

Black and Hispanic adults, immigrants, and debt-conscious individuals make up the bulk of those who neither have a credit report nor a FICO score.

As a result, they depend on payday lenders, check cashing stores, and other predatory consumer finance firms to handle their affairs.

The credit-reporting firm said that consumers who participate in its do-it-yourself credit reports go from having no FICO to a 665, on average.

90% of lenders use the FICO score to assess potential clients’ creditworthiness. It ranges from 580 to 800+. A 665 FICO is below the average U.S. consumer score, but most lenders consider it good.

Experian Boost™ Vs. Experian Go™

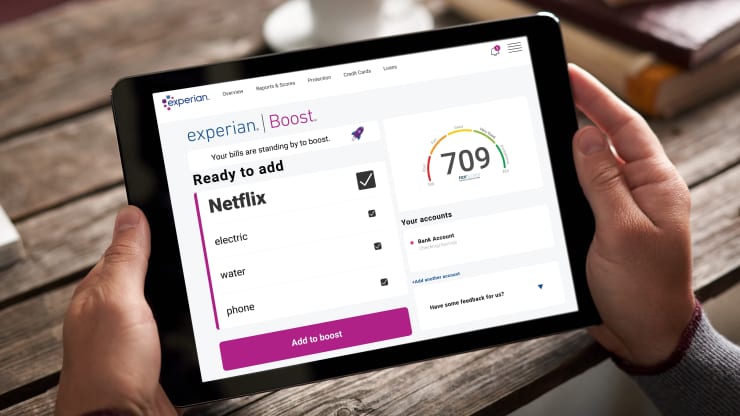

Experian PLC, one of the three major credit-reporting firms in the U.S., introduced Experian Boost™ a few years ago.

The Experian Boost™ allows consumers with thin and poor credit scores to add their rent and utility payments to their credit reports to boost their credit scores.

Experian Go™ is for those who don’t have a credit report. The program allows those consumers to create their own credit reports and then use the Experian Boost™ to add tradelines to their reports and build their credit scores.

Experian Go™ clients are new to credit, so they don’t have to deal with everyday negative items such as charge-offs and collection accounts. So, they see faster improvements in their FICO than consumers who have poor credit profiles due to collections and past-due accounts.

Clients with no existing credit reports by choice need to reconsider their decision because they pay higher insurance premiums and on other financial transactions such as check cashing and wire transfers.

Conclusion

If you are amongst tens of million American consumers who have no or limited credit history, you can start building credit today.