The Negative Equity Trap

By Article Posted by Staff Contributor

The estimated reading time for this post is 581 seconds

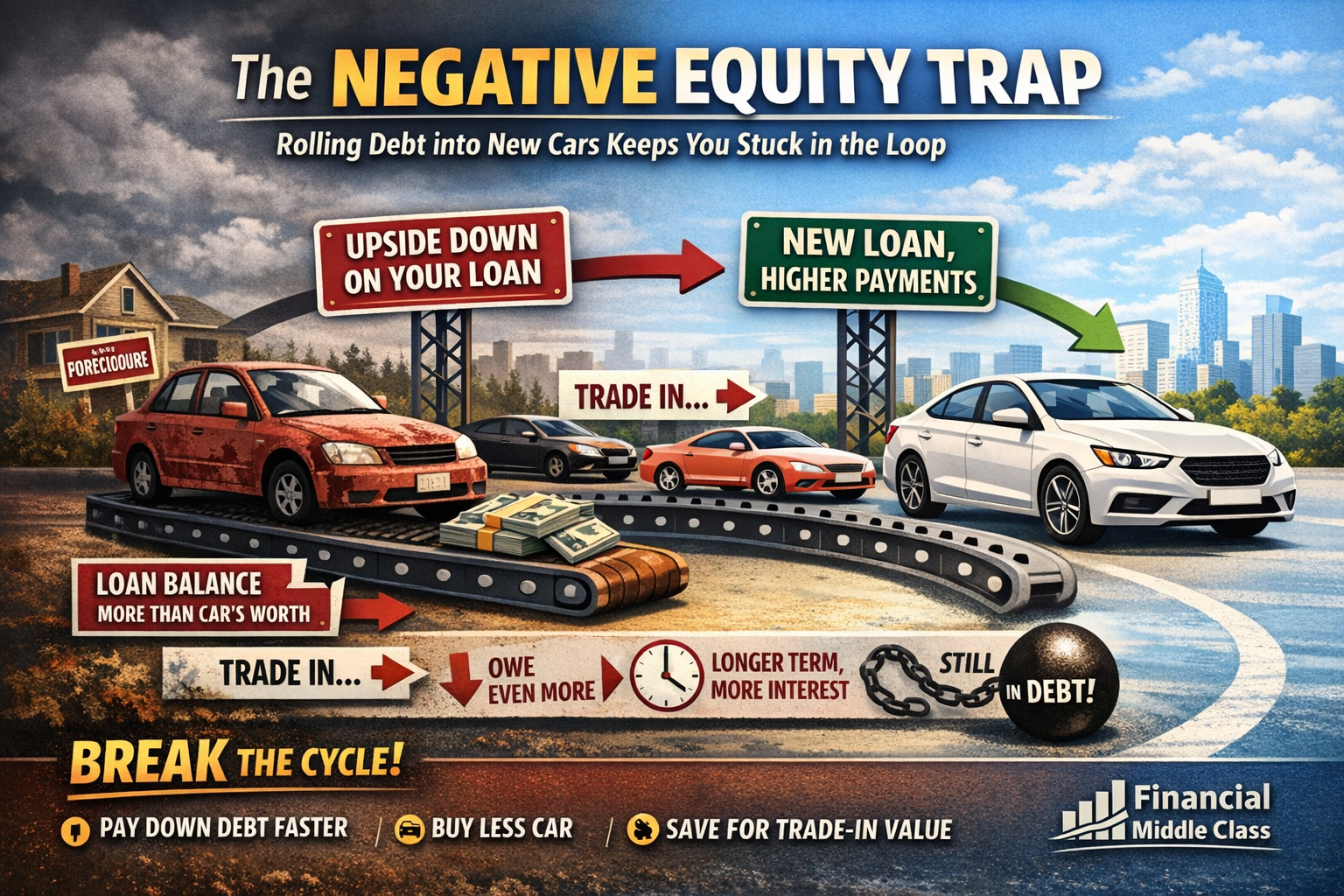

How middle-class drivers get stuck rolling debt into “upgrades” — and the delayed-gratification moves that break the loop

The most dangerous moment in the car-buying process isn’t when the lender pulls your credit.

It’s when you’re tired.

Tired of the repair bills. Tired of the rattling noise that “no one can reproduce.” Tired of the embarrassment of driving something that feels like it’s aging in public. Tired enough that the showroom starts to feel like relief. And that relief has a price tag.

In late 2025, the price tag is not subtle. Kelley Blue Book reported that the average new-vehicle transaction price hit $50,080 in September 2025, the first time it crossed $50,000. Edmunds, looking at the financing side of the market, found that buyers are stretching to survive the math: down payments have fallen, loan terms have lengthened, and $1,000+ monthly payments are no longer rare.

And that’s the backdrop for the number that should stop you cold:

Edmunds reports that in Q3 2025, 28.1% of trade-ins toward new-car purchases had negative equity, and the average amount owed on upside-down loans hit an all-time high of $6,905.

Negative equity isn’t just a personal finance buzzword. It’s a mechanism. It is how a “fresh start” quietly becomes a longer sentence.

What negative equity really is

Negative equity means you owe more on your current auto loan than the car is worth today. You can still trade it in. Dealers will still smile. Lenders will still approve deals. But the difference doesn’t disappear.

It gets rolled.

You don’t just buy the next car. You buy the remaining debt from the previous one, too—often at today’s prices, today’s insurance costs, and today’s interest rates. Edmunds calls out the behavior driving the problem: shoppers trading out too quickly, and loans taken during the pandemic-era pricing frenzy that are now “catching up.”

That’s not a lecture. That’s the market describing what it sees.

The debt loop, in one clean table

Here is the trap in plain English.

| The story you tell yourself | What the math is doing |

|---|---|

| “I’m upgrading.” | You’re transferring old debt into a new loan balance. |

| “The payment is only a little higher.” | The term got longer, the loan got bigger, and you’re paying interest on yesterday’s car. |

| “I’ll trade again in a couple years.” | Depreciation hits early, and you risk staying underwater again. AAA calls depreciation the biggest ownership cost. |

If you feel like you’ve seen this movie before, it’s because the market numbers say millions of people are living it.

What’s making negative equity worse in 2025

This isn’t just “people being irresponsible.” The system is set up to produce negative equity when prices are high and timelines are short.

Prices are historically high

Kelley Blue Book’s September 2025 tables show an industry average transaction price of $50,080. The higher the purchase price, the more room there is for depreciation to outpace your loan payoff early.

Down payments are shrinking

Edmunds reports the average down payment for new-car purchases fell to $6,020 in Q3 2025, the lowest since Q4 2021. A smaller down payment means a larger loan balance from day one. Larger balance plus early depreciation is how “barely affordable” becomes underwater.

Loan terms are stretching

Edmunds found that 22% of financed new-car purchases in Q3 2025 used 84-month-or-longer loans. Long terms lower the payment, but they can slow how quickly you build equity—especially in the early years when the car’s value drops fastest.

Monthly payments are pushing into “rent money” territory

Edmunds reported 19.1% of financed new-car transactions carried $1,000+ monthly payments in Q3 2025. That’s not a niche category anymore; it’s a visible share of the market.

Rolling debt is making the next deal more expensive than people realize

Edmunds compared Q3 2025 buyers who rolled negative equity into a new purchase with the overall average. The average payment for those rolling debt was $907, which was $140 more than the overall industry average payment of $767. Edmunds also says those buyers financed $11,164 more than typical new-vehicle buyers.

This is the line that deserves to be printed and re-read: rolling negative equity doesn’t just keep you in the market—it re-prices the market for you.

“Bad credit” gets blamed, but impatience is often the real accelerant

Credit matters. Rates matter. But negative equity is often created by behavior that has nothing to do with your FICO score.

Experian reports that average auto loan APRs in Q3 2025 were 6.56% for new and 11.40% for used, with deep subprime borrowers paying much higher averages. That difference is real.

But negative equity is not primarily an APR story. It’s a timeline story. It’s a depreciation story. It’s a “how quickly did you trade” story.

And this is where delay gratification stops being a slogan and becomes a financial strategy.

If you can delay the trade, even modestly—months, not years—you give your loan balance time to fall and you give depreciation time to slow. You don’t have to love your car. You just have to stop making expensive decisions while you’re emotionally done with it.

The “trade now” vs “wait and repair” decision

This is where middle-class finances get real. People don’t trade cars because they’re bored. They trade because the current one feels like a threat.

So the question isn’t “should you just keep it forever?” The question is: is your car unsafe, or is it merely inconvenient? Those are not the same.

| If your car is… | The financially safer move tends to be… |

|---|---|

| Unreliable in ways that create safety risk (brakes, steering, critical failures) | Replace it—safety first. But do it with a plan that avoids rolling debt. |

| Inconvenient but drivable (cosmetic issues, annoying noises, intermittent non-critical problems) | Delay gratification: fix the essentials, keep paying down principal, and avoid turning frustration into a five-figure rollover. |

You don’t need perfection. You need stability.

The hidden contributors that keep people underwater

Negative equity often grows because the loan payoff doesn’t fall as fast as people think it does.

AAA reminds consumers that depreciation is the single most significant cost of ownership, and its 2025 analysis puts average depreciation at $4,334 per year within its study. Depreciation hits hardest early. Your loan amortization is also slow early—especially on long terms. That mismatch is the underwater window.

Then you add two common accelerants: add-ons and rushed paperwork.

The FTC has warned consumers that dealers can’t charge you for add-ons you don’t want, and it encourages buyers to look closely at contracts and line items. If add-ons were financed, they raise your loan balance without raising resale value. That’s how you finance things the market won’t pay you back for later.

What the law does—and doesn’t—do for you

You have protections, but they do not replace due diligence.

The CFPB notes that the federal Truth in Lending Act requires lenders to provide key disclosures, including the APR, before you are legally obligated on the loan. That helps you compare the cost of borrowing.

But negative equity is often not a disclosure problem. It’s a “what are you bringing into the deal” problem. The paperwork can be fully legal and still financially disastrous.

For used cars, the FTC’s Used Car Rule requires dealers to display a Buyers Guide in most jurisdictions, with state exemptions noted by the FTC. Helpful—but again, it won’t stop you from rolling $8,000 of old debt into a new loan if you’re determined to escape your current car today.

How to escape the negative equity trap

This is where delay gratification pays real dividends.

There is no magic trick. Edmunds says it plainly: for many owners, there’s “no quick fix” for being underwater; the goal is minimizing how much deeper you go. The good news is that “no quick fix” is not the same as “no fix.”

Step one: find your real numbers, not your feelings

Before you even think about a trade, you need two numbers: your payoff amount and your car’s realistic market value. You’re trying to learn whether you’re underwater, and by how much.

If you’re underwater, your next step is not “shop cars.” Your next step is deciding whether the situation is urgent enough to justify paying the underwater penalty.

Step two: stop the bleeding from cancelable add-ons

Edmunds specifically advises consumers to review loan paperwork for add-on products—service contracts, wheel-and-tire protection, extended warranties—and cancel what can be canceled to recover prorated refunds that can reduce the payoff.

That is not a small move. If you financed $2,000–$4,000 of add-ons, a refund won’t erase the problem, but it can shorten the underwater period and reduce what you’d otherwise roll forward.

Step three: pick a payoff plan that matches your timeline

If you don’t have to replace the car today, you buy yourself power by waiting.

Here are the only bullet points you need—because they function as guardrails, not fluff:

- Make one extra principal-only payment per month (even small). The goal is to shrink payoff faster than the car’s value shrinks.

- Avoid extending the term “just to lower the payment.” Longer terms are how equity builds slower.

- If your rate is high and your credit has improved, explore refinance—but do it as a payoff accelerator, not as permission to buy more car.

Delay gratification here is not “waiting forever.” It’s waiting until the trade stops being a financial penalty.

Step four: if you must replace the car, don’t roll the debt if you can avoid it

Rolling negative equity is how you turn an old mistake into a new monthly obligation. Edmunds’ data shows it increases payments and inflates the financed amount.

If replacement is truly unavoidable—family needs, job requirements, safety—then treat the negative equity like a separate bill you need to confront honestly. That may mean buying less car than you wanted. That may mean paying some of the negative equity in cash. That may mean keeping the next car longer.

This is the grown-up part. It’s also the part that restores financial breathing room.

The script that protects you from the “we can make the payment work” pitch

A dealership can almost always “make the payment work.” That phrase is not reassurance; it’s a warning.

Use this short script and force the conversation back to totals:

“I need the out-the-door price in writing, with every fee and every add-on listed line by line. I’m not rolling negative equity into a new loan unless the numbers still make sense after I see the total financed amount and the total cost over the full term.”

Then stop talking. Silence is a financial skill.

The headline lesson

Negative equity thrives on urgency. It feeds on the idea that the only solution is a newer car, right now.

But the market data is telling you something uncomfortable and useful: a growing share of Americans are trading in cars that are worth less than what they owe, and the amount they’re dragging forward is rising. Meanwhile, down payments are shrinking, loan terms are stretching, and $1,000+ payments are holding near record levels.

That combination is how “transportation” turns into a long-term budget problem.

Delayed gratification won’t fix everything in your financial life. But in car buying, it’s one of the rare habits that pays you back in three places at once: lower debt, lower risk, and more flexibility.

And flexibility—quietly—is what the middle class is always fighting to keep.

RELATED ARTICLES

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy....

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect...

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises....