Are you unsure whether you should request a participant loan or an early 401(k) withdrawal? More than thirty-three million Americans filed unemployment claims in seven weeks,...

During a rally on August 15, 2019, in Manchester, New Hampshire, President Trump told the crowd, “you have no choice but to vote for me. Because...

Life insurance is an integral part of holistic financial planning, but most middle-income American households either have no life insurance or are vastly underinsured. Whether you’re...

To save, improve credit, reduce debt, and build wealth, you have to manage your money better. Here are the five best ways to manage your money....

The difference between the Roth IRA and the traditional IRA is to choose whether you want to save now pre-tax or post-tax dollars for retirement. A...

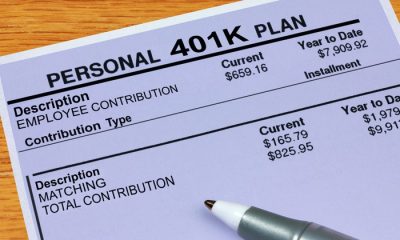

Participating in your employer’s 401(k) plan is the most convenient way to save for retirement Your employer 401(k) lets you save part of your pay before...

Should you follow Rebecca (Becky) Quick and invest 100 percent in equities? Both the short and long answers are a resounding “no.” Moreover, investors should stop...

Common bankruptcy myths are everywhere, even though American consumers have been filing chapter 13 and chapter 7 bankruptcies since modern bankruptcy laws enacted back in the...

401(k) blunders to avoid to ensure a comfortable retirement. With the disappearance of defined-benefit pensions in the workforce, employers switched another obligation to workers. That obligation...

Consumers’ balance sheet is not strong; for the second quarter of 2019, America’s total household debt was $13.86 trillion. During a 60-minute interview, JP Morgan Chase’s...