As American household debt rises, credit card fixed-interest loans are becoming a significant percentage. Credit card companies are letting their cardmembers convert part or all of their credit card’s available credit limit into installment loans.

Converting your revolving credit line into an installment tradeline gives you access to cash and can reduce interest expense, but it can also negatively affect your credit scores.

Revolving Credit vs. Installment Credit

Consumers with good credit scores often have a mix of credit products in their name, including revolving and installment trades or accounts.

Credit cards and home equity line of credit (HELOC) are examples of revolving tradelines that give consumers ultimately autonomy on using the credit line available to them.

They can use the recommended 30% or all their credit limit or nothing at all.

Car loans, student loans, and mortgages are examples of installment accounts. Installment credit does not provide consumers with the flexibility of revolving credit.

An installment credit account has fixed terms and comes with a maturity date. For instance, a $20,000 new car loan financing at a 5% annual percentage rate (APR) for five years will expire once you make your 60th payment of $377.42. After the pay-off, you will need new financing if f you want to get a new car.

Credit Card Fixed-Interest Loans

A fixed-interest credit card converts a revolving credit into an installment credit with fixed terms and interest rates. As a result, installment loans can save consumers thousands of dollars in interest charges.

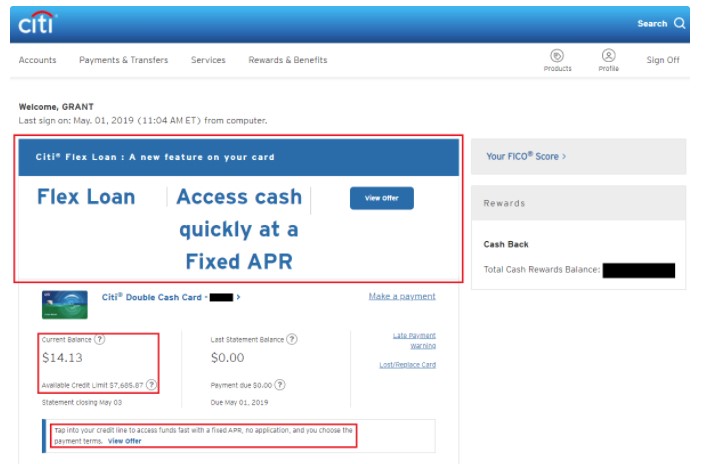

American Express, Citi, and other major financial institutions let their credit cardholders turn a portion or all of their credit’s available credit line into an installment loan.

How It Works

Let’s say that you have the Citi Simplicity Card from Citi Bank with an available credit limit of $10,000. The Citi Flex Loan will let you convert your credit limit into a personal one If you need cash.

You will get a fixed APR and a loan term of up to 5 years. Citi will include your loan’s monthly payment in your credit card’s minimum payment due.

If you convert your entire available credit limit, your monthly payment will be $194 for five years at 5.99 APR. The interest rate is based on your creditworthiness.

The loan will end up costing you about $1,164 ($194 x 60) – $10,000), which can be significantly lower than interest charges on revolving credit debt. However, the impact on your credit score can be more s significant.

Revolving credit and installment credit impact your credit scores. Still, revolving credit has a more significant effect on your credit profile because it’s part of your credit utilization rate, which makes up 30% of your credit score. Making on-time payments is the most significant factor with 35%.

The amount of your available credit card credit limit that you convert into a personal loan is now part of your credit card outstanding balance. Therefore, to take full advantage of credit card fixed-interest loans, consumers need to limit their withdrawals to 30% or lower of their available credit limit.