Investing in financial assets can help you achieve financial independence. There are many ways to build wealth, but investing in financial assets is one of the most common and effective methods.

Financial assets can include stocks, bonds, and real estate. Investing in yourself financially is also a great way to build wealth. This can include paying off debt, saving for retirement, and investing in education.

This means learning about different types of investments and how to make them work for you. It also means making sure that you have the financial assets in place to support your goals. By taking these steps, you can ensure that you are on the path to financial success.

How Do You Build Wealth: Invest in Financial Assets?

One of the most important things you can do when building wealth is invested in yourself financially. Not only will this help you reach your financial goals faster, but it can also provide you with stability and security in the long term.

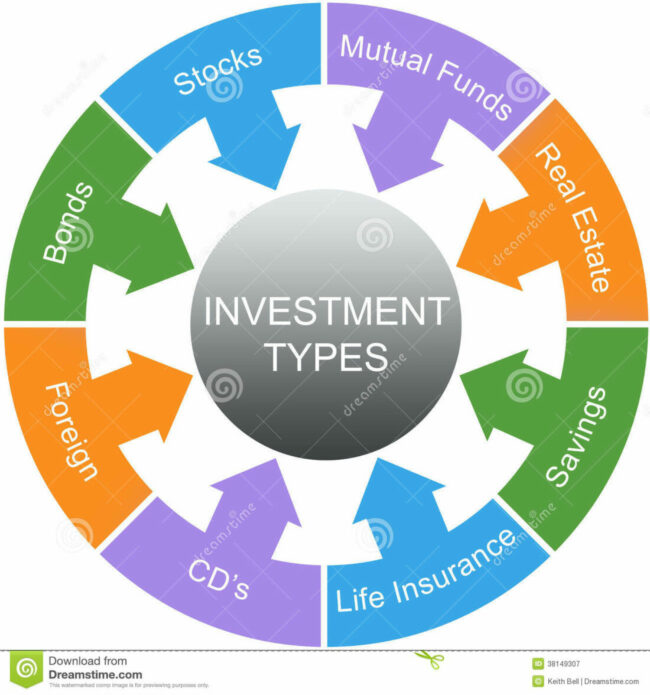

Here are a few types of investments you can make to help you reach your financial goals:

- Stock market investments:

One of the simplest and most common ways to invest in the stock market is to buy stocks. This can be done through a brokerage account, or you can invest directly in stocks through a mutual fund or individual stock.

You can also make stock market investments through investments such as ETFs (exchange-traded funds). ETFs are mutual funds that let you invest in various stocks and securities all at once. This can be a great way to get exposure to various stocks without investing a lot of money upfront.

- Mutual fund investments:

Another way to invest in the stock market is to invest in a mutual fund. Mutual funds are pools of money that are invested in a variety of stocks and securities.

Mutual fund investors benefit from the diversification benefits of a mutual fund. That means that even if one stock in a mutual fund falls in value, the fund’s overall value won’t be affected.

You can also invest in a mutual fund through an exchange-traded fund. This type of mutual fund is traded on a stock exchange.

- Real estate investments:

Real estate can also be a great way to build wealth. This is especially true if you’re looking to invest in a long-term strategy.

One way to invest in real estate is to buy the property outright. You can also invest in real estate through rental properties, condo units, and land.

You can also invest in real estate through investments such as real estate trusts (REITs). REITs are a type of mutual fund that invests in real estate.

- Bonds:

Another way to invest in the financial market is to invest in bonds. Bonds are debt investments that pay you a fixed interest rate every month.

You can also invest in bonds through investment trusts. These are trusts that invest in bonds.

- Cash:

Another way to invest in the financial market is to invest in cash or cash equivalents or fixed income. This low-risk option can give you a return on your investment over time.

You can also invest in cash through certificates of deposit (CDs). CDs are a type of savings account that offers a fixed interest rate.

There are a variety of ways to build wealth through investments. The most important thing is to be diversified and to have a plan for how you’ll reach your financial goals. Investing in yourself financially can help you reach those goals sooner and with less risk.

Here are some tips to help you invest in yourself financially:

- Make sure you have a solid understanding of your financial assets. Do you have savings accounts, Retirement Funds, and bonds? Know the details of each and make sure you are taking advantage of all your options. Do your research. Before investing in any financial asset, be sure to research the market conditions and the risks involved.

- Consider investing in financial assets that have a long-term return. This means you are not just investing in something that will offer you a quick cash payout. Look for assets that will provide you with a steady return over time. This could be in the form of a CD, a Bond, or Stocks.

- Take advantage of tax breaks when investing in financial assets. Many investments offer tax breaks for those who invest in them. This could include IRA contributions, 401k contributions, and Roth IRA contributions. Make sure you take advantage of any tax breaks available to you.

- Be sure you have a solid understanding of your credit score. This will help you understand the risk associated with investing in a particular financial asset. Know your FICO score and make sure you are using it to make smart financial decisions.

- Have an emergency fund. This should be a chunk of your savings earmarked for unforeseen costs. This could include car repairs, an unexpected illness, or a lost job. Make sure you are saving enough money to cover these types of expenses.

- Start thinking about retirement. Retirement doesn’t have to be far off. Make sure you are saving for retirement now, and begin to think about how you will make money in retirement. This could include writing articles, giving speeches, or starting your own business.

- Make sure you have the appropriate insurance. Make sure you have insurance for your financial assets in case of loss or theft.

- Make sure your investments are diversified. Make sure your investments are diversified so you don’t risk too much of your portfolio on one type of investment.

- Stay disciplined. Don’t overinvest in your financial assets, and don’t let your investments take all your income. Keep a diversified portfolio and have a plan for rebalancing your portfolio if necessary.

- Stick to a budget. Investing is a complex process, and it’s easy to get overwhelmed. Make sure you stick to a budget and don’t overspend on anything just because you’re investing.

By taking these simple steps, you can start to build wealth and achieve financial independence.

Conclusion

In conclusion, you should invest in financial assets to build wealth. By doing this, you will be setting yourself up for success.

There are many different types of investments out there, so do your research and find one that best suits your needs and find one that fits your risk tolerance and goals. Remember, your goal is to grow your wealth, so make sure you invest in a way that will allow you to do just that.

Lastly, don’t forget to monitor your investments and make adjustments as needed.

Pingback: How Do You Build Wealth: Invest in Real Estate - Personal Finance