Should you follow Rebecca (Becky) Quick and invest 100 percent in equities? Both the short and long answers are a resounding “no.” Moreover, investors should stop watching finance news shows where talking heads spurt out nonsense without any accountability.

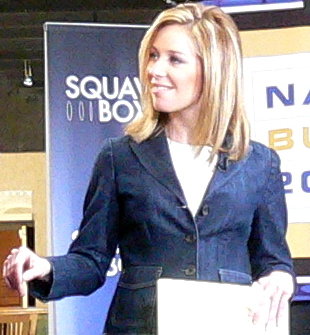

Becky, co-anchorwoman of CNBC’s financial news shows Squawk Box and On the Money, is being irrationally exuberant. She said that “I am 100% in equities. You are not going to make enough money if you have 40% of your money in bonds”. While bonds yields are at historic lows, the Dow Jones Industrial Average, the S&P 500 index, and the Nasdaq Composite Index are trading at all-time highs.

It has been a good decade for equities. However, anyone who promotes the nonsense of abandoning diversification and asset allocation is either incompetent or pushing products — too many hotspots in the macroeconomy for investors to ignore.

Brexit, trade wars, wealth and income inequality, and anemic eurozone economic growth are amongst geopolitical issues investors need to think about before throwing away the cardinal rule of investing. Time, compounding, and diversification are the foundations of all investment portfolios–optimal or not. Time and compounding eat up inflationary risk while diversification removes idiosyncratic risk.

Her comment came during an interview with Andy Sieg, who is the head of Merrill Lynch Wealth Management. Instead of shooting down Becky’s outrageous comment, he co-signed it. Mr. Sieg said that he is afraid that investors could miss on a “generational” rally.

Finance professionals who don’t solely push products and focus on their profit and loss statement (P&L) know that there is no such thing as a permanent plateau or generational rally in equities. Sooner than later, the bear will come home.

According to Wikipedia, Becky is 47 years. She has 18 years until retirement or 23 years if she decides to stay in the workforce until 70 to collect higher social security checks.

If she is 100% in equities and another financial crisis, like the one from a decade ago, happens, twenty-three years might not be enough time for her portfolio to recover fully.