Worried About When Student Loan Repayments Resume? These Programs Could Help.

By Article Posted by Staff Contributor

The estimated reading time for this post is 661 seconds

Reality Check

You’re looking at your budget and your chest gets tight. Rent, groceries that cost more than last year, childcare, car insurance. And now those student loan bills again—after years of on-again, off-again “relief,” legal fights, new plans, paused plans. It feels like the rules keep changing while you’re trying to stay upright. You’re not imagining it: millions missed payments during the first months back in 2023–24, and delinquency has climbed again in 2025 as safety nets wound down.

This piece is for the middle-class household doing the math at the kitchen table. What actually helps right now? Which programs still work? Which headlines matter—and which are noise?

The Historical Context: How We Got Here

- The payment pause years (2020–2023). COVID froze payments and collections. For many families, that cash flow became the difference between building a small cushion and sinking.

- The messy restart (late 2023 into 2024). Servicers were overwhelmed; new repayment options were promoted; error rates spiked. By April 2024, about 30% of borrowers missed a payment, while roughly 20% had a scheduled $0 payment thanks to income-driven plans. Translation: the system didn’t restart cleanly.

- 2025 whiplash. A court blocked key pieces of the SAVE plan; applications for IDR and consolidation were temporarily taken down; borrowers already in SAVE were placed in an administrative forbearance—then interest resumed on Aug. 1, 2025 for those accounts. Collections on defaulted loans also restarted in May 2025. That’s a lot, fast.

If you’re confused, that’s rational.

The Current Trap

Here’s the trap many middle-class borrowers are walking into:

- SAVE forbearance ≠ progress. If you were in SAVE, you may be in a special forbearance that doesn’t count toward forgiveness—and now interest is ticking again. If you assume you’re “safe,” your balance could creep up.

- Fresh Start ended. The one-time path to exit default—without the usual penalties—closed in October 2024. In 2025, the government turned collections back on (tax refund offsets, wage garnishment). That’s a concrete threat to cash flow.

- Backlogs and rule churn. Nearly two million applications for lower payments piled up as agencies and servicers adjusted to court orders. When systems stall, families stall.

When money is tight, delays are expensive.

| Program | Who It Helps | Counts Toward Forgiveness? | Current Status | Action |

|---|---|---|---|---|

| PSLF | Gov’t, K–12, nonprofit full-time | Yes (120 qualifying) | Active | Certify employment yearly; stay on qualifying IDR |

| SAVE (forbearance) | Prior SAVE enrollees | No while in forbearance | Interest may be accruing | Move to a lawful plan when available; prevent balance growth |

| Rehabilitation | Borrowers in default | After rehab, yes (on IDR) | Active | 9 on-time payments → exit default; then switch to IDR |

| TPD Discharge | Qualifying disabilities | N/A (discharge) | Active | Apply via StudentAid.gov; keep documentation |

A Behavioral & Economic Lens

Middle-class life runs on tight margins. We plan around paychecks, not perfect policy. When rules change mid-stream, we fall back on mental shortcuts:

- Present-bias. If the payment isn’t due today, we assume future-us will handle it. Forbearance feeds this bias.

- Complexity overload. Too many acronyms (IDR, SAVE, PSLF) pushes us toward inaction. Inaction grows balances.

- Signaling vs. building. We’ll cut back on investing to keep up the appearance that we’re “doing fine,” even as interest compounds. As we say here: owning debt doesn’t make you poor; ignoring it does.

Hidden Costs Most People Miss

- Forbearance interest. That SAVE forbearance many are in? Interest restarted August 1, 2025. Months that don’t count toward forgiveness + interest that does count against you = stealth cost.

- Delinquency credit drag. When the system resumed collections, borrowers 90–270 days late moved closer to default. That’s not just stress—it’s higher insurance premiums, rejected apartment apps, pricier car loans.

- Opportunity cost. Every $100 of interest you don’t stop is $100 you can’t put toward an emergency fund or 401(k) match. The difference between wealth and debt is how much room you leave yourself to breathe.

Solutions & Guardrails: What Actually Helps Right Now

Below is a “pick your situation” playbook. If two apply, stack them.

1) If you’re working in public service (government, K-12, nonprofit)

- Stay on the PSLF path. 120 qualifying payments while working full-time for a qualifying employer still leads to forgiveness. Recent rulemaking is updating the program, but PSLF remains in effect. Keep certifying employment annually and keep your employer eligibility straight.

Guardrails:

- Make sure your loans are Direct Loans (consolidate when applications reopen, if needed).

- Use an income-driven plan that qualifies. If plan menus change, stick with a qualifying IDR once available and keep paying.

- Submit the PSLF Help Tool annually.

2) If you were in SAVE and now stuck in forbearance with interest ticking

- Watch for official instructions to switch plans. The Department said it would contact ~7.7 million SAVE borrowers with steps to move to a “legal” repayment plan. When available, pick a plan that counts toward forgiveness.

Guardrails:

- Don’t let interest quietly snowball. Once a lawful plan is available, move off the forbearance.

- Track your payment count; keep screenshots and statements.

3) If you’re behind or in default

- Act before collections hit your cash. Collections resumed May 5, 2025. Wage garnishment and tax refund offsets are back. Contact your servicer and ask about loan rehabilitation (nine on-time payments can get you out of default) or moving into a repayment plan when applications reopen.

- Guardrails:

- Update your contact info at StudentAid.gov to catch notices.

- If you can swing it, start making rehabilitation payments now to stop the bleeding.

Practical Scripts & Moves (Use These This Week)

Call your servicer with this script:

“I want the lowest lawful monthly payment that counts toward forgiveness. If my current plan is in forbearance or not accruing credit, tell me the earliest date I can switch, and what you need from me. Please note this call and send a recap by email.”

Public Service: 3 must-dos for PSLF

- Confirm employer eligibility; recertify yearly via the PSLF Help Tool.

- Stay on a qualifying IDR; avoid plan gaps that don’t count.

- Track your payment count; save monthly statements and confirmations.

In SAVE forbearance right now?

Interest may be accruing. Set a reminder to switch to a lawful plan when available and consider at least interest-only payments to prevent balance growth.

Behind or in default

Call your servicer and ask about rehabilitation (9 on-time payments). Update contact info and request an emailed recap after every call.

4) If you’re disabled or your school misled you

- Total & Permanent Disability (TPD) discharge. If you meet the medical or SSA/VA criteria, your loans can be discharged. Applications run through StudentAid.gov; post-2025 updates centralized the workflow.

- Borrower Defense to Repayment. If your school lied or broke the law, you may qualify for discharge. Some rules are in flux under new federal changes, but the avenue exists—file the claim and preserve your place.

Guardrails:

- Keep records: screenshots of ads, emails, catalogs.

- Watch for rule changes; agencies owe you written updates.

5) If your biggest constraint is retirement saving while paying loans

- Ask HR about the SECURE 2.0 “student loan match.” Since 2024, employers may match your student loan payments into your 401(k)/403(b)/457(b) as if you’d contributed to the plan. If your company offers it, you can reduce your loans and still capture the match—real money.

Guardrails:

- The benefit is optional; many employers don’t know they can do it. Ask. Send HR the IRS notice.

- Your combined loan payments + deferrals can’t exceed the annual limit—HR will track it.

6) If your balance looks wrong versus your years of payment

- IDR “one-time account adjustment.” The government has been crediting certain past periods (older repayments, some deferments/forbearances) toward IDR and PSLF forgiveness counts. Some deadlines have passed, but spousal joint-loan separations tied to the adjustment had a June 30, 2025 date—and implementation details are still being processed. If you’re in this niche, document everything and watch your count.

Guardrails:

- Log into StudentAid.gov quarterly; export your payment history.

- If counts change, take screenshots and file a payment-count review with your servicer.

7) If cash flow is the whole ballgame (it usually is)

- Aim for the lowest lawful payment that counts. When plan menus reopen or change, choose an IDR that reduces your bill and accrues credit toward forgiveness (or shortens the path if you owe < $12k under prior rules—subject to legal changes). If menus are paused, make at least the interest-only payment to keep balances from growing while you wait.

- Build a two-envelope system. Treat your student loan like a utility: auto-pay the minimum on payday; any month you get breathing room, send a targeted extra to the highest-interest loan.

- If you must pause, choose deferment over blind forbearance. Some deferments preserve subsidies or benefits; many forbearances don’t.

Quick Reference: What’s Working Today (and What’s Not)

- Working:

- PSLF continues; certify employment; keep paying on a qualifying plan.

- TPD discharge for qualifying disabilities; now processed through a more centralized flow.

- SECURE 2.0 student-loan 401(k) match—if your employer offers it.

Working but watch the fine print:

- IDR account-adjustment credits (still rolling out; special cases like

- spousal separation tied to June 30, 2025).

- Loan rehabilitation to exit default (collections active again).

Not working like before:

- SAVE applications are blocked; borrowers in SAVE forbearance saw interest resume Aug. 1, 2025. Move to a qualifying plan when available.

- Fresh Start closed Oct. 2, 2024. If you missed it, your path out of default is now the traditional route (rehab or consolidation when available).

Practical Scripts & Moves (Use These This Week)

Call your servicer (or the Default Resolution Group if in default) with this script:

“I want the lowest lawful monthly payment that counts toward forgiveness. If my current plan is in forbearance or not accruing credit, tell me the earliest date I can switch, and what you need from me. Please note this call and send a recap by email.”

Email HR about the SECURE 2.0 match:

“Does our retirement plan offer the student-loan payment match allowed under IRS Notice 2024-63? If not, can we explore it for 2025/2026? It would help employees pay down debt without sacrificing retirement savings.”

Track your count:

- Download payment histories from StudentAid.gov and your servicer.

- Keep a simple spreadsheet: date, plan, billed amount, paid amount, status (counts/doesn’t count).

- Set two calendar reminders: income recertification and PSLF certification (if applicable).

Economic Trade-Offs: A Middle-Class Reality Check

- Cash flow beats perfection. The “best” plan on paper means nothing if it’s unpayable in practice. Pick the lowest payment that counts, then prevent balance growth with small, steady extras.

- Don’t sacrifice the match. If your employer will match retirement contributions—including student-loan matches—capture it. That’s guaranteed return in a world with very few guarantees.

- Avoid signaling traps. Driving a car that looks “successful” while your loans quietly compound is how the middle class gets squeezed. Wealth is built by leaving yourself room to breathe.

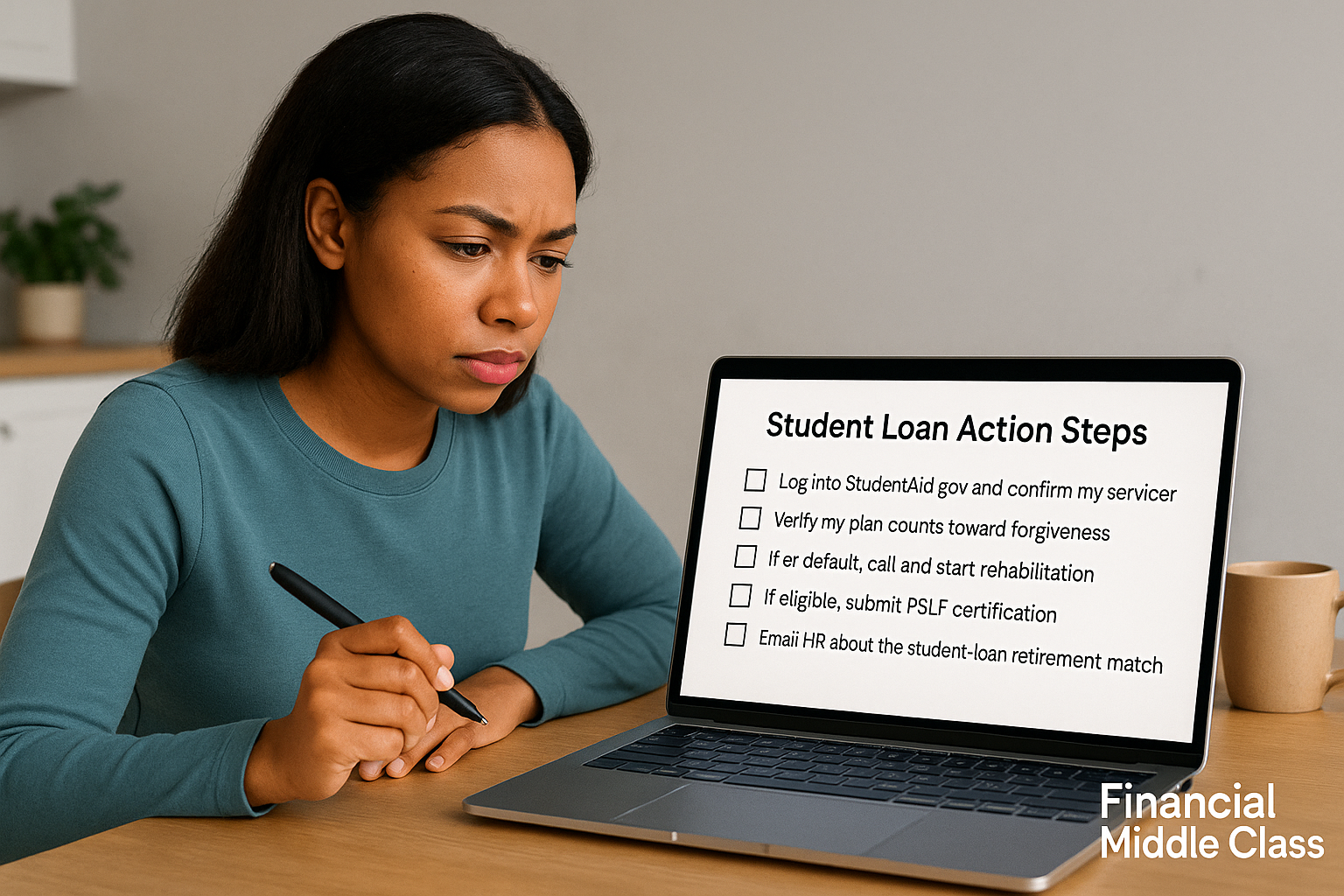

If You Only Do Five Things

- Log in to StudentAid.gov and confirm your contact info and servicer.

- Check your plan status. If you’re in SAVE forbearance, note that interest is accruing; plan a switch to a qualifying repayment as soon as allowed.

- If you’re in default, call now. Collections are active again; ask about rehabilitation.

- File for PSLF, TPD, or Borrower Defense if you qualify; those paths still work (with evolving rules).

- Email HR about the SECURE 2.0 match so you’re not giving up free retirement money while paying your loans

Student Loan Action Steps — Financial Middle Class

Bottom Line

The middle class works harder than ever just to stand still. When rules shift, standing still gets expensive. Don’t play the old game—where balances grow in the background and hope carries the budget. Play the cash-flow game: lowest lawful payment that counts, protections you actually qualify for, receipts for everything. The difference between wealth and debt isn’t the diploma on your wall. It’s the space you carve in your month to breathe.

RELATED ARTICLES

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy....

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect...

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises....