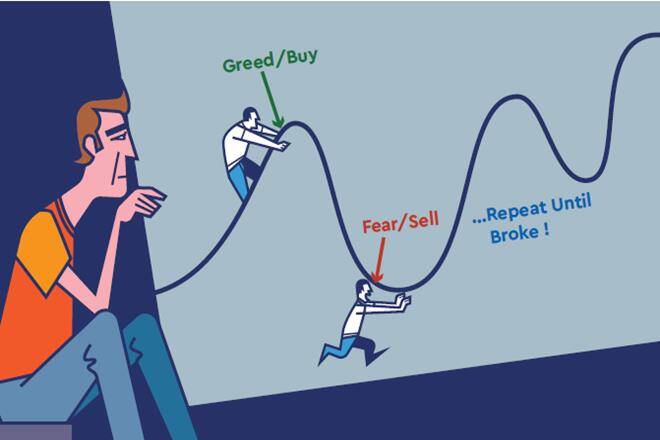

Commission-free trading, meme stocks, and overhyped sectors have built an irrational exuberance in individual investors. More retail investors are buying and selling shares of individual companies.

While professional money managers are pulling back from the U.S. stock market due to numerous uncertainties, including rising inflation and future fiscal policies, retail investors are trekking alone.

The Wall Street Journal reported, individual investors bought nearly $28 billion of stocks and exchange-traded funds (ETFs) in the month of June-the highest amount in 7 years.

Their Inexperience might have something to do with their unyielding optimism. According to a 2020 Annual Financial Literacy Survey by NFCC, only 57% of Americans can make informed financial choices regarding savings, investing, borrowing, and more.

Commission-free trading platforms such as Robinhood, eToro, Webull, and others let retail investors open a brokerage account and start buying stocks, cryptocurrencies, and other financial assets in minutes.

Individual Investors-Unsolicited & Unbiased Investments Education

To protect the new crop of inventors against themselves, online trading giants must integrate unsolicited and unbiased investments education tools into their platforms.

In its latest Form S-1, which is the initial registration that a United States company must file in advance of an Initial Public Offering (IPO), RobinHood reports that it has 18 million net cumulative funded accounts. Almost all companies within the industry have seen their customers grow in number.

More than 50% of RobinHood’s customers opened brokerage accounts for the first time.

The Robinhood application functions like it was designed by Mojang Studios, which developed Minecraft. It has numerous game-like features to incentivize its clients to trade.

Meme stocks such as GameStop Corp and AMC Entertainment and overhyped sectors like cannabis and cryptocurrencies are a byproduct of the gamification of equity trading and other financial assets.

The rise of individual investors is welcome news. More than half of U.S households have some investment in the stock market, but according to Pew Research, only 31% of non-Hispanic blacks and 28% of Hispanic households.

The U.S. stock market is truly one of the most significant sources of wealth creation. The more people who participate in it, the merrier.

However, the onus is on trading platforms to provide adequate education to prevent another Alex Kearns, a 20-year-old who killed himself nearly one year ago after believing he owned almost $750,000 on a risky bet on Robinhood.

Commission-free trading and user-friendly platforms are fueling the rise of individual investors, but the third and most crucial component is missing—unsolicited and unbiased investments education tools.

Pingback: IT'S OFFICIAL: Robinhood is a Meme Stock - FMC