Financing a Pool: Exploring Options for Your Backyard Oasis

By Article Posted by Staff Contributor

The estimated reading time for this post is 329 seconds

A swimming pool can be a fantastic addition to any home, offering a refreshing escape from the summer heat and a gathering place for family and friends. However, the cost of building a pool can be a significant investment.

This article aims to provide an in-depth guide on financing a pool, covering various financing options and weighing their pros and cons.

We will discuss the cost of pools, maintenance considerations, affordability, pool loans, cash-out refinancing, home equity lines of credit (HELOCs), home equity loans, personal loans, top lenders for pool loans, and whether pool financing is a good idea.

Different Types of Swimming Pools

Above Ground Pools

Above-ground pools are a cost-effective and versatile option for homeowners. They are typically constructed using steel, aluminum, or resin materials and come in various sizes and shapes.

Above-ground pools are easy to install and require minimal excavation, making them a popular choice for those on a budget or with limited space.

The average cost to build an above-ground pool can range from $1,500 to $15,000, depending on size, materials, and additional features.

In-Ground Vinyl Pools

In-ground vinyl pools feature a flexible liner that stretches across a dug-out hole and is supported by steel, aluminum, or polymer walls. These pools offer more design flexibility than above-ground pools and can be customized to fit various shapes and sizes.

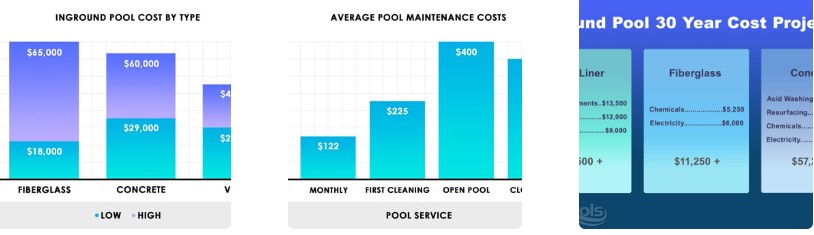

In-ground vinyl pools are typically more affordable than concrete or fiberglass options, with construction costs ranging from $20,000 to $50,000. However, the vinyl liner may require periodic replacement, increasing long-term maintenance costs.

Concrete Pools

Concrete pools are a popular choice for those seeking durability and customization options. These pools are constructed by excavating the desired shape, installing steel reinforcements, and spraying or pouring concrete to create the pool structure.

Concrete pools can be tailored to suit specific design preferences and include features like attached spas, waterfalls, and intricate tile work.

Due to their versatility and longevity, concrete pools are often the most expensive to build, ranging from $30,000 to $100,000 or more.

Fiberglass Pools

Fiberglass pools consist of a pre-formed shell made of fiberglass-reinforced plastic. These pools are manufactured off-site and then transported to the installation location, where they are placed in a prepared excavation.

Fiberglass pools are known for their smooth, non-porous finish, which resists algae growth and requires less maintenance.

They are available in various shapes and sizes but offer less customization than concrete pools. The average cost of a fiberglass pool installation can range from $30,000 to $60,000, depending on size, features, and site preparation.

Maintenance Costs to Consider:

Owning a pool entails ongoing maintenance expenses that should be factored into your budget. These costs include water, electricity, chemicals, cleaning equipment, regular servicing, and repairs.

On average, you can spend around $1,200 to $2,500 annually for maintenance.

How Much Pool Can You Afford?

Determining how much pool you can afford involves evaluating your financial situation and considering your income, expenses, and existing debt.

Experts suggest that your monthly pool payment, including maintenance costs, should be at most 10% of your monthly income. It is essential to establish a realistic budget to avoid potential financial strain.

What is a Pool Loan?

A pool loan is financing specifically designed for swimming pool construction or renovation. It is often an unsecured personal loan that can cover the entire cost of the pool project, including materials, labor, and additional features.

Pool Financing Options

Cash-out Refinance:

Cash-out refinancing involves replacing your existing mortgage with a new loan for a higher amount, allowing you to borrow against the equity in your home.

This option provides a lump sum of cash that can be used to finance a pool. However, it extends your mortgage term and may incur closing costs. Pros include lower interest rates and tax-deductible interest payments.

Home Equity Line of Credit (HELOC):

A HELOC is a revolving line of credit that uses your home equity as collateral. It provides flexibility in borrowing and repaying funds and can be used to finance a pool.

Pros include low-interest rates, tax-deductible interest payments, and the ability to reuse the credit line. However, it carries the risk of variable interest rates and may require a longer repayment period.

Home Equity Loan:

Similar to a HELOC, a home equity loan utilizes the equity in your home as collateral. It provides a lump sum for pool financing with a fixed interest rate and predictable monthly payments.

Pros include fixed interest rates, potentially lower rates than other loans, and tax-deductible interest payments. However, it may extend your mortgage term and involve closing costs.

Personal Loans or “Pool Loans”

Personal loans are unsecured loans that can be used for various purposes, including financing a pool. These loans offer flexibility and quick access to funds.

Pros include no collateral required, a simplified application process, and shorter loan terms. However, interest rates may be higher than secured loans, and loan amounts may be limited.

Pros and Cons of Different Financing Options

To summarize the advantages and disadvantages:

Cash-out Refinance:

- Pros: Lower interest rates and tax-deductible interest payments.

- Cons: Extended mortgage term, closing costs.

Home Equity Line of Credit (HELOC):

- Pros: Low-interest rates, tax-deductible interest payments, flexibility in borrowing.

- Cons: Variable interest rates, the potential for a long repayment period.

Home Equity Loan:

- Pros: Fixed interest rates, potentially lower rates, tax-deductible interest payments.

- Cons: Extended mortgage term, closing costs.

Personal Loans or “Pool Loans”

- Pros: No collateral required, simplified application process, shorter loan terms.

- Cons: Higher interest rates and limited loan amounts.

Top Lenders for Best Pool Loans

There are numerous lenders offering pool financing options. The best lenders vary based on individual circumstances, credit history, and loan requirements.

Research and compare offers from reputable financial institutions such as LightStream, SoFi, Wells Fargo, and TD Bank.

Is Pool Financing a Good Idea?

The decision to finance a pool depends on your financial situation, goals, and priorities. Consider the following points:

- Assess your long-term financial stability and ability to repay the loan.

- Determine if the enjoyment and benefits of having a pool outweigh the costs.

- Explore alternative options, such as saving or scaling down your pool project.

- Take into account potential home value appreciation and increased property appeal.

Conclusion:

Financing a pool requires careful consideration of costs, maintenance expenses, and available financing options.

Evaluate your financial situation and preferences before committing to a loan. While pool financing can provide access to your dream backyard oasis, weighing the pros and cons, exploring alternative solutions, and choosing the best option with your financial goals and circumstances is crucial.

Remember, a well-planned and financially responsible approach can help turn your pool dreams into a reality without causing undue financial strain.

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...