Examining the Impact of Stock Buybacks: House Democrats Reintroduce Bill Targeting Corporate Practices Subtitle: A comprehensive analysis of the Consequences and legislative response surrounding stock buybacks...

The Receding American Dream: Navigating the Obstacles to Equality and Prosperity The American Dream, once a symbol of hope and boundless opportunity, faces formidable challenges in...

Many people want to be like “Mike,” but many more want to be rich. Achieving financial security and building wealth is a common aspiration many individuals...

Be a Better Investor™ Diversification is a fundamental concept in investment management that aims to minimize risk and maximize returns by spreading investments across different asset...

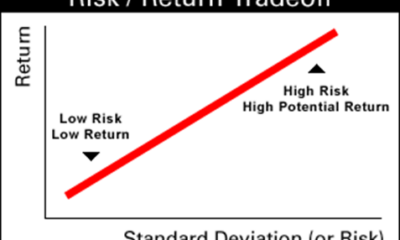

Be a Better Investor™ Risk-return tradeoff is the type of investment principle that all investors must understand. Individuals often invest their money in various assets such...

The stock market is often considered one of the best ways to build long-term wealth. By investing in stocks, individuals can potentially reap significant rewards over...

Be a Better Investor™ Target-date funds are mutual funds that have gained popularity in recent years due to their convenience and ease of use for investors....

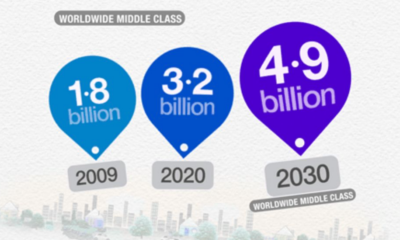

In recent years, there has been an unprecedented expansion of the global middle class. According to the World Bank, between 1990 and 2015, the percentage of...

Intergenerational poverty is a condition where poverty is passed down from one generation to another. The poor decisions that parents make affect children over several generations...

Lenders use the 28/36 rule to assess borrowers’ ability to manage their liabilities, including consumer debts and mortgages. The American middle-class can use it to get...