Credit card grace periods can mean $0 interest. Learn how they work, what cancels them, and how to get them back. Read now.

Cash advance vs personal loan vs payday loan—compare real costs, fees, and traps. Pick the least-bad option with our checklist.

Need cash fast? Learn the cheapest ways to use credit card funds—without cash-advance fees. Use the cost ladder & choose your lane.

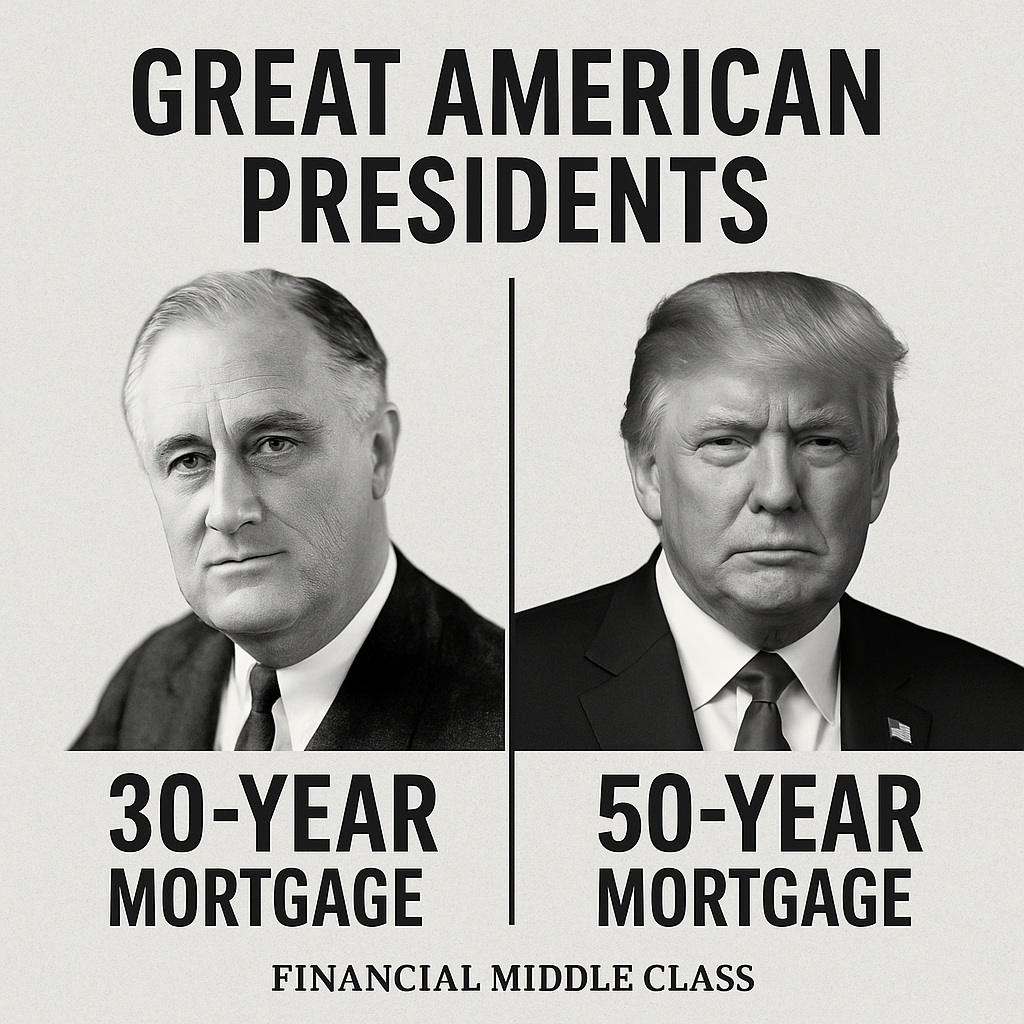

Explore why data and voters disagree on the Trump economy in this neutral, fact-driven analysis. Learn the key numbers and arguments.