Exploring the Large Gap in Stock Market Participation Between Black and White Households

By MacKenzy Pierre

The estimated reading time for this post is 233 seconds

Investing in the stock market is often seen as a pathway to building wealth and is one of the main ways Americans accumulate assets. However, when it comes to stock market participation, there is a significant gap between Black and White households.

According to a report by the Federal Reserve of St. Louis, the gap in stock market participation between Black and White households is large and persistent.

The report found that in 2019, 60% of White households held stocks directly or indirectly, compared to only 33% of Black households. This gap is even wider when it comes to direct stock ownership, with 55% of White households owning stocks directly compared to just 14% of Black households.

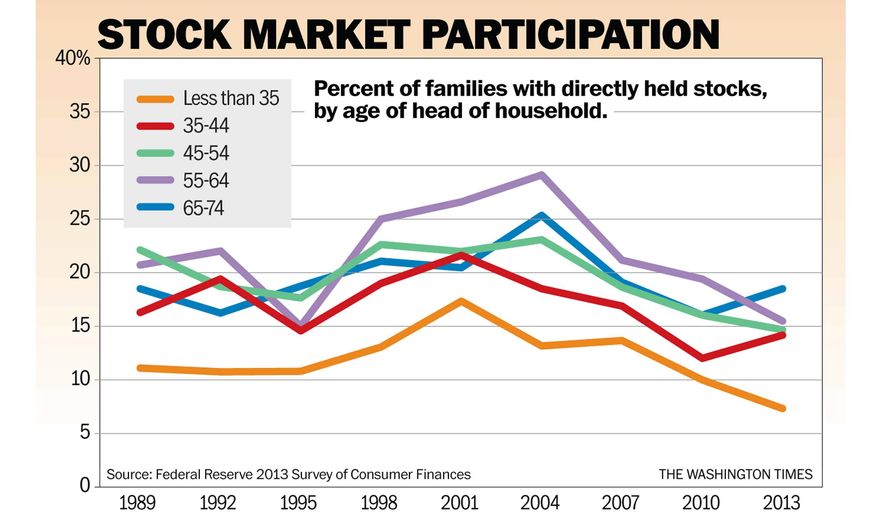

The report also found that this gap has persisted over time, with little improvement in stock market participation among Black households since the 1980s.

There are several reasons why this gap exists. One of the main factors is the wealth gap between Black and White households. According to the Federal Reserve of St. Louis, the median net worth of Black households in 2019 was just $24,100, compared to $188,200 for White households. This wealth gap means Black households have less money to invest in the stock market.

Another factor contributing to the gap in stock market participation is differences in education and financial literacy. Research has shown that people with higher education and financial literacy levels are more likely to invest in the stock market.

However, Black households are more likely to have lower education and financial literacy levels than White households. This makes it more difficult for Black households to understand the benefits of investing in the stock market and navigate the financial system’s complexities.

Furthermore, discrimination and historical factors also contribute to the gap. For example, historical discrimination in the housing market has led to Black households having less home equity, often used as collateral to secure loans for investing in the stock market.

Additionally, Black households are less likely to have access to financial advisors and other resources that can help them navigate the stock market.

Closing the gap in stock market participation between Black and White households will require a multifaceted approach.

One important step is to address the underlying causes of the wealth gap between Black and White households, such as discrimination in the housing market and access to quality education.

Improving financial literacy and education can also help reduce the gap in stock market participation and increase access to financial advisors and resources.

The large gap in stock market participation between Black and White households is a complex issue that requires attention from policymakers, financial institutions, and society.

By addressing the underlying causes of the gap, we can help create a more equitable and inclusive financial system for all Americans.

One way to increase stock market participation among Black households is through targeted education and outreach. Financial institutions can play a role in this by providing resources and education on investing in the stock market that are tailored to the needs of Black households.

This can include offering financial literacy programs and workshops addressing the unique challenges Black households face.

Another approach is to increase access to financial services and products for Black households. This includes providing affordable banking services and credit to underserved communities and expanding access to investment opportunities such as 401(k) plans and individual retirement accounts (IRAs).

By increasing access to financial services and products, more Black households may be able to invest in the stock market and build wealth over time.

Policymakers can also play a role in addressing the gap in stock market participation. For example, policies that address discrimination in the housing market and improve access to education can help to reduce the wealth gap between Black and White households.

Policies that promote financial education and literacy can also help to increase stock market participation among Black households.

In addition to these policy and institutional changes, there are also individual steps that Black households can take to increase their stock market participation. This includes seeking financial education and advice, using online resources to research investment opportunities, and starting small by investing in low-cost index funds.

In conclusion, the large gap in stock market participation between Black and White households is a complex issue requiring various stakeholders’ attention.

Addressing the underlying causes of the gap, including discrimination and historical factors, improving financial literacy, and increasing access to financial services and products can help to reduce the gap and create a more inclusive financial system.

By working together to address this issue, we can help to ensure that all Americans have access to the benefits of investing in the stock market and building wealth over time.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...