Financing Mobile, Manufactured, and Modular Homes

By Article Posted by Staff Contributor

The estimated reading time for this post is 618 seconds

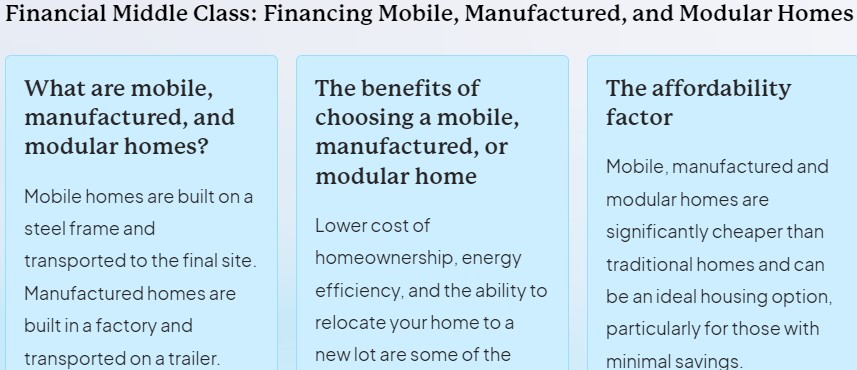

Mobile, manufactured, and modular homes have become affordable alternatives to traditional housing options. These types of homes offer flexibility, cost-effectiveness, and various financing options.

In this article, we will explore the differences between mobile, modular, and manufactured homes, discuss different financing methods, and highlight the key factors to consider when buying a mobile home.

Differences between Mobile, Modular, and Manufactured Homes:

While often used interchangeably, mobile, modular, and manufactured homes have distinct characteristics:

-

Mobile Homes

Mobile homes, also known as trailers or single-wides, are constructed on a steel frame with wheels for transportation. They are designed to be moved and are typically smaller in size.

However, due to safety concerns, manufactured homes have replaced many mobile homes.

-

Manufactured Homes

Manufactured homes, sometimes called double-wides or triple-wides, are built entirely in a factory and transported to their permanent location.

They comply with the U.S. Department of Housing and Urban Development (HUD) construction and safety standards, known as the HUD Code.

-

Modular Homes:

Modular homes are constructed in sections, or modules, in a factory and then transported to the building site for assembly.

They are built to local or state building codes, similar to traditional site-built homes, and offer more design flexibility.

Ways to Obtain Mobile Home Financing:

FHA Loans:

The Federal Housing Administration (FHA) expanded its lending to include manufactured and modular homes. This move has opened up opportunities for individuals and families to realize their dreams of homeownership more affordably and flexibly.

The FHA’s involvement in the manufactured and modular housing market aims to make homeownership more accessible to individuals who may not qualify for conventional mortgage loans.

The FHA provides insurance on loans made by approved lenders, reducing the risk for lenders and making it easier for borrowers to secure financing for these types of homes.

Advantages of FHA Loans for Manufactured and Modular Homes:

Lower Down Payment Requirements: One of the primary benefits of FHA loans for manufactured and modular homes is the lower down payment requirement. Borrowers can often secure a loan with as little as 3.5% down, compared to the higher down payments typically required for conventional loans.

More Lenient Credit Requirements: The FHA’s credit requirements are generally more lenient than conventional loans, making it easier for individuals with less-than-perfect credit histories to qualify. This opens homeownership opportunities for those needing help securing financing through other channels.

Competitive Interest Rates: FHA loans offer competitive interest rates, which can help borrowers save money over the life of the loan. These rates are often comparable to or even lower than those offered for conventional mortgages, making homeownership more affordable for buyers of manufactured and modular homes.

Streamlined Loan Process: The FHA’s loan process is streamlined, making it faster and more efficient than some traditional mortgage programs. This can be particularly advantageous for those who need to secure financing quickly, allowing them to move forward with their home purchase without unnecessary delays.

Permanent Foundation Requirement: To qualify for FHA financing, manufactured homes must be placed on a permanent foundation. This requirement ensures that the houses are structurally sound and meet specific safety standards, providing buyers with additional peace of mind.

Fannie Mae and Freddie Mac Empower Borrowers to Finance Manufactured Homes with Conventional Loans

The two government-sponsored enterprises (GSEs) have taken significant steps to make the homeownership dream a reality for Americans looking to finance manufactured homes.

To support affordable housing options and increase accessibility to conventional loans, Fannie Mae and Freddie Mac have developed programs specifically tailored to the unique needs of manufactured home borrowers.

Fannie Mae’s Manufactured Housing program

Fannie Mae’s program for manufactured housing, known as MH Advantage, aims to increase the availability of conventional financing for borrowers purchasing manufactured homes.

Under this program, Fannie Mae provides lenders with specific guidelines and loan eligibility criteria for manufactured homes.

To qualify for MH Advantage, manufactured homes must meet specific requirements, including construction standards, size limitations, and aesthetic features.

These standards ensure that the homes offer the same quality, durability, and energy efficiency as site-built homes.

By providing conventional financing options for manufactured homes, Fannie Mae’s MH Advantage program allows borrowers to secure competitive interest rates and more favorable terms.

This enables homeowners to build equity, benefit from potential appreciation, and enjoy conventional mortgages’ stability.

Freddie Mac’s Manufactured Homes program

Freddie Mac also offers a program that facilitates conventional financing for manufactured homes called CHOICEHome.

Like Fannie Mae’s MH Advantage, CHOICEHome sets specific guidelines and eligibility criteria for lenders and borrowers.

Manufactured homes eligible for Freddie Mac’s CHOICEHome program must adhere to construction standards and meet size, design, and feature requirements.

These standards ensure that the homes maintain the same quality and durability as site-built homes, further enhancing their long-term value and appeal.

With Freddie Mac’s CHOICEHome program, borrowers can access conventional mortgage options, including fixed-rate and adjustable-rate mortgages.

This empowers them to enjoy the advantages of traditional financing, such as lower interest rates, longer loan terms, and the potential to build equity over time.

Benefits of Financing Manufactured Homes with Conventional Loans

The availability of Fannie Mae’s MH Advantage and Freddie Mac’s CHOICEHome programs offers several advantages to borrowers seeking to finance manufactured homes:

- Affordability: Conventional loans typically offer lower interest rates than specialized manufactured home loans, resulting in reduced monthly mortgage payments.

- Equity Building: By financing a manufactured home through a conventional loan, homeowners can build equity over time, similar to traditional site-built homes.

- Competitive Terms: Conventional loans have longer loan terms, providing borrowers with more manageable monthly payments.

- Flexibility: With conventional loans, borrowers can access various mortgage products, including fixed-rate and adjustable-rate options, catering to individual financial preferences and needs.

- Increased Accessibility: Fannie Mae and Freddie Mac’s programs help make manufactured homes viable for borrowers who may have previously faced financing challenges.

VA Loans for Mobile and Manufactured Homes: Supporting Veterans’ Housing Needs

The Department of Veterans Affairs (VA) has long been dedicated to supporting veterans and active-duty military personnel in various aspects of their lives, including housing.

Recognizing the evolving housing needs of veterans, the VA provides eligible individuals with the opportunity to obtain financing for mobile and manufactured homes through VA loans.

Understanding VA Loans for Mobile and Manufactured Homes

VA loans for mobile and manufactured homes are designed to assist eligible veterans and active-duty military personnel in purchasing, refinancing, or improving these residences.

These loans offer favorable terms and conditions, making homeownership more accessible for those who have served their country.

Benefits of VA Loans for Mobile and Manufactured Homes

- No Down Payment: One of the most significant advantages of VA loans is that they often do not require a down payment. This eliminates a substantial financial barrier and allows veterans and military personnel to secure affordable housing without a significant upfront investment.

- Competitive Interest Rates: VA loans typically offer competitive interest rates, which can result in significant savings over the life of the loan. This feature makes mobile and manufactured homes more affordable and helps veterans and military personnel manage their monthly mortgage payments.

- No Private Mortgage Insurance (PMI) Requirement: Unlike many conventional loans, VA loans do not require private mortgage insurance (PMI). This can save borrowers hundreds of dollars each month and contribute to long-term affordability.

- Flexible Credit Requirements: VA loans are known for their more flexible credit requirements than traditional mortgages. This enables veterans and active-duty military personnel with broader credit profiles to qualify for financing.

Eligibility for VA Loans for Mobile and Manufactured Homes

To be eligible for a VA loan for a mobile or manufactured home, individuals must meet specific criteria, including:

- Military Service: Eligibility is generally based on military service. Honorably discharged veterans, active-duty personnel, and National Guard or Reserve members with good service are typically eligible. The specific requirements can be found on the VA’s official website.

- Certificate of Eligibility (COE): Applicants must obtain a Certificate of Eligibility from the VA to confirm their eligibility for a VA loan. This document can be received online through the VA’s eBenefits portal or by submitting a request through a VA-approved lender.

- Property Requirements: The mobile or manufactured home must meet the VA’s property requirements, including being affixed to a permanent foundation and meeting applicable safety and building standards.

- Lender Qualification: Veterans and military personnel must meet the lender’s qualification criteria, including credit score, income verification, and debt-to-income ratio.

Chattel Loans: Financing Your Mobile Home on the Move

Chattel loans are personal property loans explicitly designed for mobile homes, not permanently attached to real estate.

Unlike traditional mortgages that finance real property, chattel loans focus on financing a personal property.

Personal property refers to the home and any moveable possessions in mobile homes.

One of the primary reasons individuals choose mobile homes is their mobility. These homes can be easily transported from one location to another, allowing homeowners to change their surroundings or relocate to a different area.

This flexibility, however, creates unique challenges when it comes to securing financing.

Traditional mortgage lenders typically require collateral in the form of real estate. Since mobile homes are not permanently affixed to land, they cannot be used as collateral for a standard mortgage.

This is where chattel loans come into play. Like an auto loan, chattel loans use the mobile home as collateral.

Chattel loans are commonly used for financing both new and used mobile homes. Lenders offering chattel loans consider factors such as the borrower’s credit history, income, and the value of the mobile home when determining loan eligibility.

Interest rates and loan terms can vary depending on the borrower’s financial profile and the lender’s policies.

It’s important to note that while chattel loans provide a viable financing option for mobile homes, they often come with higher interest rates than FHA, Fannie Mae’s MH Advantage, and Freddie Mac’s CHOICEHome program. This is due to several factors, including the perceived risk associated with mobile homes as collateral and the shorter loan terms typically offered for chattel loans.

Borrowers should carefully consider the total cost of the loan, including interest and fees, before committing to a chattel loan.

When applying for a chattel loan, borrowers must provide the lender with various documents, including proof of income, identification, and the title of the mobile home. Lenders may also request an appraisal to assess the value of the mobile home.

While chattel loans primarily focus on financing the mobile home itself, there are instances where borrowers may secure loans to finance land purchases.

This is known as a chattel mortgage, where the loan is used to finance the mobile home and the land on which it will be permanently placed.

It’s worth mentioning that chattel loan regulations and requirements can vary from jurisdiction to jurisdiction.

It’s essential to research and understand your area’s specific laws and regulations before pursuing a chattel loan.

Factors to Consider When Buying a Mobile Home:

Location: Consider the location of the mobile home, whether it will be on private land, in a mobile home park, or on leased land. Each option has different considerations and costs.

Quality and Condition: Inspect the quality and condition of the mobile home thoroughly, including its structure, plumbing, electrical systems, and overall maintenance. Ensure compliance with local building codes and the HUD Code.

Resale Value: Mobile homes typically depreciate over time, so it’s essential to consider the potential resale value. The house’s age, condition, and location can impact its resale potential.

Insurance and Maintenance: Determine the insurance cost and ongoing maintenance for the mobile home. Consider insurance coverage for natural disasters, structural issues, and personal belongings.

Affordability and Budget: Evaluate your financial situation and determine what you can comfortably afford, including the cost of the home, financing options, monthly mortgage payments, utilities, and other expenses.

Conclusion

Mobile, manufactured, and modular homes offer many individuals a flexible and affordable housing option. Exploring FHA loans, Fannie Mae and Freddie Mac programs, VA loans, and chattel loans is crucial when considering financing options.

Location, quality, resale value, insurance, and budget should also be carefully considered.

While these homes offer benefits such as cost-effectiveness and flexibility, it’s essential to be aware of potential drawbacks such as depreciation and limited financing options.

By understanding these factors, prospective buyers can make informed decisions when financing and purchasing a mobile home.

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...