How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use this 60-second framework—read now.

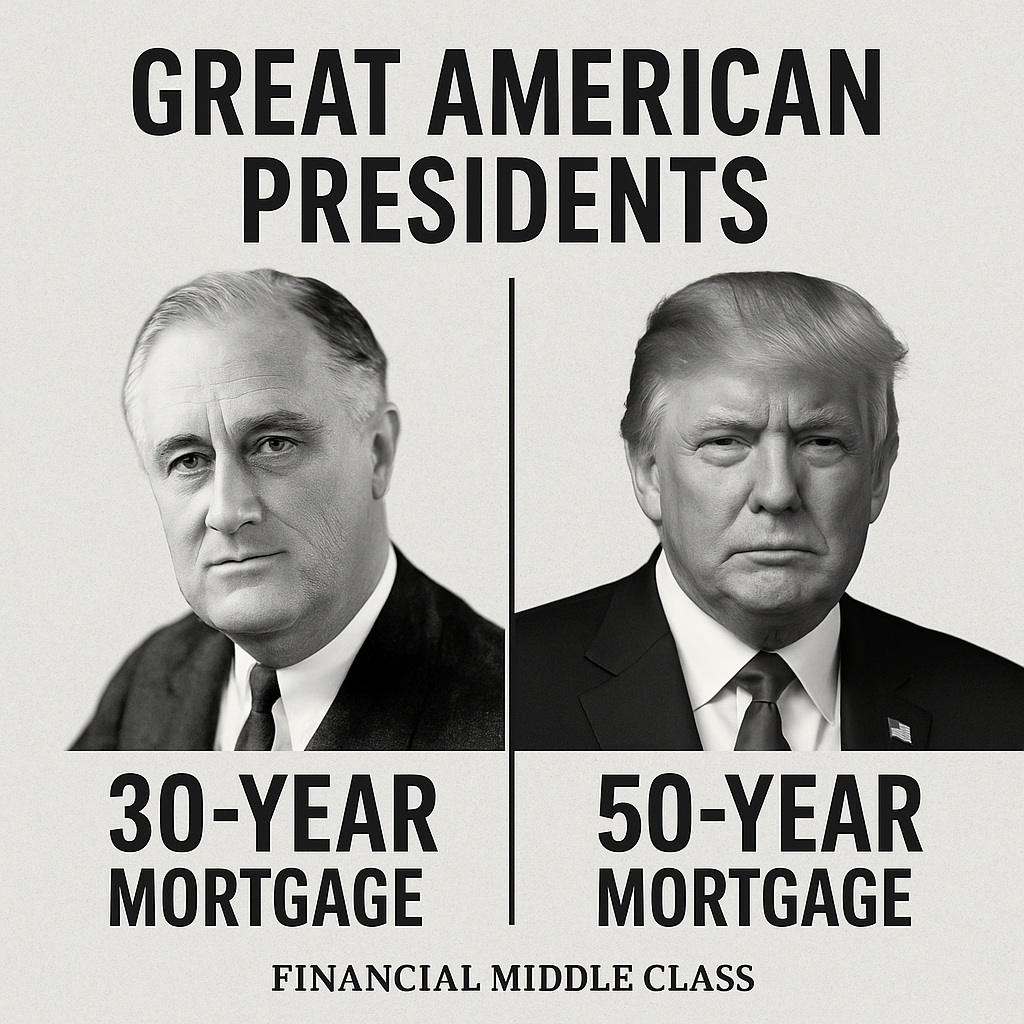

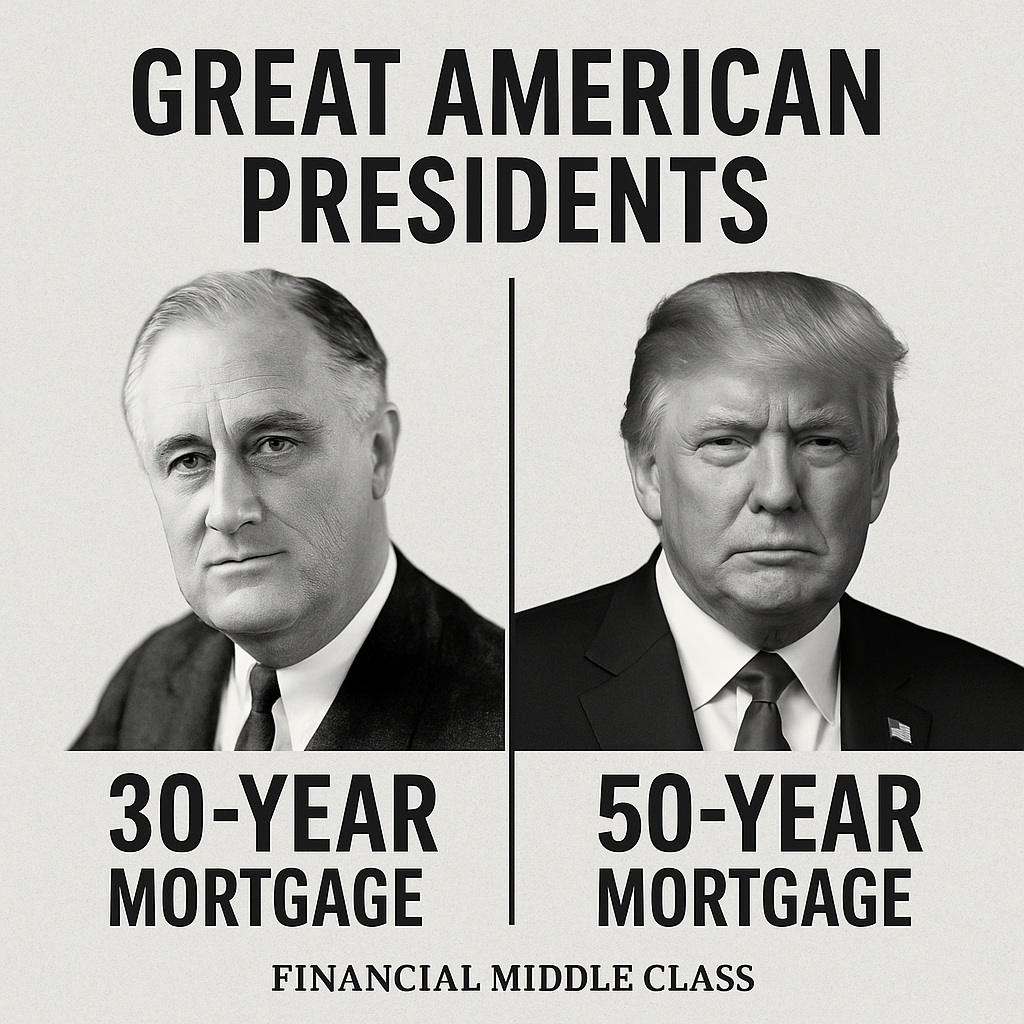

Will Trump’s affordability proposals lower your bills—or backfire? Housing, rates, tariffs, gas, credit cards—explained. Read now.

Last updatedJanuary 13, 2026 — Updated for IRS e-filing pathways (Pay.gov), the 501(c)(4) notice requirement, and a clearer “choose your lane” decision framework. Skip to Jump to the section you need. No doom scrolling required. Intro Two doors: State vs...