How to Pick Investments for Your 401(k)

By Article Posted by Staff Contributor

The estimated reading time for this post is 328 seconds

The modern world shows a higher degree of uncertainty. You can’t anticipate what might happen the next day that could jeopardize your financial position. In such a bleak situation, it becomes necessary to channelize your retirement funds in safe investment vehicles. Enrolling in the 401(k) turns out to be the best plan for your future. Pick investments for Your 401(k) is the most vital part of your investment planning.

However, choosing the right investments is vital. While the current economic time warrants wise investment decisions, it offers the best options. You may now choose between various options to multiply your earnings. Many people get worried about the wide variety of investments. If this is your situation, don’t fret. Picking your 401(k) is more straightforward than it appears. The following guide will help you select investments for your 401(k).

Tips for picking investments for your 401(K)

Most people get pressed when making their choice. To avoid such a scene, do away with fear. Remember that you’re taking a big step – investment. At this point, don’t bother where you should invest. You don’t want the best fund. Instead, you need one or a few funds that may kick-start your investment process. You could always change your investment vehicles. However, you won’t get back those years of growth you could miss by not choosing any investment.

Step 1 – Figure out your allocation.

Fund or asset allocation involves the proportion of bonds, stocks, and other options you’ve in your portfolio. Allocation is significant as it dictates your portfolio’s risk level.

Two ways to assess investment risk exist – How much risk you could bear without making huge losses or the amount of risk you should take to earn the desired return on investments.

As a general rule, the longer the time frame, the more the risk you can take. For instance, if there are 25 or more years for your retirement, you could retain more stocks to maximize your earning potential. However, if you can’t assume risks and sell stocks prematurely due to market volatility, stay clear of an aggressive portfolio even if you wish to earn higher returns.

According to Chad Parks (the CEO and founder of ubiquity retirement and savings), if you’re a smart person and understand that the market will move up and down without worrying, you can easily tolerate risks. On the other hand, investing conservatively might be your better bet if you worry more about your money and get panicked even with small unfavorable market movements.

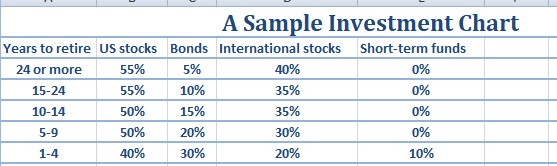

No matter how much risk you can bear, scaling back your aggressiveness is highly advised. This is more so when you’re nearing your retirement age. Such a move will protect your investment and let you cut down unnecessary losses due to higher risks. Keeping this point in mind, your 401(k) investment allocations might look somewhat similar to this chart.

A sample investment chart

Note that the above strategy is a general allocation of assets. When you get closer to your retirement age, you need to customize your strategy as per the situation.

Step 2 – Pick the investments for your 401(k) account.

Once you figure out the investment amount for bonds versus stocks, you could choose the investments for an ideal portfolio. Of course, your investment options largely depend on the amount of money you have. If you’ve enough money, here are your options.

Adopt a set it and forget strategy for the one-fund – Target-date funds were mainly initiated for 401(k) investors. These funds gradually get more conservative when the target date gets closer. Just pick the fund that aligns with your needs and retirement year. The fund manager will handle the rest.

Mike Lynch (the vice-president of Hartford funds for strategic funds) endorses target-date funds for 401(k) investors. When you get close to your retirement age, consider replacing your existing fund, or add other options for a more customized strategy.

The don’t-forget strategy for the one-fund – Asset allocation funds or target-risk mutual funds make a perfect choice for a target investment allocation. As opposed to a retirement date, the fund maintains a 60 percent exposure for stocks and 40 percent for bonds.

The biggest plus of these funds is you don’t have to monitor your funds. Someone else does it for you. However, there’s a red flag with such funds as they don’t change the allocation. In case your situation changes, you ought to find another fund or add more money to your existing fund. Since these funds won’t become more conservative toward your retirement, you may want to switch to another fund to balance your risk-reward ratio.

The simple DIY portfolio

If you’re a smart investor, you may go for a DIY portfolio. Just check the various 401(k) investments out there. Review each option in accordance with your needs and fund availability and pick the best option.

Embracing a three-fund approach could be a better choice for you. Such a strategy includes an index fund in the US stock market, an index fund in the US bond market, and an index fund in the international stock market. By allocating your savings in each of these funds, you enjoy a better, diversified portfolio.

If diversification is your primary intent, you may add a commodities fund, real estate fund, or an alternative fund to your allocation.

When finding an index fund, sort each fund by the expense ratio (the fee you pay to get one unit in each fund) from lowest to highest. The cheapest fund ought to be your index fund. Select one fund for each of the categories and allocate the money you wish (mentioned in the first step).

If you want to earn higher returns, make the portfolio more aggressive. On the flip side, go for a conservative portfolio for low risks and low reward investment options.

Step 3 – Keep costs low.

No matter which funds you choose and what approach you apply, try to keep the costs low. You can’t control the performance of your investments. However, you can easily control the fees you pay for each allocation. Keeping the expense ratio below 0.5 percent is highly recommended by most experts.

Bottom line

Channelizing your retirement savings in suitable 401(k) investments could be a demanding task. However, you may do away with this challenge easily. Follow the above steps to pick investments for your 401(k) account to accumulate a significant sum for your old age.

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

2 Comments

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

Pingback: Financial Literacy: How to Be Smart with Your Money - Personal Finance

Pingback: Get Your Social Security Personal Accounts - FMC