A creditor with a default judgment against you can levy your bank account, garnish your wages, or both. If a creditor sues you, you must respond...

Biggest Financial Crimes: Countrywide Financial Corporation The opacity of the financial industry and complex business operations allow certain groups of organizations, financial and non-financial institutions, and...

Investors need to Netflix and chill and cancel all the noise coming from Wall Street analysts. The company announced yesterday that it lost net subscribers for...

Buying a home for the first time might be difficult, especially right now with the median U.S. home price above $400,000. Understandably, you’d be concerned about...

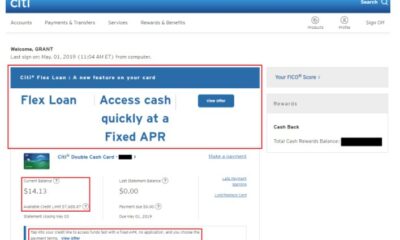

As American household debt rises, credit card fixed-interest loans are becoming a significant percentage. Credit card companies are letting their cardmembers convert part or all of...

In America, there is a massive knowledge gap America when it comes to personal finance. This article will explore the current state of financial education in...

Everyday credit cards provide cardholders with price protection, cashback rewards, rental car insurance, and more excellent rewards. However, not all credit cards are great financial...

American credit cardholders carry, on average, about $6,000 in credit balances, but 40% of them don’t know the interest rate that they are paying on such...

American homeowners have $9.4 trillion in tappable home equity. The average wealthy American homeowner can take $178,000 out of their home to start their business, build...

Lenders use the 28/36 rule to assess borrowers’ ability to manage their liabilities, including consumer debts and mortgages. The American middle-class can use it to get...