Which Debt to Pay Off First: Analyzing Strategies for Effective Debt Elimination

By MacKenzy Pierre

The estimated reading time for this post is 563 seconds

Managing debt can be daunting, especially when faced with multiple financial obligations. To tackle this challenge, it is crucial to prioritize debt repayment wisely.

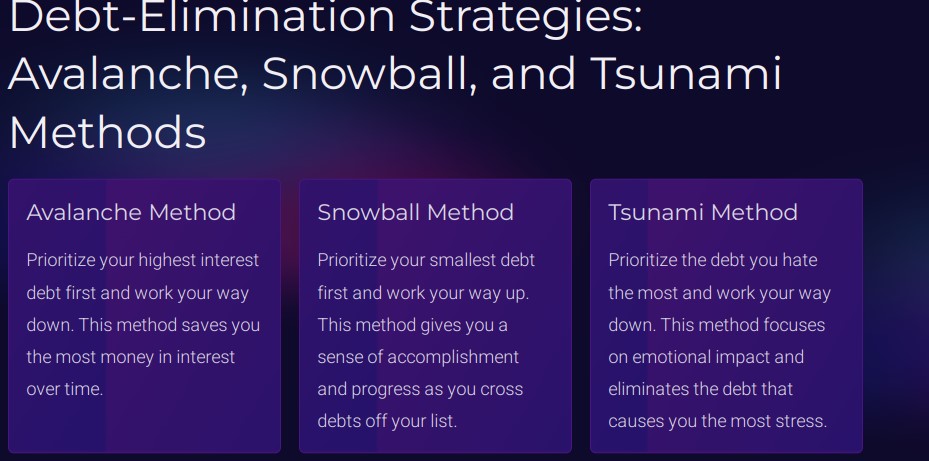

In this article, we will explore three popular debt elimination strategies: the Avalanche Method, the Snowball Method, and the Tsunami Method.

We will delve into the reasoning behind each strategy, discuss alternative perspectives, and weigh the pros and cons before concluding which approach might be most suitable for your circumstances.

Why Eliminating Debt is Essential

debt has become an all-too-common aspect of many people’s lives. Whether it’s credit card debt, student loans, mortgages, or other forms of borrowing, the burden of debt can have significant implications on individuals, families, and the economy as a whole.

While debt may be necessary to fund financial goals, eliminating debt cannot be overstated. Personal financial well-being and broader economic stability need to eliminate or reduce debt.

Financial Freedom and Peace of Mind

Financial freedom and peace of mind are the most compelling reasons to eliminate debt.

Debt creates constant financial pressure and stress, as individuals are burdened with monthly payments, interest charges, and the looming fear of default.

By eliminating debt, individuals can regain control over their financial lives, reduce stress, and experience a sense of freedom and security.

Increased Disposable Income

Debt payments, especially high-interest ones, consume a significant portion of an individual’s income. Individuals can free up their disposable income by eliminating debt, allowing for more flexibility and financial opportunities.

This extra income can be used for savings, investments, or fulfilling other critical financial goals, such as buying a house, starting a business, or saving for retirement. Eliminating debt paves the way for increased financial stability and the ability to build wealth over time.

Improved Credit Score and Future Opportunities

Debt, particularly in the form of credit card balances and loans, directly impacts one’s credit score. A high level of debt and missed payments can significantly damage creditworthiness, making it challenging to secure future loans or favorable interest rates.

Individuals can improve their credit scores by eliminating debt and consistently making on-time payments, opening doors to better financial opportunities.

A good credit score can facilitate obtaining mortgages, car loans, and other forms of credit with more favorable terms, ultimately saving money in the long run.

Reduced Interest Payments

Debt often comes with interest charges that can accumulate over time, making the overall cost of borrowing significantly higher.

Individuals can save themselves from paying substantial interest over the long term by eliminating debt. This saved money can be redirected towards other financial goals, such as emergency funds, investments, or paying off other debts.

Debt elimination can be seen as an investment in one’s financial future, as it minimizes the drain of interest payments and allows for greater financial flexibility.

Protection from Economic Instability

During periods of economic downturn or financial crisis, those burdened with debt are often hit the hardest. Loss of employment or a decrease in income can make it challenging to meet debt obligations, leading to defaults, foreclosures, and bankruptcy.

Individuals can build a financial safety net by eliminating debt and shielding themselves from potential economic instability.

Being debt-free provides a buffer during uncertain times, allowing individuals to focus on rebuilding and adapting without the added stress of overwhelming financial obligations.

Positive Economic Impact

On a broader scale, eliminating debt has positive implications for the overall economy.

High consumer debt levels can hinder economic growth, as individuals are less likely to spend and invest when burdened by excessive financial obligations.

By eliminating debt, individuals contribute to a healthier economic environment, promoting increased consumer spending and investment and stimulating economic growth and job creation.

We know Why Eliminating Debt is Essential now; let’s talk about the cost of debt.

The Cost of Debt

The longer you wait to pay off your debts, the more interest you’ll accrue, ultimately leading to higher costs:

Understanding the Cost of Debt

When you borrow money, whether it’s from a bank, credit card company, or other lending institution, you incur an obligation to repay the principal amount along with any additional interest and fees.

The cost of debt refers to the total expense you’ll bear over the repayment period, which is influenced by the interest rate and the time it takes to repay the debt.

The Federal Reserve has raised rates ten consecutive times since March 22, pushing its benchmark rate to between 5 and 5.25%, meaning that student loans, credit card debt, or mortgages are costing you more now.

Accumulating Interest:

Interest is the primary factor that contributes to the cost of debt. Lenders charge interest as compensation for the risk they assume by lending you money.

The interest rate is typically an annual percentage rate (APR), representing the cost of borrowing over one year.

The longer it takes to pay off the debt, the more interest you’ll accumulate, resulting in a higher overall cost.

Compounding Effects:

Interest on debt can compound, further amplifying its cost. Compound interest is calculated on the initial principal and any accumulated interest that hasn’t been paid.

Therefore, the longer you carry the debt, the more frequently interest is added to the outstanding balance, leading to faster growth in the total debt. Credit card debt is often seen as the worst because it compounds daily.

Opportunity Cost

You may miss potential investment opportunities by allocating your financial resources toward servicing debt.

When a significant portion of your income is dedicated to paying off debt, fewer funds are available for saving, investing, or fulfilling other financial goals. According to a study by Northwestern Mutual, 40% of Americans spend up to half of their income servicing debt.

Strategies for Paying off Debt

To eliminate debt quickly and efficiently, consider the following strategies:

Create a Budget

Develop a comprehensive budget for your income, expenses, and debt repayments.

By tracking your spending and identifying areas where you can cut back, you can allocate more money toward debt repayment.

The Avalanche Method: Prioritize Your Highest Interest Debt First

The Avalanche Method focuses on debts with the highest interest rates while making minimum payments on other debts.

You can save money in the long run by tackling high-interest debts first. Here’s how it works:

Reasoning

The rationale behind the Avalanche Method is rooted in mathematics. Targeting debts with high-interest rates minimizes the overall interest paid, allowing you to become debt-free faster. This approach maximizes cost savings and optimizes your financial resources.

Pros:

Long-term savings: Prioritizing high-interest debts saves money on interest payments over repayment.

Financial efficiency: By eliminating high-interest debts first, you free up cash flow for other financial goals.

Improved credit score: Reducing debts with high utilization rates positively impacts your credit utilization ratio, potentially boosting your credit score.

Cons:

Time-consuming: Paying off high-interest debts first might take longer, as more significant balances tend to accumulate more interest over time.

Psychological impact: Progress may seem slower due to the focus on debts with more significant balances, which may dampen motivation.

The Snowball Method: Prioritize Your Smallest Debt First

The Snowball Method involves prioritizing the repayment of the smallest debt balances while making minimum payments on other debts. Here’s how it works:

Reasoning:

The Snowball Method aims to provide quick wins and psychological motivation by tackling smaller debts first.

By experiencing progress early on, you may be more inclined to stay motivated throughout your debt repayment journey.

Pros:

Emotional boost: Paying off smaller debts quickly generates a sense of accomplishment and keeps motivation high.

Simplification: As you eliminate smaller debts, you reduce the number of creditors and minimum payments required, making it easier to manage your finances.

Momentum building: The Snowball Method creates a positive feedback loop, allowing you to progressively apply for the payments from the eliminated debts toward more significant obligations.

Cons:

Potential long-term costs: Prioritizing smaller debts first may result in paying more interest overall, mainly if higher-interest debts are left untouched for an extended period.

Delay in addressing high-interest debts: The Snowball Method may not be the most financially efficient strategy, as it does not directly target debts with higher interest rates.

The Tsunami Method: Prioritize the Debt You Hate the Most

The Tsunami Method involves focusing on the debt that carries the most emotional burden or has the most substantial negative impact on your life. Here’s how it works:

Reasoning:

The Tsunami Method is rooted in the belief that eliminating the debt that causes the most stress or emotional strain can lead to better overall well-being and financial stability.

By addressing the debt you dislike the most, you can alleviate psychological burdens.

Pros:

Emotional relief: Tackling the debt that causes the most stress can provide a significant emotional weight off your shoulders.

Motivation boost: By confronting and eliminating the debt you hate the most, you may experience enhanced motivation to continue your debt repayment journey.

Improved mental well-being: Eliminating a debt that negatively impacts your life can reduce anxiety and improve your sense of financial control.

Cons:

Financial implications: The Tsunami Method may not align with the most financially optimal strategy, as it does not prioritize high-interest debts or consider the long-term cost savings of tackling them first.

Delay in addressing other debts: Focusing solely on the debt you hate the most may result in neglecting other obligations that could be more financially burdensome in the long run.

Alternative Perspectives:

While the Avalanche, Snowball, and Tsunami Methods are widely discussed and practiced, it’s essential to consider alternative perspectives that may suit individual circumstances:

Hybrid Approach: You can combine elements of different strategies to create a personalized debt repayment plan.

For instance, you could use the Avalanche Method to tackle high-interest debts first but incorporate the Snowball Method for a psychological boost by occasionally paying off smaller debts.

Proportional Allocation: Instead of focusing on a single debt, allocate your resources proportionally to all your debts. This approach ensures that all obligations receive attention and helps maintain a balanced financial approach.

Conclusion

The significance of eliminating debt cannot be overstated in pursuing personal financial well-being and broader economic stability.

From gaining financial freedom and peace of mind to increasing disposable income, improving credit scores, reducing interest payments, protecting against economic instability, and positively impacting the economy, the benefits of eliminating debt are numerous and profound.

The cost of debt extends beyond the principal amount borrowed as interest and fees accumulate over time.

By understanding the concept of the cost of debt and the various factors that contribute to it, you can make informed decisions to eliminate debt quickly.

Determining which debt to pay off first requires carefully analyzing your financial situation, personal preferences, and long-term goals.

The Avalanche Method offers a mathematically sound approach, saving money on interest payments, but it may take longer to see progress.

The Snowball Method provides quick wins and psychological motivation but may increase overall interest payments.

The Tsunami Method prioritizes emotional relief but may not align with the most financially optimal strategy.

Ultimately, the choice depends on your financial objectives, emotional well-being, and personal circumstances.

Consider consulting with a financial advisor or using debt repayment calculators to assess the impact of different strategies on your specific situation.

Remember, the most crucial step is taking action and consistently working towards debt-free.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars...

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years of economic growth and increased financial services accessibility, millions of Americans continue to operate...

Leave Comment

Cancel reply

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Saving vs. Investing: What’s the Difference?

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

Gig Economy

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

American Middle Class / Oct 26, 2024

10 Credit Cards with the Highest Annual Percentage Rates (APR) on Purchases and Cash Advances

The estimated reading time for this post is 362 seconds When you’re on the hunt for a credit card, there are many things to consider—the rewards...

By Article Posted by Staff Contributor

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two...

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2%...