4 TYPES OF BAD CREDIT REPORTS AND HOW TO FIX THEM

By MacKenzy Pierre

The estimated reading time for this post is 500 seconds

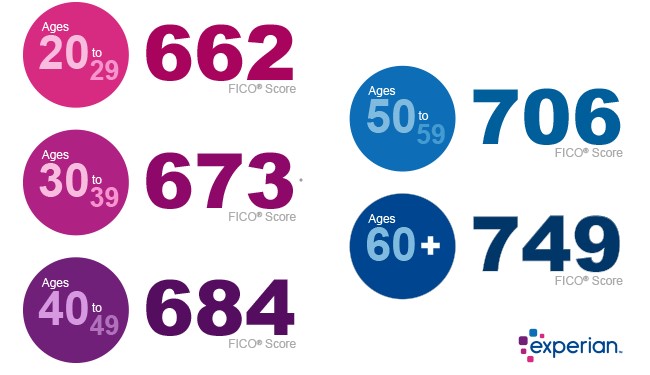

According to data from Experian, the average credit score in America is 688, which is one of the big 3 credit agencies. Equifax and Transunion are the other two bureaus. Baby boomers tend to have the highest credit score, while younger millennials often have the lowest. The FICO score ranges from 300 to 850. The screenshot below shows the main components of your credit score calculation.

Despite the average good credit score, more than half of Americans are either credit invisible or have poor credit, according to a study by Prosperity Now.

The median American credit score, not the average, shows the financial struggles of many consumers. Below are 4 types of bad credit reports and how to fix them:

- Bad Credit Report Due to Bankruptcy and Public Record

- Bad Credit Report due to Collections and Past-due Accounts

- Bad Credit Report Due to High Credit Utilization

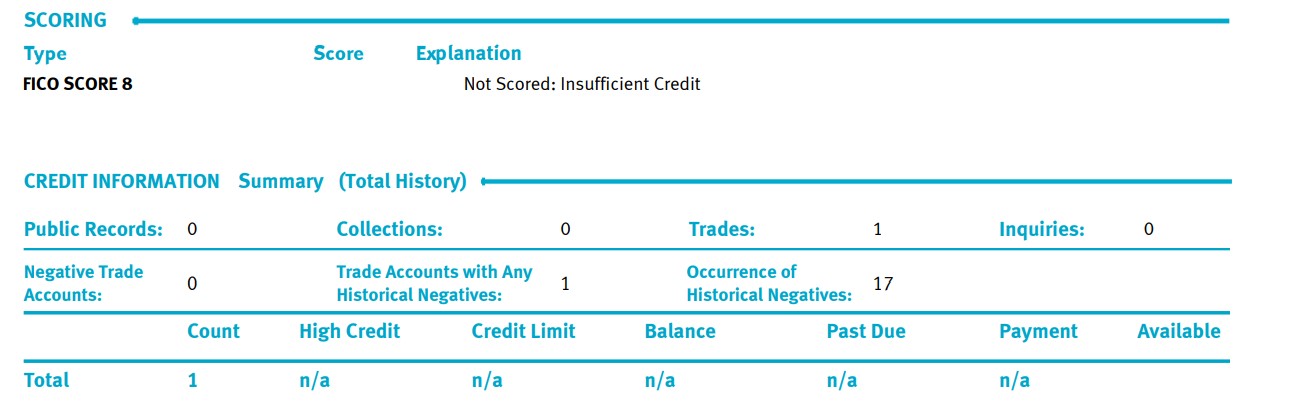

- Bad Credit Report Due to Insufficient Credit

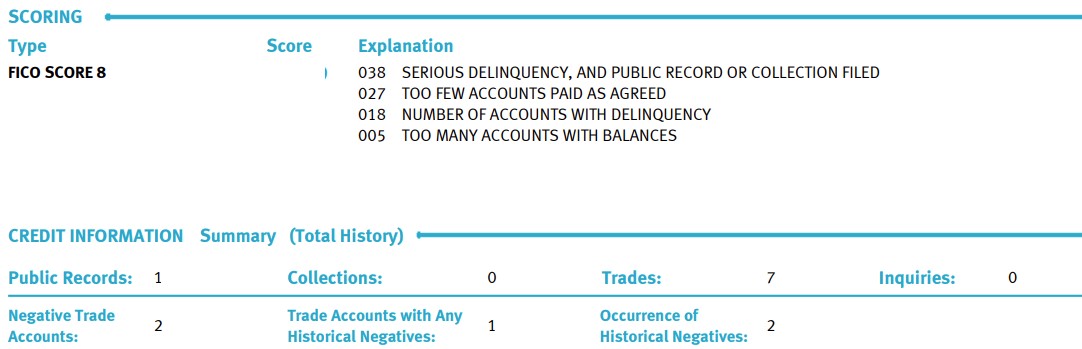

Bad Credit Report Due to Bankruptcy and Public Record

Civil judgments and tax liens are no longer factored into credit scores. The only derogatory public record that should appear on your credit report is bankruptcy.

Chapter 13 or 7 Bankruptcy will show on your credit report and negatively impact it for 10 years. As a result, your credit score can drop to as much as 250 points due to bankruptcy reporting.

Although civil judgments no longer appear on your credit report, they can be sources of your bad credit report.

The creditor that gets the judgment against you would probably report the account being 30, 60, and 90 days past due, charge it off and send it to a collections agency before they decided to sue you.

Fix Bad Credit Report Due to Bankruptcy and Public Record

With a bankruptcy on your credit report, engaging in the credit market will be costly. For Example, People fresh out of bankruptcy pay an average 22 annual percentage rate (APR) on car loans.

It would be best if you started building your credit the moment that the bankruptcy is discharged. The best way to start this process is to get a secured credit and signup for a reputable self-lender.

Secured credit is a refundable security deposit. The limit does not matter much. You need to get a secured credit card and maintain a balance of no more than 30% of the approved amount.

For example, if you deposit $200 for a credit line for the same amount, the outstanding balance you keep on the card cannot be higher than 60 dollars or 30% of the available credit limit.

A self-lender provides credit-builder loans without money upfront. You choose your desired payment.

Let’s say $30 each month. You send the monthly payment to the self-lender, which deposits it in an FDIC-insured bank. The self-lender reports your tradeline or account to all three of the credit agencies each month.

At the end of your agreed terms, you will get all your deposits back minus the self-lender’s fees.

Between the secured credit card and the self-lender, you will have two new revolving trades reporting positive remarks to your credit reports.

You need to sign for UltraFICO score and Experian Boost; the latter factors how you manager your checking and savings accounts, and the former factors your on-time utility payments.

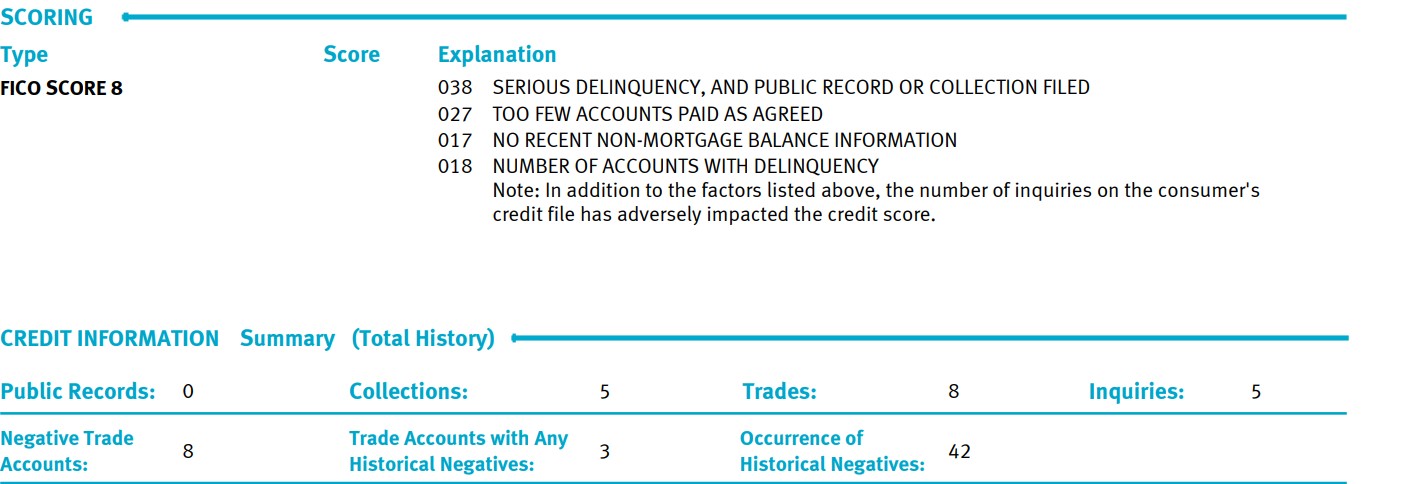

Bad Credit Report due to Collections and Past Due Accounts

Your payment history is the biggest factor in calculating your FICO® Score 8. As a matter of fact, payment history is 35% of your credit score calculation. Missing payments and defaulting on accounts will definitely damage your credit report.

Most bad credit reports are due to payment history. People overextending themselves, then they get into trouble.

Fix Bad Credit Report due to Collection and Past-Due Accounts

The first thing you need to do if your credit report is bad due to collection and past-due accounts is to draft a personal budget, which will force you to get intimated your cash inflows and outflows.

Second, you have to reach out to your creditors and inform them of your intention to meet your obligations. You can’t escape that.

Some people waste their money on credit repair agencies. Improving your credit is simple. You have to pay what you owe and dispute erroneous information.

When it comes to collection accounts, you have to call the agency and verify its validity. After verifying the validity of the debt, ask them for a settlement.

Most collection agencies settle for 70 cents or less on a dollar. Before making any payments, you need to request a letter with the details on the settlement offer.

As far as the past-due accounts, you have to let your creditors know about your financial struggles and ask for forbearance or deferment. You can also ask them to reduce your interest rate. Not talking to your creditors when you are experiencing financial hardship is the worst thing you can do.

A secured credit and signup for a reputable self-lender can also add positive remarks to your credit report while dealing with your collection agencies and lenders.

Secured credit is a refundable security deposit. The limit does not matter much. You need to get a secured credit card and maintain a balance of no more than 30% of the approved amount.

For example, if you deposit $200 for a credit line for the same amount, the balance you keep on the card cannot be higher than $60 or 30% of the available credit limit.

A self-lender provides credit-builder loans without money upfront. You choose your desired payment.

Let’s say $30 each month. You send the monthly payment to the self-lender, which deposits it in an FDIC-insured bank. The self-lender reports your tradeline or account to all three of the credit agencies each month.

At the end of your agreed terms, you will get all your deposits back minus the self-lender’s fees.

Between the secured credit card and the self-lender, you will have two new revolving trades reporting positive remarks to your credit reports.

You need to sign for UltraFICO score and Experian Boost; the latter factors how you manager your checking and savings accounts, and the former factors your on-time utility payments.

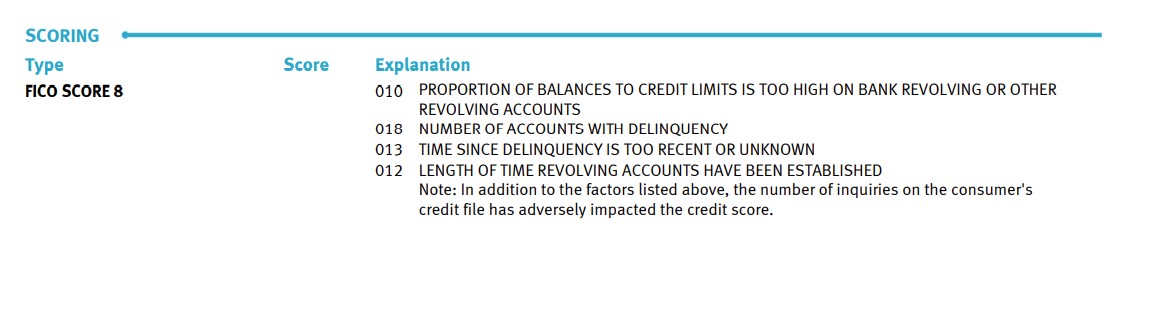

Bad Credit Report Due to High Credit Utilization

Forty percent of Americans don’t have $400 in the bank for an emergency. That factor is really affecting their credit report.

How you use revolving credit and how much of it you use can impact your credit report tremendously. The fact that 30% of your credit score calculation is how you use your credit cards and other revolving debts.

To have the best positive impact on your FICO® Score, your overall credit utilization rate has to be around 30% or less.

For example, if you have two credit cards with a $1,000 credit limit each, the outstanding balance you keep on both cards cannot be higher than $600 ($2,000 x 0.30) dollars or 30% of the available credit limit. It’s perfectly okay to have a $600 outstanding balance on one card and $0.0 on the other card.

Fix Bad Credit Report Due to High Credit Utilization

A high credit utilization rate means that you rely on your credit cards and other revolving accounts to live. So, the best way to see what’s going on and develop a solution is to draft a personal finance budget.

While drafting a personal finance budget, you will see what areas you need to cut back on. Sometimes, your cash inflow is just too low that you need to get a better-paying job, a side hustle, or both.

Reach out to your credit card companies and ask them to reduce the APR on your cards, which will reduce your interest expense.

You can draw down an emergency fund to pay down debts if your job is secured.

If you realized that there is no way that you can reduce your outstanding debts after you work on your personal finance budget, bankruptcy might be your best option.

Bad Credit Report Due to Insufficient Credit

Building great credit is part of the wealth-building strategy. It would help if you had an excellent credit score to access cheap capital, which will allow you to fund your financial goals and dreams.

Without a credit history, you will struggle to get a mortgage, car loan, and even business loan from the Small Business Administration (SBA)

Fix Bad Credit Report Due to Insufficient Credit

You can have a life without credit, but you need an excellent credit score if you want to start a business and build wealth. There are ways to improve your credit score without debt:

It would be best to have a secured credit and signup for a reputable self-lender to add positive remarks to your credit report while dealing with your collection agencies and lenders.

Secured credit is a refundable security deposit. The limit does not matter much. You need to get a secured credit card and maintain a balance of no more than 30% of the approved amount.

For example, if you deposit $200 for a credit line for the same amount, the balance you keep on the card cannot be higher than $60 or 30% of the available credit limit.

A self-lender provides credit-builder loans without money upfront. You choose your desired payment.

Let’s say $30 each month. You send the monthly payment to the self-lender, which deposits it in an FDIC-insured bank. The self-lender reports your tradeline or account to all three of the credit agencies each month.

At the end of your agreed terms, you will get all your deposits back minus the self-lender’s fees.

Between the secured credit card and the self-lender, you will have two new revolving trades reporting positive remarks to your credit reports.

You need to sign for UltraFICO score and Experian Boost; the latter factors how you manager your checking and savings accounts, and the former factors your on-time utility payments.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

21 Comments

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

Pingback: HOW TO FINANCE A CAR - Personal Finance - %

Pingback: What Is a Bad Credit Score and How Do You Fix It - FMC

Pingback: You Can't Build Generational Wealth If You Are Broke - FMC

Pingback: Are You a Deadbeat If You Have Bad Credit - American Middle Class

Pingback: Credit Card Sign-Up Bonus or SUB - Credit Cards

Pingback: 4 types of bad credit reports and how to fix them - ArticleCity.com

Pingback: All You Need to Know about Buy Now Pay Later companies - FMC

Pingback: How to Build Credit as a College Student - FMC

Pingback: Build Your Credit for Free - Personal Finance

Pingback: Do You Know the Interest Rate On Your Credit Card - Credit Cards

Pingback: Credit Card Fixed-Interest Loans: Explained - Credit Cards

Pingback: The Complete Home Buying Guide - Real Estate

Pingback: How to Overcome Intergenerational Poverty - Personal Finance

Pingback: Charge Offs, Collections, & Judgments - Personal Finance

Pingback: We Should Teach Financial Literacy to All Americans? - FMC

Pingback: Debt collection - Personal Finance - FMC

Pingback: 10 Ways Black Entrepreneurs Can Access Capital - FMC

Pingback: What Is Money Management - FMC

Pingback: Refinance Your Mortgage and Save - Real Estate

Pingback: Foreclosure Filings Increasing Across America - Real Estate

Pingback: Does Paying Off Collections Improve Your Credit Score? Here's What You Need to Know - FMC