Where to Put Your Emergency Fund

By MacKenzy Pierre

The estimated reading time for this post is 218 seconds

Accessing your emergency fund the moment you need it is the only thing to keep in mind when figuring out where to invest it. Even with the record-high stock market, historic low unemployment rate, and pre-recession level homeowners’ equity, millions of Americans are only 400 dollars away from financial disaster.

An emergency fund is a scarcity in America’s middle class. If you spend more money than you earn every month, read our article on how to save money on a budget. If you happen to be amongst those who manage to build a sizable emergency fund, you need to know where to put it.

After all, you don’t want to leave it under the mattress forever, even if you live in Europe, where many banks charge you a fee to safeguard your money. The consensus amongst personal finance professionals is you need to have at least six months’ worth of living expenses in your emergency fund. Here are the four places you need to put your emergency fund:

Savings Account

You should have a checking and savings account. You use your checking account for cash inflows (wages and other incomes) and cash outflows (living expenses and savings). Every month after you pay all your living expenses, you should transfer your remaining balance to your savings account.

Checking account pays zero to no interest, so you shouldn’t keep your emergency fund in there. Brick and mortar banks such as JP Morgan Chase and Bank of America pay little annual percentage yield (APY) on their savings account. For example, Chase Savings account interest pays one basis point or 0.01%. If you have $10,00 in the Chase Savings, you will earn $100 worth of interest income every year.

To earn more interest income, you should transfer your emergency fund to an online bank; they pay a higher interest rate on a savings account. As of this writing, American Express National Bank is offering a 1.90% annual percentage yield (APY).

Money Market Accounts

Putting your emergency fund in a money market account will earn a higher interest rate than it will be in regular checking and savings accounts. Although you can write checks and make debit purchases from a money market account, it’s best that you used as a savings vehicle. Keep a regular checking account from a brick and mortar bank and open a money market account with an online bank.

The Federal Deposit Insurance Corporation (FDIC) insures money market accounts. You do get a higher annual percentage yield (APY) and insurance protection. However, money market accounts require that you maintain a minimum balance.

As of this writing, Banco Bilbao Vizcaya Argentaria (BBVA) USA is offering 2.15% APY with a $10,000 minimum on its money market account. In this environment of the super-low interest rates, BBVA’s APY is excellent.

Short-term Certificates of Deposit (CD)

Certificate of deposit (CD) requires you to part ways with your money for a specific time, ranging from 6 to 60 months.

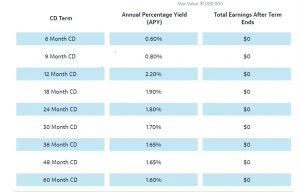

You should invest your emergency fund in short-term CDs only. You don’t want to tie up your emergency fund for longer than one year, preferably six months. Since we are living in an inverted yield environment, short-term interest rates are higher than long-term ones. You don’t have any incentives to lock your cash for longer than one year.

As you can see on the above chart from Capital One, you get 2.20% APY for 12 months while you get only 1.60% for 60 months. Again, you shouldn’t tie up your cash for more than 12 months.

U.S. Treasury Bills

U.S Treasury bills (T-Bills) are short-term U.S. government debt obligations back the Treasury Department with a maturity of one year or less. You are lending your emergency fund to the United States’ Federal Government.

You can buy a T-bill with a 4, 8, 13, 26, or 52 weeks maturity date. They are like bank CDs, but you need a brokerage account to buy them. A brokerage account is an investment account that lets you buy and sell financial securities such as stocks, bonds, and T-bills. You can open a Schwab or Fidelity brokerage account and buy T-bills with no fee.

Your emergency fund is not an investable asset, so easy access to it is more important than investment return. Those four options we discussed above are the safest and short-term places to put your emergency fund and access it the moment you need it.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...