Student Debt Relief

By Article Posted by Staff Contributor

The estimated reading time for this post is 341 seconds

The Biden-Harris Administration has proposed a comprehensive student debt relief plan that aims to alleviate the burden of student loan debt on millions of Americans.

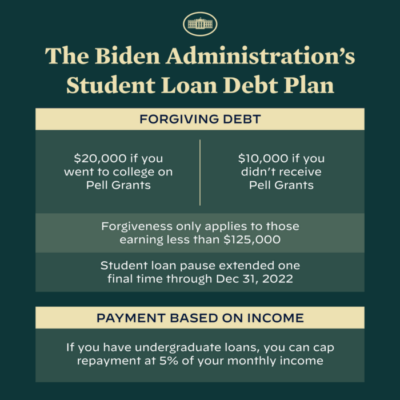

The plan includes measures such as expanding Public Service Loan Forgiveness (PSLF), cancelling up to $10,000 in student debt per borrower, and providing debt relief for borrowers who attended predatory for-profit institutions.

However, the plan has faced opposition from various quarters, including the Supreme Court of the United States (SCOTUS), which could potentially strike down student debt relief, and the Grand Old Party (GOP), whose debt ceiling plan puts student debt relief in jeopardy.

In this article, we will examine the Biden-Harris Administration student debt relief plan and the PSLF program, their potential impact on borrowers, and the challenges that lie ahead in their implementation.

The Biden-Harris Administration Student Debt Relief Plan

The Biden-Harris Administration’s student debt relief plan seeks to address the growing crisis of student loan debt in the United States, which currently stands at a staggering $1.7 trillion. The plan aims to provide relief to borrowers by cancelling some of their debt and expanding existing loan forgiveness programs.

Under the plan, the administration has proposed to cancel up to $10,000 in student debt per borrower. This would provide immediate relief to millions of borrowers who are struggling to make their monthly payments.

The administration has also proposed to provide debt relief for borrowers who attended predatory for-profit institutions that engaged in fraudulent or deceptive practices.

In addition to these measures, the administration has proposed to expand the PSLF program, which currently allows borrowers who work in public service jobs to have their loans forgiven after making 120 qualifying payments. The proposed expansion would make the program available to more borrowers and simplify the application process.

PSLF Program

The PSLF program was created in 2007 to incentivize borrowers to enter and remain in public service jobs.

Under the program, borrowers who work in public service jobs, such as teachers, nurses, and government employees, can have their loans forgiven after making 120 qualifying payments while working full-time for a qualifying employer.

The PSLF program has been a lifeline for many borrowers who have taken on significant amounts of student loan debt to pursue careers in public service. However, the program has faced numerous challenges, including high denial rates and a complex application process.

One of the main issues with the PSLF program is that it is difficult to navigate. Borrowers must meet a number of requirements to qualify for loan forgiveness, including making qualifying payments while working full-time for a qualifying employer.

This can be challenging for borrowers who are not familiar with the program’s requirements or who work in jobs that do not qualify.

Another issue with the program is that many borrowers have been denied loan forgiveness.

According to a report from the Government Accountability Office, only 1% of borrowers who applied for loan forgiveness under the PSLF program were approved as of December 2020.

The high denial rate has been attributed to a variety of factors, including unclear program requirements and insufficient guidance from loan servicers.

Despite these challenges, the PSLF program remains an important tool for borrowers who are pursuing careers in public service. The proposed expansion of the program under the Biden-Harris Administration’s student debt relief plan could make it more accessible to more borrowers and simplify the application process.

Potential Impact on Borrowers

The Biden-Harris Administration’s student debt relief plan and the proposed expansion of the PSLF program could have a significant impact on borrowers who are struggling with student loan debt.

The cancellation of up to $10,000 in student debt per borrower would provide immediate relief to millions of borrowers and make it easier for them to make their monthly payments.

The debt relief for borrowers who attended predatory for-profit institutions could also be a game-changer for these borrowers, who often face high levels of debt and limited job prospects.

The expansion of the PSLF program could also provide much-needed relief to borrowers who are pursuing careers in public service and struggling to make their loan payments.

However, the impact of these measures is likely to be limited in the face of the broader student loan debt crisis. While cancelling up to $10,000 in student debt per borrower would provide relief to some, it would not address the underlying issue of the rising cost of higher education and the increasing burden of student loan debt on borrowers.

Furthermore, the proposed expansion of the PSLF program may not be sufficient to address the challenges that borrowers currently face in accessing loan forgiveness.

While simplifying the application process and making the program more accessible is a step in the right direction, more needs to be done to ensure that borrowers are aware of the program and understand its requirements.

Challenges in Implementation

The implementation of the Biden-Harris Administration’s student debt relief plan and the proposed expansion of the PSLF program is likely to face significant challenges. One of the biggest challenges is the potential for legal challenges to the plan, including from the SCOTUS.

The SCOTUS recently heard arguments in a case involving a group of borrowers who are seeking loan forgiveness under the PSLF program.

The case centers on the question of whether borrowers who have made payments under income-driven repayment plans are eligible for loan forgiveness under the PSLF program.

If the SCOTUS rules against the borrowers, it could have significant implications for the PSLF program and the Biden-Harris Administration’s student debt relief plan.

It could also create uncertainty for borrowers who are currently making payments under income-driven repayment plans and relying on the PSLF program for loan forgiveness.

Another challenge in implementing the student debt relief plan is the potential for political opposition, particularly from the GOP.

The GOP has opposed the plan and has proposed a debt ceiling plan that would limit the amount of money the government can borrow and potentially jeopardize the student debt relief measures.

The GOP’s opposition to the plan could make it more difficult for the Biden-Harris Administration to pass the necessary legislation to implement the plan. It could also lead to a protracted political battle that could further delay relief for borrowers.

Conclusion

The Biden-Harris Administration’s student debt relief plan and the proposed expansion of the PSLF program have the potential to provide much-needed relief to millions of borrowers who are struggling with student loan debt. However, the plan faces significant challenges, including legal challenges and political opposition.

While the proposed measures would provide immediate relief to some borrowers, they do not address the broader issue of the rising cost of higher education and the increasing burden of student loan debt on borrowers.

More needs to be done to address these issues and ensure that borrowers have access to affordable higher education and a path to financial stability.

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

1 Comment

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

Pingback: Americans of all Generations Living Paycheck to Paycheck - FMC